First it was Japan, then Korea—and now it’s China that is contending for the crown as the world centre for auto manufacturing. That crown, of course, once belonged to the US, particularly Detroit. But it’s been decades since America has been seen as the world leader in auto manufacturing.

Over the past decade or so the auto industry has been reinventing itself, with electric vehicles (EVs), autonomous driving, and advanced onboard AI systems turning cars into computers on wheels. And that reinvention provides a potential opportunity for the US to return to its former leadership role, setting trends and advancing the technology that will power the vehicles of tomorrow.

The emerging renaissance of vehicle production in the US will lead to a resurgence of manufacturing, innovation, and technological advancements. Technology—in manufacturing, electronics and much more—has long been driven by the auto industry, and the mainstreaming of future technologies will likely be driven by the auto industry as well. Several major developments—including the return of chip manufacturing to the US, increased automation, government policy on EVs, and advanced AI development—are fuelling an infrastructure that will help centre the new automotive industry, and with it the future of advanced technology, on American shores.

Chip manufacturing is key

Far East tensions were among the impetuses of the 2022 CHIPS Act, which provides financial incentives, tax breaks, and support for research and development in the semiconductor industry. And in just a few short months, the Act has spurred a huge wave of investment; companies like Intel, Samsung, Texas Instruments and a host of others—even Taiwan’s TSMC—are spending billions to build chip factories and plants that provide materials for semiconductors. The objective is to bring chip manufacturing to America’s safer shores.

Far East tensions were among the impetuses of the 2022 CHIPS Act, which provides financial incentives, tax breaks, and support for research and development in the semiconductor industry. And in just a few short months, the Act has spurred a huge wave of investment; companies like Intel, Samsung, Texas Instruments and a host of others—even Taiwan’s TSMC—are spending billions to build chip factories and plants that provide materials for semiconductors. The objective is to bring chip manufacturing to America’s safer shores.

Currently, more than 90% of the world’s advanced chips are made in Taiwan. Now, national security, along with ensuring that the supply chain for semiconductors doesn’t get disrupted by war or policy issues, are among the reasons the US is strongly encouraging chip fabrication at home. More than 80 plants, in fact, are set to be built by 2024—and many of them will produce chips that could be used to control different aspects of vehicles, including powering self-driving vehicles. At the same time, export restrictions proposed by the US and other countries, including Japan, aim to prevent China from being able to manufacture its own chips, increasing the potential for a chip-driven vehicle manufacturing comeback in the US.

Chips are clearly in high demand. Nvidia, which is investing heavily in automotive chip technology, has seen its valuation shoot up in recent months, with its stock tripling in barely half a year as it doubles down on AI and smart automotive technology. And Nvidia is far from alone; many of the biggest chip manufacturers are developing products specifically for vehicles. Many of these advanced chips are set to be developed and manufactured in the US—likely putting America ahead of the curve on advanced vehicle technology.

Automation and customisation

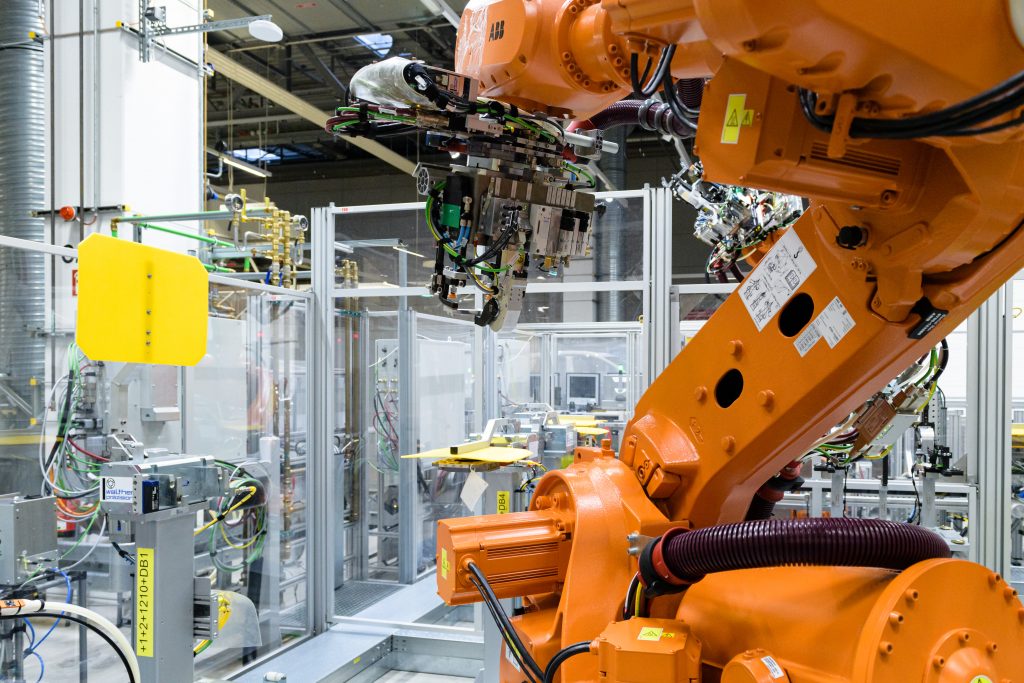

Automation has long been a feature of US manufacturing, including vehicle manufacturing, but advanced technology is taking automation to newer and higher levels. A report by McKinsey cites advanced robotics—enabling automated systems to act more or less independently in manufacturing—as one of the biggest game-changing trends of the 2020s. According to the report, “increasingly capable robots or robotic tools, with enhanced ‘senses,’ dexterity, and intelligence—can take on tasks once thought too delicate or uneconomical to automate.”

That could enable American vehicle manufacturers to cut costs. With lower costs, plus quality and chip and tech advantages, US manufacturers may be able to more successfully compete with low-cost EVs from China. The US is already advancing rapidly in this area, and is currently third in the world in annual installations of industrial robotic systems. Automated assembly lines, robotic systems, and machine learning algorithms can accelerate manufacturing processes, minimise errors, and enable precise customisation, ultimately enhancing the competitiveness of American-made vehicles.

AI development is a game changer

Level 5 autonomous vehicles will, of course, require a very high level of AI, enabling them to analyse input from sensors, LiDAR, streaming data, communication systems, and much more in order to ensure that a vehicle can navigate safely. And AI is important even for vehicles with a lesser degree of autonomy; AI systems can analyse the performance and safety levels of vehicle components, like brakes and batteries, key for more efficient manufacturing and maintenance.

Here, too, US leadership is crucial—and although China is a close second, experts say that the US is the leader in AI development. The world’s most advanced AI developers, including Google, Meta, and Microsoft are all American companies. Despite the huge investment the Chinese government is making in AI, it’s the US private sector that is by far the world’s biggest investor in AI with nearly US$50bn invested by companies in 2022—3.5 times the amount invested by China that year. As American manufacturers increase the level of AI in their vehicles, American researchers will expand their efforts to provide the technology needed for these advanced vehicles.

Electric vehicles are the next frontier

Americans drive much more than do residents of other countries, so it makes sense that US companies would seek their largest market share at home. In the coming years—whether due to customer demand or government mandate—vehicle production will focus on EVs. Here, the US will be fighting an uphill battle; China is currently the leader in EV production, by a wide margin. If only to nab a bigger portion of the market, US manufacturers are working hard to deveop ways to compete with Chinese EV makers.

But as any manufacturer knows, competing with China—especially on price and production costs—is very difficult. And competition with China for market share is becoming fierce. If American manufacturers will not be able to compete on price, they will have to compete on quality and technology, like producing batteries that are cheaper and longer lasting than those Chinese competitors can offer. Developing those capabilities will require innovation in research, production, and marketing— traits that are baked into the American psyche and that have served Americans well in the past. New qualifications for tax breakson EVs, including requirements that significant parts of the car and battery be made in the US or in a country that the US has a free-trade agreement with, could provide some of the needed momentum to increase manufacturing rates of these vehicles in the US.

There is no doubt that tech is affecting the future of many parts of life and consumer products. But innovation in vehicles could be a true game-changer, for cars—and for the entire US economy. Vehicles today are bigger, more complicated, and require hundreds of systems to work safely, properly, and efficiently. In the US, leadership in technological development is combined with consumer demand and need. And that combination is poised to help the US take the lead in developing the cars of the future—and with them, the tech of the future.

About the author: Eliron Ekstein is Co-founder and Chief Executive at Ravin.ai