Honda Motor Co., Ltd. Director, President and Representative Executive Officer (Global CEO) Toshihiro Mibe held a press briefing today, on Honda initiatives centering on automobile electrification.

Following is a summary of his formal remarks:

1. Recent changes in the EV market environment and the direction of the strategy realignment

In order to sustainably offer the joy and freedom of mobility, Honda has put the highest priority on its initiatives in the areas of the environment and safety, including an ambitious goal to “achieve carbon neutrality for all products and corporate activities” and “zero traffic collision fatalities” by 2050.

For small-size mobility products including passenger vehicles, Honda believes that electric vehicles (EVs) are the optimal solution for achieving carbon neutrality from a long-term perspective. Based on this belief, Honda made the strategic decision to make a major shift toward the popularization of EVs and has been making progress with various initiatives.

In the meantime, the environment surrounding the automobile industry is changing day by day. Uncertainty in the business environment is increasing, due particularly to the slowdown in the expansion of EV the market due to several factors, including changes in environmental regulations, which had been the premise for the widespread adoption of EVs, as well as changes in trade policies of various countries. In order to maintain its competitiveness in such a business environment and continue to help and inspire people through its mobility products and services, Honda must create new value not only through electrification but alsowith enhanced application of intelligent technologies, and then offer such value to a broader range of customers in more accessible and affordable ways.

From this standpoint, Honda will realign its automobile electrification strategy, in the following two directions.

- Further enhance the competitiveness of EV and HEV models with the core focus on application of intelligent technologies

- Strengthen its business foundation through the reassessment of the powertrain portfolio

In the area of applying intelligent technologies, which will be the most critical competitive area of automobile business in the future, while focusing on independent development of next-generation ADAS as a key driving force, Honda will create new value from multiple aspects, while also leveraging collaboration with partners. With this core focus on the advancement of intelligent technology applications, Honda will strengthen its business foundation by reassessing its powertrain portfolio, such as EVs and HEVs.

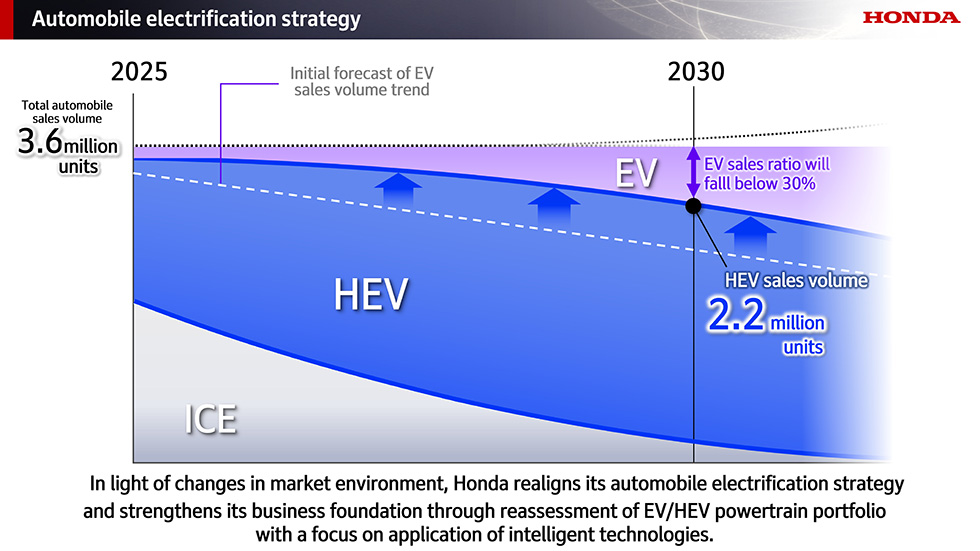

As for EVs, due to the revision of the product launch plan considering the recent market slowdown, the Honda global EV sales ratio in 2030 is now expected to fall below the previously announced target of 30%. On the other hand, current market demand for HEV models is high. Therefore, Honda will position its HEVs, mostly next-generation HEV models to be introduced to market in 2027 onward, as the powertrain that will play a key role during the transition period toward the popularization of EVs and further enhance its HEV lineup.

With the steady execution of this realignment, by 2030, Honda will strive to increase total automobile sale volume to above the current level of 3.6 million units, with a HEV sales target of 2.2 million units at the core.

1-1. Enhancing the competitiveness of automobile models through the development and expanded application of next-generation ADAS

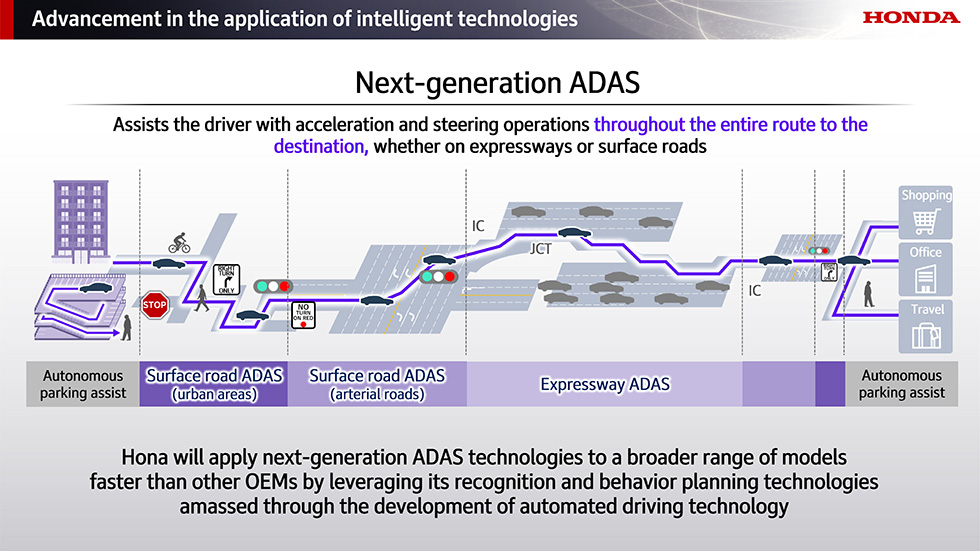

As one of the key technologies to enhance application of intelligent technologies, Honda is currently developing its original next-generation ADAS which assists the driver with vehicle operations such as acceleration and steering throughout the entire route, whether on expressways or surface roads, to the destination the driver inputs on the navigation system. Developing next-generation ADAS is especially challenging in urban areas, where there are various types of people sharing the road, and where turning at intersections is frequent. However, by leveraging the recognition and behavior planning technologies we have amassed through our automated driving development, Honda is working to develop next-generation ADAS that enables safe and comfortable driving all the way to the destination, including in urban environments. Honda will apply this new, next-generation ADAS to a broad range of key EV and HEV models Honda will launch in North America and Japan around 2027.

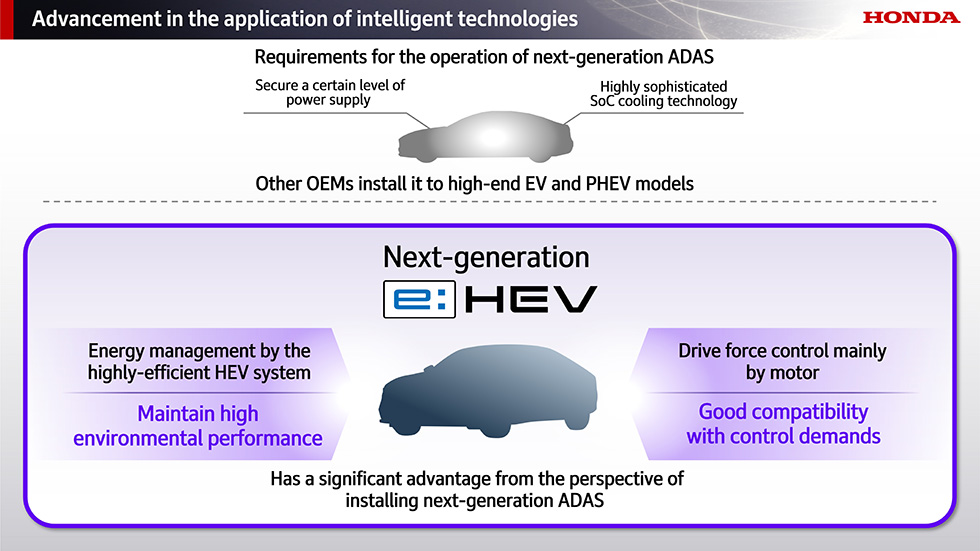

Currently, next-generation ADAS technologies are being adopted mainly to high-end EV and PHEV models due to technical challenges such as power supply constraints and the need for SoC cooling. However, the full-fledged hybrid system of Honda has technological advantages necessary to overcome such challenges as it meticulously performs highly efficient energy management. Also, based on the Honda M/M Concept*1, which calls for maximizing the space available for people and minimizing the space required for mechanical components, Honda can install ADAS-related devices while minimizing the impact on cabin space and vehicle design, which makes it possible to equip small-size vehicles with next-generation ADAS.

By leveraging such unique strengths of Honda HEV and car design technologies and by adopting this next-generation ADAS not only to EVs but also to increasingly popular HEVs, Honda will take advantage of its large business scale to achieve both high competitiveness and low cost, and offer high value-added “joy of mobility” at affordable prices for more customers.

In China, where electrification and application of intelligent technologies are proceeding faster than other regions, Honda will work with Momenta Global Limited, a Chinese startup company developing autonomous driving technology, to develop next-generation ADAS optimized for road conditions in China and install it to all future models Honda will launch in China.

*1 The “man maximum, machine minimum” concept is a basic approach to Honda car design, an approach to increase the efficiency of the vehicle interior by maximizing space for people and minimizing the space required for mechanical components.

1-2. Strengthening Honda EV strategy

Honda will further advance its original two-motor hybrid system, e:HEV hybrid system, and platforms in all aspects. Both small-size and mid-size e:HEV systems will realize the world’s most efficient powertrain through various advancements such as an expansion of range where the engine operates most efficiently and an increase in the driving efficiency of the hybrid unit. By combining this hybrid system with 1) a next-generation platform which is advanced in all aspects, including driving stability and further weight reduction, and 2) a newly-developed electric AWD drive unit that realizes highly precise and responsive motor control, Honda will strive to improve the fuel economy of the next-generation e:HEV model by more than 10% and further advance a driving experience unique only to Honda, which is high-quality, exhilarating and resonating with all of the driver’s senses.

Moreover, to increase the cost competitiveness of HEV models, which are the core of Honda automobile business, Honda is pursuing further cost reduction mainly with key components such as batteries and motors with various initiatives including co-creation activities with suppliers, further improvement of production efficiency and commonization of more parts and components. Through these initiatives, along with an increase in sales volume, Honda is aiming to reduce the cost of the next-generation hybrid system by more than 50% compared to the hybrid system installed to models introduced in 2018, and by more than 30% compared to the hybrid system introduced in 2023 to current models.

In the North American market, which is the main battleground for Honda HEV models, there continues to be solid demand for large-size vehicles with spacious interiors and high cargo capacity. In order to fulfil such demand in a sustainable manner, Honda will develop a hybrid system for large-size vehicles, which will feature powerful driving performance, high towing capability and high environmental performance, with an aim to apply this hybrid system on products to be launched in the latter half of the 2020s.

While further refining the competitiveness of its products, Honda will launch 13 next-generation HEV models globally, over a four-year span starting in 2027, to build a broad lineup of HEV models and capture growing HEV demand in the market.

1-3. Initiatives toward popularization of EVs

Due to the recent market slowdown, the Honda EV sales ratio in 2030 is now expected to fall below the previously announced target of 30%. In light of this outlook, Honda is reassessing its EV strategy and roadmap, including plans for the EV product lineup and the timing of relevant investments including one to build a comprehensive EV value chain in Canada.

In the meantime, there is no change in the Honda position that EVs are the optimal solution to achieve carbon neutrality of passenger vehicles. Therefore, Honda will steadily carry out initiatives being undertaken to prepare for the future EV shift at the appropriate timing.

As for the Honda 0 Series, which will become the main pillar of the company’s future EV business, the first-generation models will be introduced to market next year. Through these models, Honda will offer the value of SDVs tailored to each and every user through “ultra-personal optimization,” which is made possible mainly by the ASIMO OS and AD/ADAS Honda introduced at CES 2025.

In order to offer even more sophisticated AD/ADAS functions, the next-generation Honda 0 Series models will be equipped with the Centralized E&E Architecture. In addition, jointly with Renesas Electronics, Honda will develop a high-performance system-on-chip (SoC), which will achieve one of the industry’s top class AI performances of 2,000 TOPS*2 (Sparse) with 20 TOPS/W power efficiency. With these technologies, Honda will continue to increase the value SDVs can offer to its customers. Looking ahead to the forthcoming period of EV popularization, Honda will steadily work to build a strong EV brand and business foundation from a long-term perspective.

*2 Tera Operations Per Second (TOPS) is a metric of AI processing performance and measures the number of operations that can be performed per second. Based on a sparse AI model.

1-4. Summary of the realignment of the automobile electrification strategy

Honda is committed to creating new and unique value suited to the era of intelligent and electrified mobility products. When the driver wants to take the wheel, they can enjoy high-quality and exhilarating “joy of driving” unique only to Honda, and when the driver wants a stress-free ride to the destination, they can take advantage of the value of SDVs and enjoy a comfortable ride whether on surface roads or expressways. Honda will provide such a wide range of experiential value in one vehicle.

Moreover, as a symbol of the transformation of Honda automobile business, the new “H mark” will be used not only for EV models, but for major HEV models, starting with the next-generation models to be introduced to market in 2027 and beyond.

1-5. Automobile production and procurement systems

Honda is striving to pursue a resilient supply chain strategy that is not easily swayed by fluctuations in demand—such as shifts between EVs and HEVs—or unforeseeable factors such as changes in government policies in different countries.

During the early adoption period, where fluctuations in the speed of EV popularization are expected, Honda will establish a flexible production system that is capable of optimizing production according to demand and sales strategies. This will be achieved mainly with mixed-model production lines capable of producing both EVs and HEVs. In anticipation of continuous growth in HEV sales and a mid- to long-term EV shift, Honda is working to secure a stable supply of electrified components, particularly batteries, by optimizing supply capacity and allocation, including the effective use of existing assets.

Moreover, Honda has established supply chains based on its longstanding commitment to “build products close to the customer,” which is a concept of “local production for local consumption.” In addition, Honda has been strengthening its flexible production system that enables the swift transfer of production models between facilities. Such a system is enabling Honda to adjust the production allocation flexibly according to demand. While maintaining a commitment to “local production for local consumption,” Honda will continue to strengthen its supply chains to be resilient to unexpected changes in the market.

2. Initiatives in motorcycle business

For the fiscal year ended March 31, 2025, Honda motorcycle unit sales reached 20.57 million units, which account for approximately 40% of the global motorcycle market, setting an all-time record for fiscal year sales in 37 countries and territories. Moreover, demand for motorcycles is expected to grow further, particularly in the Global South, which includes India, the world’s largest motorcycle market, where population is increasing and people’s income is increasing. Industry-wide sales are expected to grow from the current level of 50 million units to the level of 60 million units by around 2030.

In order to capture this growing demand, Honda will offer attractive products tailored to the diverse needs of global customers and also optimize its product supply system. Furthermore, in order to maintain its position as an industry leader in environmental initiatives, Honda will accelerate electrification of its motorcycle products, while also improving the fuel economy of its ICE models and expanding the lineup of flex-fuel compatible models.

As for electric motorcycle models, in February of this year, Honda began sales of Active e: and QC1, which were announced in India last year. Moreover, sales of CUV e: and ICON e:, global electric commuter models began first in Indonesia, then in Vietnam, Thailand and the Philippines. The CUV e: is also scheduled to go on sale in Europe and Japan this year. Going forward, Honda will modularize models developed exclusively as electric models and begin production at a highly efficient, dedicated electric motorcycle production plant which will become operational in India in 2028, which will enable further strengthening of the electric motorcycle business structure. Through these initiatives, Honda will offer more affordable electric motorcycle models to more customers, and further down the road, Honda will strive to capture the No. 1 market share in the electric motorcycle market, as well.

In this way, by continuously launching attractive products and building an efficient supply system for both ICE and electric models, Honda will effectively capture growing demand for motorcycles. As a result, in the long term, Honda motorcycle business, including both ICE and electric models, will establish a solid profit base with a global market share of 50% and ROS of more than 15% as of FY2031 (fiscal year ending March 31, 2031).

3. Financial strategy – improvement in profitability, reassessment of resource investment, capital allocation

Toward 2030, Honda will improve profitability with 1) continuous expansion of motorcycle business, 2) cost reduction effects in automobile business associated with the adoption of the next-generation e:HEV system and platforms, and 3) an increase in unit sales of HEV models, and will keep making progress toward achieving the company-wide ROIC target of 10% for the FY2031 (fiscal year ending March 31, 2031).

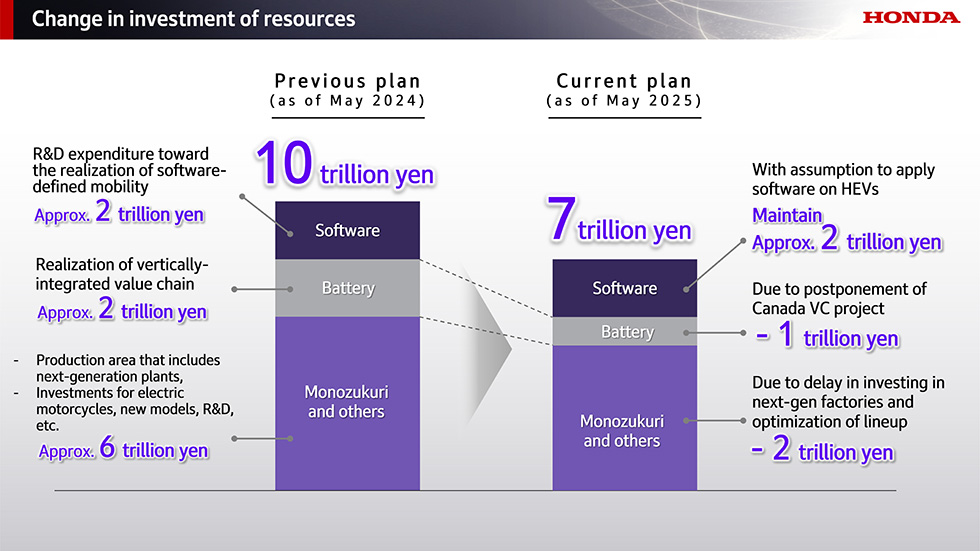

As for the plan announced last year to invest 10 trillion yen in resources to pursue its electrification strategy, Honda decided to reduce the investment amount by 3 trillion yen, to a total of 7 trillion yen, over the period through the FY2031 (fiscal year ending March 31, 2031), based on its decision to postpone the project to establish a comprehensive EV value chain in Canada and change the timing to construct dedicated EV production plants.

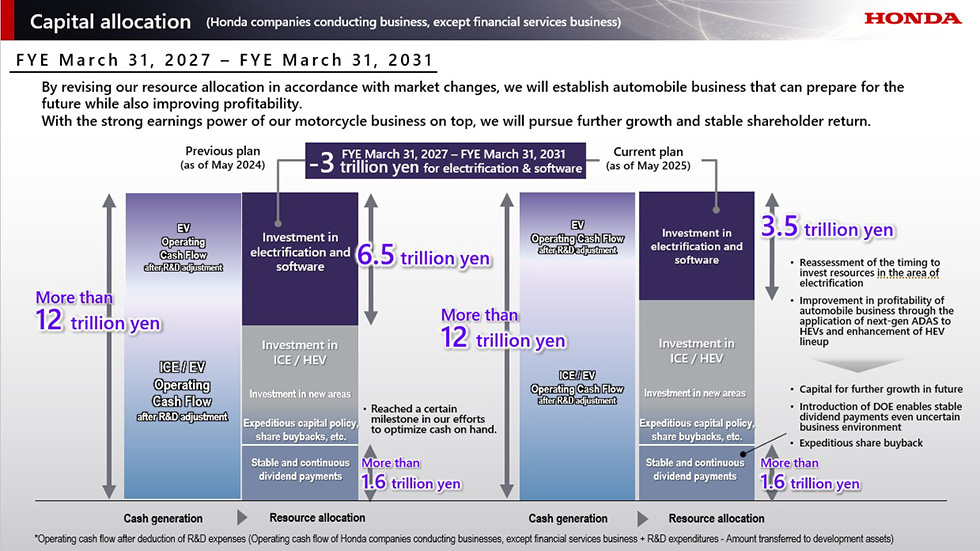

Regarding the changes in capital allocation over the five-year period starting from the 2027 fiscal year, in light of the reduction in the resource investment amount, Honda will strive to generate more than 12 trillion yen in cash, combining its ability to generate cash stably from its motorcycle business and an increase in unit sales of HEV models. As for resource allocation through the 2031 fiscal year, while reducing EV-related investment by 3 trillion yen, Honda expects a minimal increase in investment related to HEV business. As for shareholder returns, Honda will maintain the previously announced target and strive for more than 1.6 trillion yen.

Revising its resource allocation by responding to market changes swiftly and flexibly, Honda will establish automobile business that can prepare for the future while also improving profitability. By adding the strong earnings power of its motorcycle business, Honda will pursue further growth even under uncertain market conditions. Moreover, Honda made a decision to introduce DOE (dividend on equity ratio) as an expression of its ongoing commitment to maintain shareholder returns in line with business growth. In this way, Honda will achieve growth through further strengthening of its business structure and stable, and continuous shareholder returns at the same time.

SOURCE: Honda