Electric vehicles (EVs) have rapidly evolved from being a curiosity to a disruptive force. They’re upending the relationship between car manufacturers and dealerships, redefining the future of automotive service, and creating customer experience (CX) challenges for the entire automotive industry. As more consumers buy EVs, they’re finding that purchasing, owning, and servicing an EV may differ dramatically from what they experienced with vehicles that use traditional internal combustion engines.

EVs are gaining momentum

EVs continue to achieve penetration in major global markets, with China driving growth in 2021 and accounting for 52% of EVs sold, while Europe was at 34%, and the US at 9%. According to a survey by EY, more than half of potential car shoppers globally plan to make an EV their next purchase.

There is no going back, as evidenced by the state of California moving to ban the sale of gasoline powered vehicles by 2035 and the recent passage of the Inflation Reduction Act, which is designed to encourage the manufacture of EVs in the US.

Data from customer experience software expert Reputation underscores consumer readiness for EVs. It recently examined five million customer reviews of dealerships over the past 12 months, and found that mentions of EVs in ratings/reviews are up 34% year-over-year in the US and 57% in Europe. In addition, nearly half of the consumers surveyed said that they are likely to consider purchasing an EV in the next year, and 69% are likely to consider purchasing a hybrid. Notably, the survey took place amid an inflationary economy, and EVs are typically more expensive than the industry average for all cars.

Direct-to-consumer and CX headaches

The phenomenal success of Tesla’s direct-to-consumer (DTC) sales model is inspiring car manufacturers to adopt their own forms of DTC for EVs. Manufacturers are bypassing dealerships to sell vehicles online, including allowing consumers to configure their purchases ahead of time. Mercedes said that it will cut 10% of its dealerships globally and up to 20% in Germany as the company moves toward a DTC model. Ford Chief Executive Jim Farley told investors that the company’s plans for the EV market include selling EVs online and turning dealerships into service centres instead of sources of sales.

The rise of DTC creates tension between manufacturers and dealerships. Dealerships are not likely to accept a more limited role in the service lane, and should not be counted out anytime soon. Dealerships are leaning into digital to sell and service EVs and they possess a built-in service infrastructure that can be retrofitted for EV service.

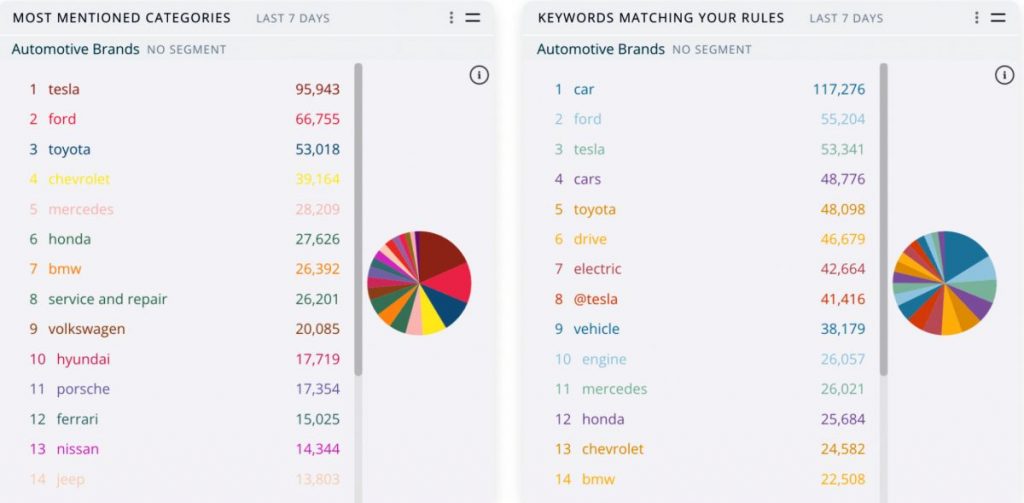

Meanwhile, the rising costs of EVs have created a reputation headache for manufacturers. Reputation has used social listening to monitor how consumers talk about cars on sites such as Twitter. Recently, it detected a spike in consumer conversations about the US$7,000 price hike for the Ford F-150 Lightning EV. Ford became a trending topic, but not for a positive reason.

Going into 2023, both car manufacturers and dealerships alike need to monitor customer sentiment and manage expectations about the rising costs of EVs. For instance, clearly communicating the impact of the Inflation Reduction Act of 2022 would be helpful in managing expectations. The Act’s EV tax credit requires all vehicles to contain a battery entirely sourced from North America, which could increase the cost of battery manufacturing if automakers stop relying on less expensive overseas resources.

In addition, Reputation’s own analysis of dealership reviews reveals that in fact, customers are less likely to give a dealership a negative review about the cost of a car than they are when they experience surprises with costs, such as unexpected surcharges that were not communicated clearly.

The future of EV servicing

Will EVs be more expensive to service or less costly? The answer remains murky because EVs are still evolving. In theory, EVs should require less service because they have fewer moving parts than fuel-powered vehicles. But initial data suggests that EV owners are paying more and are less satisfied with their service even though their vehicles require fewer trips to the service lane—or not at all. Finding EV service in any area outside of large cities can also be very difficult, creating another challenge for both EV owners and manufacturers.

This negative owner sentiment underscores a reality: manufacturers that sell directly to consumers also inherit the associated CX challenges that come with this still-emerging product. Tesla has been criticised for poor service and the company is trying to make service easier through self-service technology.

One thing is clear: even OEMs that plan to sell EVs directly acknowledge that they’ll need dealerships to service them. Dealerships have an opportunity to boost profits by improving the service lane. That’s because service and parts account for about half of a dealership’s profitability. When the Reputation Data Science team examined customer ratings/reviews, they discovered that the quality of the service lane is a major driver of customer discontent.

Some dealerships are turning to technology such as artificial intelligence to improve the accuracy and speed of service. Others are adopting online payments to make service more convenient. As they improve service, dealerships are also facing uncertainty about how EVs will affect service.

Tips for dealerships and manufacturers

The rise of EVs and associated negative consumer sentiment suggests that both manufacturers and dealerships need to monitor what their customers are saying more than ever. If they are going to create long-term, profitable relationships, auto industry players need to listen to car shoppers, respond to them, and improve their CX.

For instance, they need to ask for reviews, respond to them, and learn from them— especially the negative ones. This demonstrates a commitment to CX. According to Reputation’s consumer survey, reviews are the most important factor when choosing a dealership, behind price and inventory. In fact, 85% of consumers said reviews are important when selecting a dealership, and 70% said they’d be willing to travel up to 20 miles to a top-rated dealership.

Even OEMs that plan to sell EVs directly acknowledge that they’ll need dealerships to service them

CX leaders in the automotive sector should make sure their teams are responding to all reviews to show they are on top of any problems or concerns. They need to monitor all reviews across the web for all dealership locations and create templated responses to ensure brand consistency. Many dealerships are already managing reviews actively. If more car manufacturers adopt the DTC model, they will really need to step up their game in managing reviews, too.

This is how everyone wins in an economy fuelled by customer feedback—not only with EVs but with all vehicles.

About the author: Joe Fuca is Chief Executive of Reputation