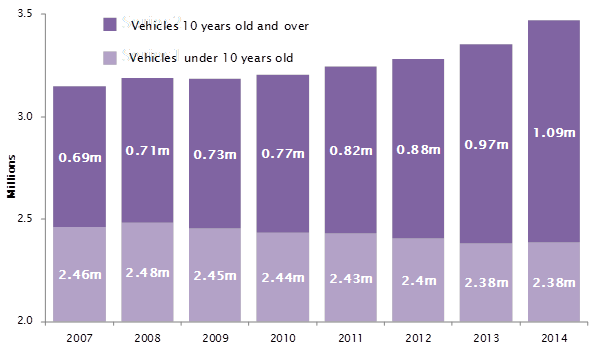

One in three vans* on UK roads is now at least ten years old, as businesses continue to put off investment in their commercial vehicles fleets, says leading finance provider, LDF. LDF says that sustained economic uncertainty and reduced availability of traditional lending have led many businesses to retain ageing vehicles for much longer than originally intended, with these ageing vehicles now accounting for 31% of all vans on the road, up from just 22% in 2007 (see table below). This means that for the first time, there are now more than one million vans aged at least ten years old on the road in the UK, up from 690,000 prior to the credit crunch.

The concern is that businesses that push their vehicle assets beyond their reliable lifespans risk making false economies as reliability and efficiency problems occur more frequently.

LDF adds that SMEs in particular are still finding it difficult to commit to significant capital investment in commercial vehicles, due to lingering doubts about the strength of the economic recovery, and the difficulty of securing funding from traditional sources.

Peter Alderson, LDF Managing Director says: “A lot of small businesses are pushing their vans and other parts of their commercial vehicle fleet to the absolute limit, with many often well beyond their useful economic life.”

“It is not just the repair costs and efficiency of these older vans that create problems – there’s also the very substantial negative impact on the business’ brand of using tired, dated vehicles and additionally, the potential environmental factors to consider.”

“A lot of businesses have been pushing their commercial vehicle assets through the period of recession, but many will soon find that the vans they bought in 2006 and 2007 are no longer viable to run, and they will need to invest again.”

“A growing number have started to invest in electric vehicles as replacements for ageing vans in their fleets, but many SMEs may still not be confident enough to make large up-front capital investments.”

“SMEs with smaller fleets cannot afford to get to the point where their vehicles let them down, but while they may be unable or reluctant to find the cost of replacements upfront, seeking finance through a specialist provider can be a much simpler solution for a smaller business.”

LDF advises that finance can be a cost-effective consideration for businesses who rely heavily on business transport, as it provides for immediate use of the vehicles, while the cost can be spread over a typical 3-5 year period.

Peter Alderson says: “Commercial vehicle finance means that retail businesses can avoid having to make substantial lump-sum investments that impact on cash flow, while still accessing the vehicles their businesses need to grow as the economy recovers.”