TomTom records robust growth in Location Technology

TOMTOM’S CHIEF EXECUTIVE OFFICER, HAROLD GODDIJN –

“We had a good start to the year, with our Location Technology business continuing to gather momentum in the first quarter.

Our new TomTom Maps Platform, which we announced last year, will enable us to make further inroads in the Enterprise and Automotive markets. The new maps will add significant value for our customers and partners as they will provide global coverage, richer attributes, and fast data integration.

We are on track for a phased launch of our new maps across geographies and markets, adding features to support increasingly sophisticated use cases. In anticipation of the start of the roll-out, we have increased our sales and marketing efforts during the quarter.”

OPERATIONAL SUMMARY

- We deepened our partnership with SAP, integrating our Maps APIs with their cloud-based SAP HANA Spatial Services offering

- Our new Navigation SDK has been received well, showing traction in Enterprise markets like fleet & logistics, ride-hailing, and food delivery

- We doubled our advanced driver assistance systems (ADAS) installed base to over 10 million automated vehicles, outperforming market growth

- Sale of equity interest in Cyient Ltd. for a total transaction value of €15 million

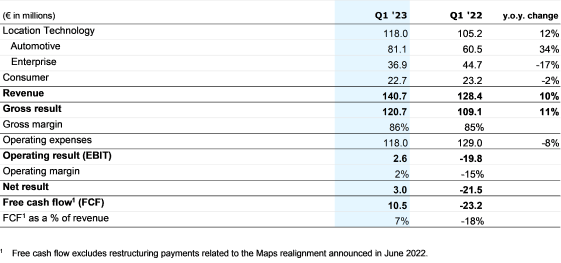

FINANCIAL SUMMARY FIRST QUARTER 2023

- Group revenue increased by 10% to €141 million (Q1 ’22: €128 million)

- Location Technology revenue increased by 12% to €118 million (Q1 ’22: €105 million)

- Automotive operational revenue increased by 22% to €84 million (Q1 ’22: €68 million)

- Free cash flow1 is an inflow of €10 million (Q1 ’22: outflow of €23 million)

- Net cash of €321 million (Q4 ’22: €304 million)

KEY FIGURES

TOMTOM’S CHIEF FINANCIAL OFFICER, TACO TITULAER –

“We recorded year-on-year Location Technology revenue growth in the first quarter. Our Automotive business grew on a reported basis, also when correcting for the change in revenue recognition for new map subscription contracts. With a 22% year-on-year increase, Automotive operational revenue outperformed the growth of car production volumes in our core markets. Our Enterprise business performed in line with our expectations.

Operating expenses showed a year-on-year decline, mainly as a result of the realignment of our Maps organization announced last year. Gains from realized efficiencies in our mapmaking platform were partially offset by continued investments in our application layer and sales and marketing activities.

During the first quarter, a one-off gain from the sale of our equity interest in Cyient Ltd. improved our net cash position.

We remain confident that we can deliver on our guidance, and reiterate it today. Supported by growing revenues, we expect to generate positive free cash flow1 in the range of 0% to 5% of group revenue this year.”

SOURCE: TomTom