March 25, 2024

Global light vehicle sales forecast – March 2024 edition

February 26, 2024

Global light vehicle sales forecast – February 2024 edition

February 15, 2024

Hyundai Motor Group model plans and production forecast to 2028

January 29, 2024

Vehicle registration and production data blast – Q1 2024 edition

January 22, 2024

Global light vehicle sales forecast – January 2024 edition

January 18, 2024

Toyota model plans and production forecast to 2028

December 27, 2023

Global light vehicle sales forecast – December 2023 edition

December 14, 2023

The world’s new vehicle market: outlook for 2024

December 7, 2023

BMW Group model plans and production forecast to 2027

November 27, 2023

Global light vehicle sales forecast – November 2023 edition

November 23, 2023

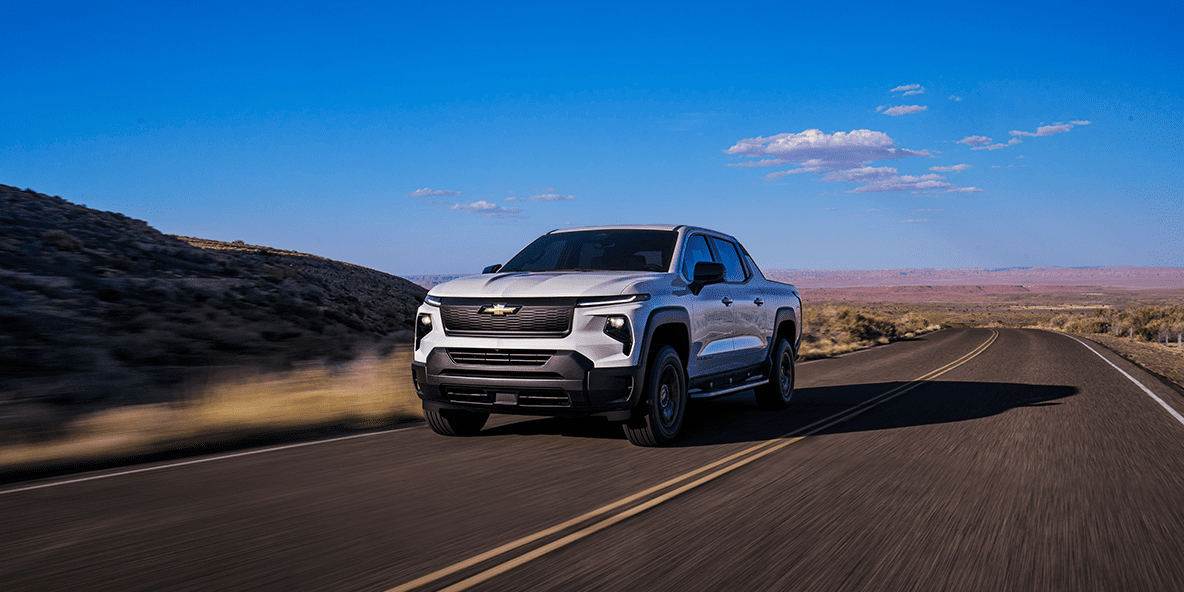

General Motors model plans and production forecast to 2027

October 23, 2023

Global light vehicle sales forecast – October 2023 edition

October 19, 2023

Vehicle registration and production data blast – Q4 2023 edition

October 5, 2023

Daimler Truck model plans and production forecast to 2027

September 25, 2023

Global light vehicle sales forecast – September 2023 edition

Webinars

2nd May

3pm Stuttgart | 6:30pm Mumbai | 9am Detroit

Building a safe foundation for software-defined vehicles with EB corbos

Elektrobit’s Joel Thurlby outlines the impact of functional failures and interference on vehicle functions and automotive software.

7th May

4pm Stuttgart | 7:30pm Mumbai | 10am Detroit

Next-level vehicle cybersecurity using ESCRYPT CycurHSM on AURIX™ TC4x devices

Rohan Pandit of ETAS and Infineon’s Michael Arzberger and Laurent Heidt discuss the complexities of balancing cybersecurity, performance, and cost-effectiveness in today’s competitive market.

8th May

4pm Stuttgart | 7:30pm Mumbai | 10am Detroit

Beyond battery cycling basics – how to verify design, compliance, safety, and production with validation planning and analysis

Element’s Mike Pendleton explains how battery design verification and analysis can help answer questions before they arise and how to save costs in design and production validation cycles.

13th May

10am Stuttgart | 1:30pm Mumbai | 4am Detroit

Maximizing automated vehicle safety with AI and data-driven validation techniques

IAV’s Max Winkelmann and Mike Hartrumpf provide a clear vision of automated vehicle safety validation and explain how to carry out effective testing.