Digitisation, automation, and new business models have revolutionised other industries. The automotive industry will be no exception. These forces are giving rise to four disruptive technology-driven trends in the automotive sector: diverse mobility, autonomous driving, electrification, and connectivity.

Most industry players and experts agree that these four trends will reinforce one another, and that the automotive industry is ripe for disruption. This article aims to make the imminent changes more tangible – and looks at eight areas that will change dramatically until 2030.

1. New business models could expand automotive revenue pools by about 30%, adding up to US$1.5tr

The automotive revenue pool will significantly increase and diversify toward on-demand mobility services and data-driven services. This could create up to US$1.5tr, or 30% more, in additional revenue potential in 2030, compared with about US$5.2tr from traditional car sales and aftermarket products/services, up by 50% from about US$3.5tr in 2015 (Exhibit 1).

Connectivity, and later autonomous technology, will increasingly allow the car to become a platform for drivers and passengers to use their time in transit to consume novel forms of media and services or dedicate the freed-up time to other personal activities. The increasing speed of innovation will require cars to be upgradable.

2. Despite a shift toward shared mobility, vehicle unit sales will continue to grow, but likely at a lower annual rate of about 2%

Overall global car sales will continue to grow, but the annual growth rate is expected to drop from the 3.6% over the last five years to around 2% by 2030. This drop will be largely driven by macroeconomic factors and the rise of new mobility services such as car sharing and e-hailing.

Dense areas with a large, established vehicle base are fertile ground for these new mobility services, and many cities and suburbs of Europe and North America fit this profile. New mobility services may result in a decline of private-vehicle sales, but this is likely to be offset by increased sales in shared vehicles that need to be replaced more often due to higher utilisation and related wear and tear.

The remaining driver of growth in global car sales is the positive macroeconomic development, including the rise of the global middle class consumer. With established markets slowing in growth, however, growth will continue to rely on emerging economies, particularly China, while product-mix differences will explain different development of revenues.

3. Consumer mobility behaviour is changing, leading to up to one in ten cars sold in 2030 potentially being a shared vehicle and the subsequent rise of a market for fit-for-purpose mobility solutions

Changing consumer preferences, tightening regulation, and technological breakthroughs add up to a fundamental shift in individual mobility behaviour. Individuals increasingly use multiple modes of transportation; goods and services are delivered to rather than fetched by consumers. As a result, the traditional business model of car sales will be complemented by a range of diverse, on-demand mobility solutions, especially in dense urban environments.

Consumers today use their cars as all-purpose vehicles. In the future, they may want the flexibility to choose the best solution for a specific purpose, on demand and via their smartphones. We already see early signs that the importance of private-car ownership is declining: in the US, for example, the share of young people (16 to 24 years) who hold a driver’s license dropped from 76% in 2000 to 71% in 2013, while there has been over 30% annual growth in car-sharing members in North America and Germany over the last five years.

Consumers’ new habit of using tailored solutions for each purpose will lead to new segments of specialised vehicles designed for very specific needs. For example, the market for a car specifically built for e-hailing services – that is, a car designed for high utilisation, robustness, additional mileage, and passenger comfort – would already be millions of units today, and this is just the beginning.

Hence, up to one out of ten new cars sold in 2030 may likely be a shared vehicle, which could reduce sales of private-use vehicles. This would mean that more than 30% of miles driven in new cars sold could be from shared mobility.

4. City type will replace country or region as the most relevant segmentation dimension that determines mobility behaviour

Understanding where future business opportunities lie requires a more granular view of mobility markets: by city types based primarily on their population density, economic development, and prosperity. Across those segments, consumer preferences, policy and regulation, and the availability and price of new business models will strongly diverge. In megacities such as London, for example, car ownership is already becoming a burden for many, due to congestion fees, a lack of parking, and traffic jams. By contrast, in rural areas private-car usage will remain the preferred means of transport.

The type of city will thus become the key indicator for mobility behaviour, replacing the traditional regional perspective on the mobility market. By 2030, the car market in New York is likely to have much more in common with the market in Shanghai than with that of Kansas.

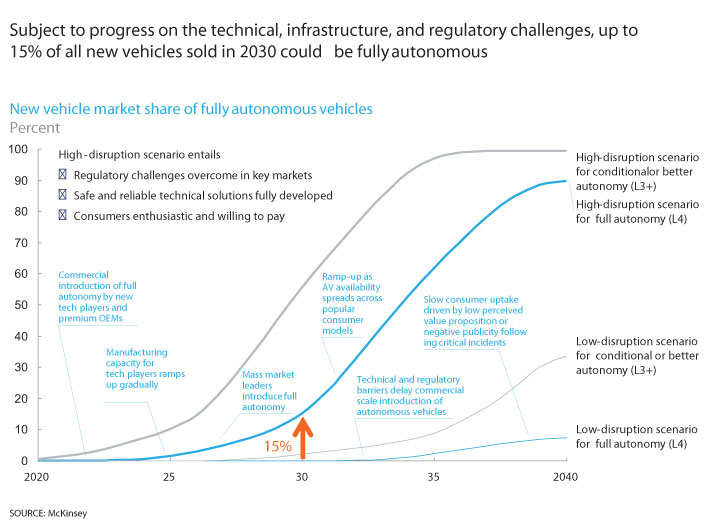

5. Once technological and regulatory issues have been resolved, up to 15% of new cars sold in 2030 could be fully autonomous

Fully autonomous vehicles are unlikely to be commercially available before 2020. Meanwhile, advanced driver-assistance systems (ADAS) will play a crucial role in preparing regulators, consumers, and corporations for the medium-term reality of cars taking over control from drivers.

The market introduction of ADAS has shown that the primary challenges impeding faster market penetration are pricing, consumer understanding, and safety/security issues. Regarding technological readiness, tech players and start-ups will likely also play an important role in the development of autonomous vehicles. Regulation and consumer acceptance may represent additional hurdles for autonomous vehicles. However, once these challenges are addressed, autonomous vehicles will offer tremendous value for consumers. A progressive scenario would see fully autonomous cars accounting for up to 15% of passenger vehicles sold worldwide in 2030 (Exhibit 2).

6. Electrified vehicles are becoming viable and competitive; however, the speed of their adoption will vary strongly at the local level

Stricter emission regulations, lower battery costs, more widely available charging infrastructure, and increasing consumer acceptance will create strong momentum for electrified vehicles (hybrid, plug-in, battery electric, and fuel cell) in the coming years. The speed of adoption will be determined by the interaction of consumer pull (partially driven by total cost of ownership) and regulatory push, which will vary strongly at the regional and local level.

In 2030, the share of electrified vehicles could range from 10% to 50% of new-vehicle sales. Adoption rates will be highest in developed dense cities with strict emission regulations and consumer incentives (tax breaks, special parking and driving privileges, discounted electricity pricing, et cetera).

Through continuous improvements in battery technology and cost, those local differences will become less pronounced, and electrified vehicles are expected to gain more and more market share from conventional vehicles. With battery costs potentially decreasing to US$150 to US$200 per kilowatt-hour over the next decade, electrified vehicles will achieve cost competitiveness with conventional vehicles, creating the most significant catalyst for market penetration. At the same time, it is important to note that electrified vehicles include a large portion of hybrid electrics, which means that even beyond 2030, the internal combustion engine will remain very relevant.

7. Incumbent players will be forced to compete simultaneously on multiple fronts and cooperate with competitors

While other industries, such as telecommunications, have already been disrupted, the automotive industry has seen very little change and consolidation so far. For example, only two new players have appeared on the list of the top-15 automotive OEMs in the last 15 years, compared with ten new players in the handset industry.

A paradigm shift to mobility as a service will inevitably force traditional car manufacturers to compete on multiple fronts. Mobility providers (Uber, for example), tech giants (such as Apple, Google), and specialty OEMs (Tesla, for instance) increase the complexity of the competitive landscape. Traditional automotive players will feel the squeeze, likely leading to shifting market positions in the evolving automotive and mobility industries, potentially leading to consolidation or new forms of partnerships among incumbent players.

8. New market entrants are expected to target attractive segments and activities along the value chain before potentially exploring further fields

Diverging markets will open opportunities for new players, which will initially focus on a few selected steps along the value chain and target only specific, economically attractive market segments – and then expand from there. While Tesla, Google, and Apple currently generate significant interest, we believe that they represent just the tip of the iceberg. Many more new players are likely to enter the market.

Automotive incumbents cannot predict the future of the industry with certainty. To get ahead of the inevitable disruption, incumbent players need to implement a four-pronged strategic approach:

Prepare for uncertainty: Success in 2030 will require automotive players to shift to a continuous process of anticipating new market trends, exploring alternatives and options that complement the traditional business model, and exploring new mobility business models and their economic and consumer viability.

Leverage partnerships: The industry is transforming from competition among peers toward new competitive interactions, but also partnerships and open, scalable ecosystems.

Drive transformational change: With innovation and product value increasingly defined by software, OEMs need to align their skills and processes to address new challenges like software-enabled consumer value definition, cyber security, data privacy, and continuous product updates.

Reshape the value proposition: Car manufacturers must further differentiate their products and services, and change their value proposition from traditional car sales and maintenance to integrated mobility services.

Detlev Mohr is a Director McKinsey’s Stuttgart office and EMEA Automotive Practice Leader, Dominik Wee is a Principal in McKinsey’s Munich Office and Timo Möller is a Senior Expert in McKinsey’s Cologne office.

This article appeared in the Q1 2016 issue of Automotive Megatrends Magazine. Follow this link to download the full issue.