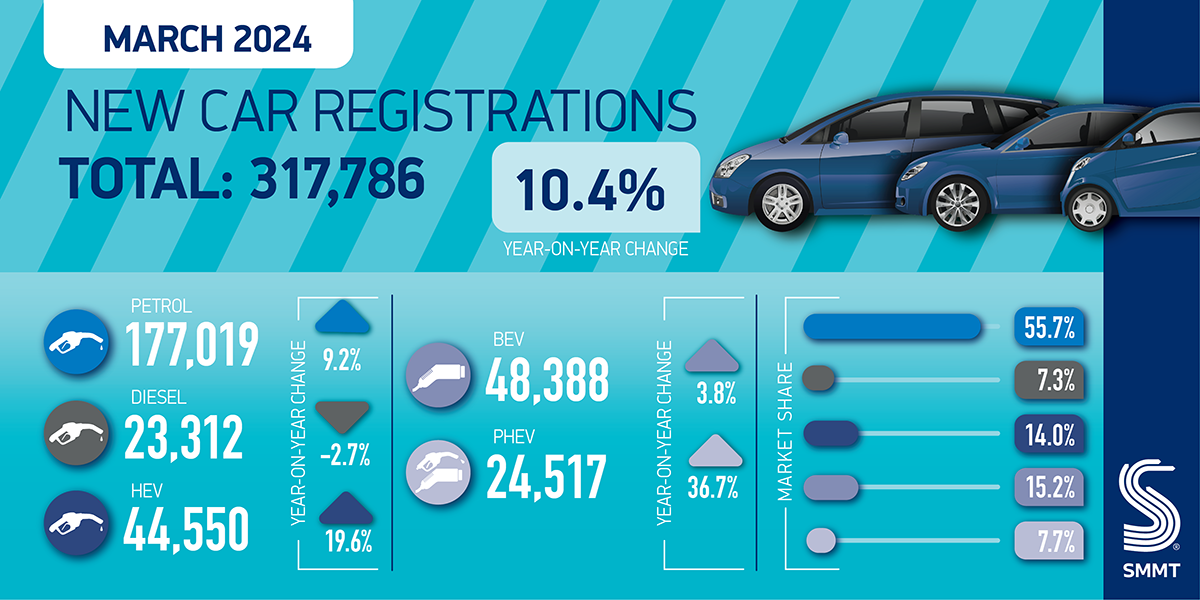

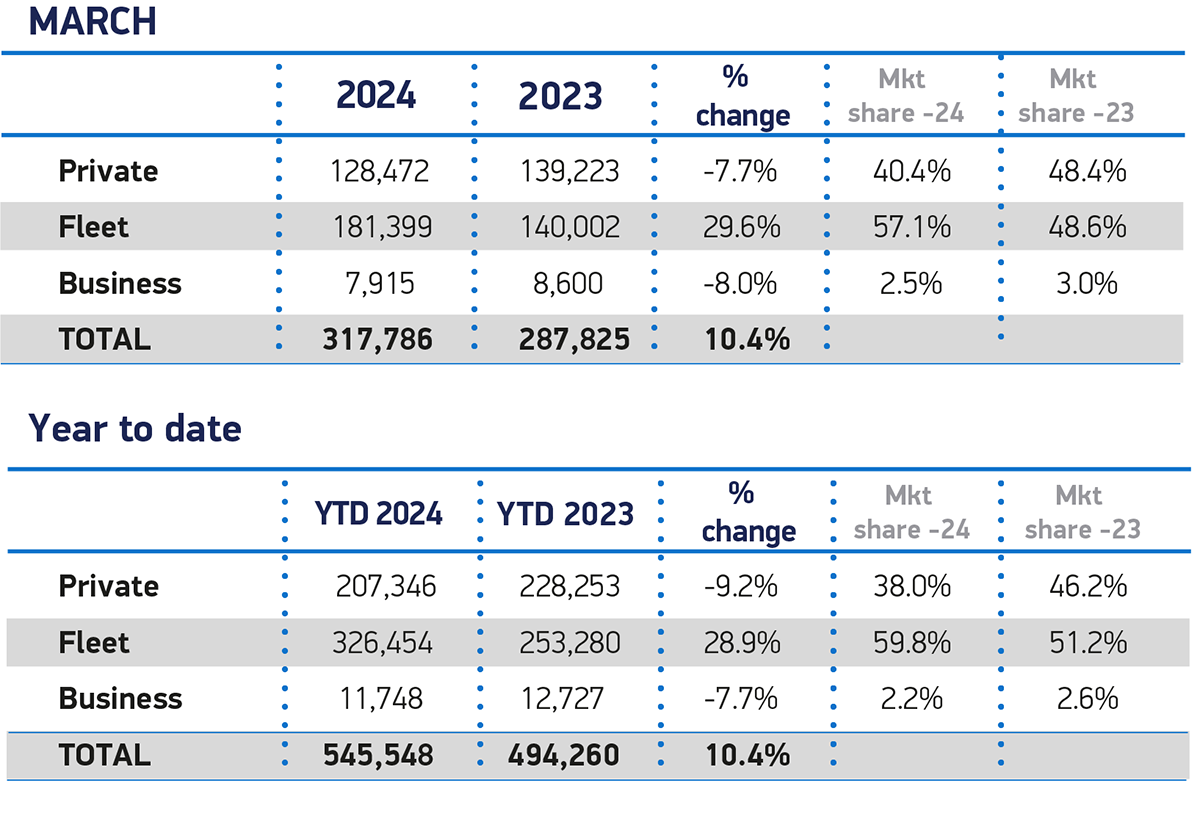

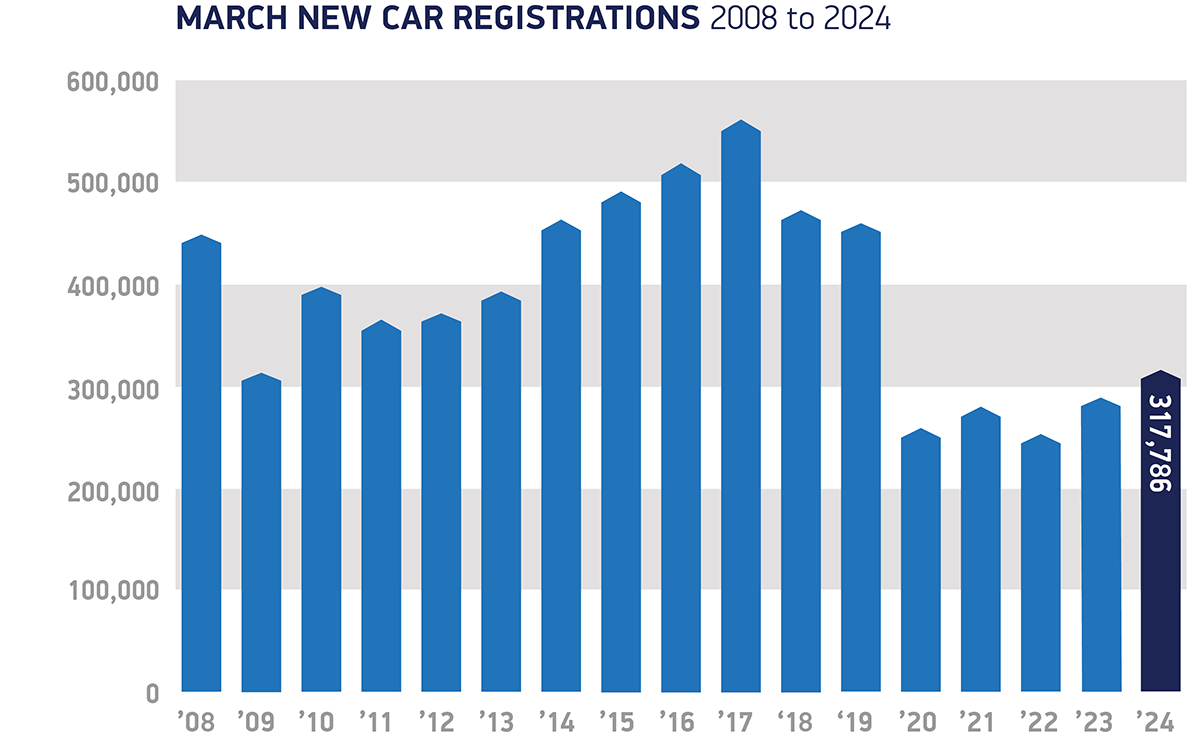

The UK new car market clocked up its 20th consecutive month of growth in March, with a 10.4% rise in registrations. In what is typically the busiest month of the year due to the new numberplate, 317,786 new cars reached the road with a 24 plate – the best March performance since 2019, although still -30.6% below pre-pandemic levels.1

Growth was again driven by fleet investment, up 29.6% as the sector continues to recover following the constrained supply of previous years. Registrations by private buyers fell by -7.7%, with a challenging economic backdrop of low growth, weak consumer confidence and high interest rates. The small business registration segment, meanwhile, declined -8.0%.

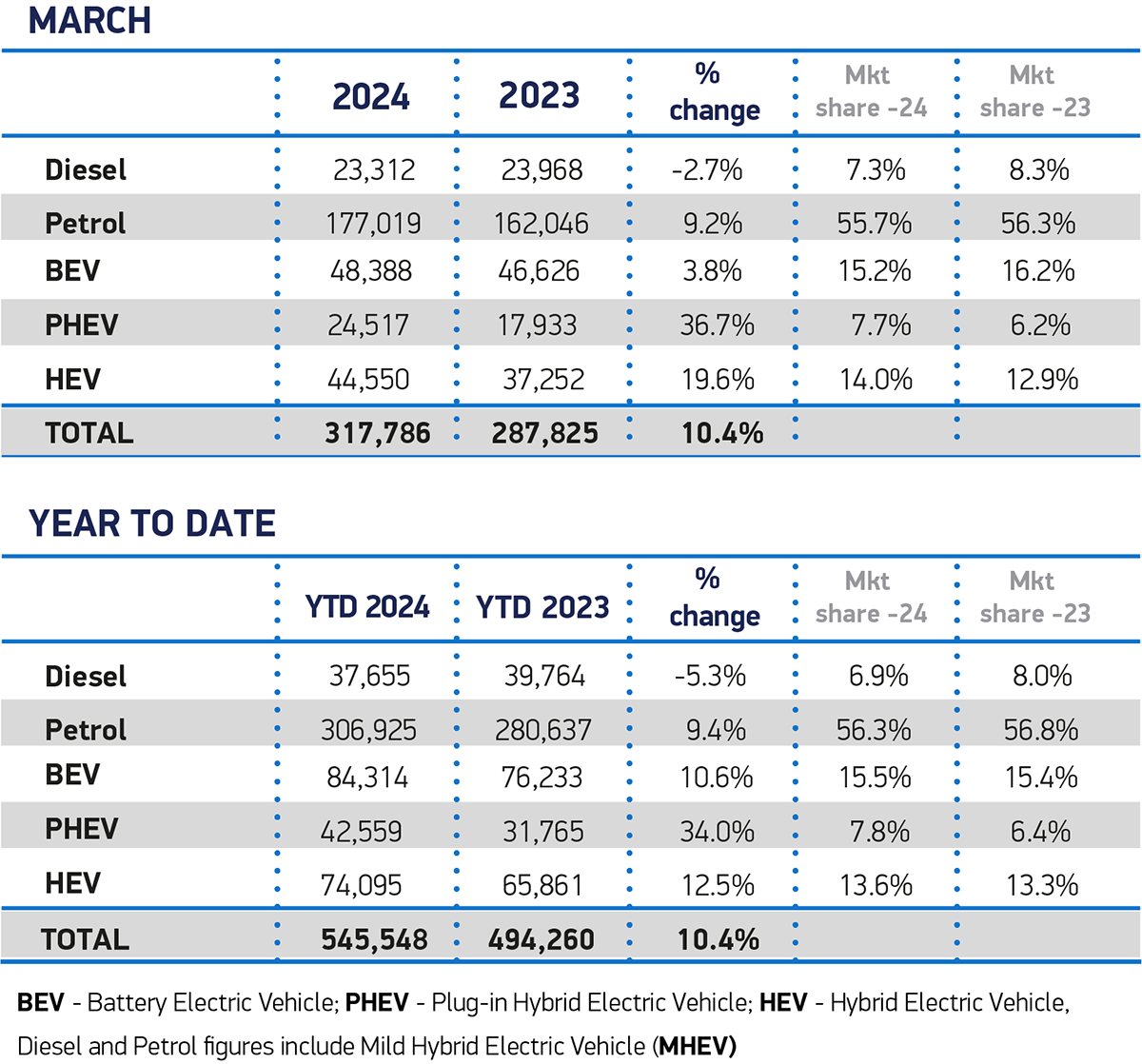

Petrol cars retained the lion’s share of the market, at 55.7%, with registrations up 9.2% year on year, as diesel volumes fell -2.7% to account for just 7.3% of demand. Uptake of hybrid electric vehicles (HEVs) reached record levels, rising by 19.6% to 44,550 units and 14.0% of the market, while the biggest percentage growth was recorded by plug-in hybrids, up by more than a third to 24,517 units, or 7.7% of all new registrations. Conversely, while battery electric vehicle (BEV) registration volumes were at their highest ever recorded levels, market share fell by one percentage point from the same month last year, down to 15.2%. Registrations rose 3.8%, with only fleets showing any volume growth.

The fall in BEV market share within a growing market underscores the need for government to support consumers to speed up fleet renewal. Large fleets continue to drive BEV uptake, thanks to compelling tax incentives but while registration volumes increased in March, market share declined. A tough economic backdrop makes it ever more challenging for consumers to invest in these new technologies.

Manufacturers themselves are offering generous incentives, helping more drivers switch to zero emission vehicles and deliver government and industry carbon targets, but this cannot be sustained indefinitely.2 A full market transition needs incentives not just for fleet and business buyers but private retail buyers as well, something that would bring the UK into line with other major markets. Temporarily halving VAT on BEVs, revising the threshold for the expensive car supplement on Vehicle Excise Duty next April, and abolishing the ‘pavement penalty’ on public EV charging by equalising VAT rates to 5% in line with home charging, would make a significant difference to consumers, helping more of them move to zero emission vehicles sooner.

Mike Hawes, SMMT Chief Executive, said,

Market growth continues, fuelled by fleets investing after two tough years of constrained supply. A sluggish private market and shrinking EV market share, however, show the challenge ahead. Manufacturers are providing compelling offers, but they can’t single-handedly fund the transition indefinitely. Government support for private consumers – not just business and fleets – would send a positive message and deliver a faster, fairer transition on time and on target.

1 March 2019: 458,054 registrations

2 What Car research shows EV discounts have increased by 204% since January 2023

SOURCE: SMMT