Interest in battery electric vehicles (BEVs) is growing rapidly. In 2021, electric cars account for only 4 percent of the global passenger vehicle sales. By 2030, this figure is expected to rise to over 30 percent. However, such a strong increase in demand will create new risks for the lithium-ion battery supply chain, particularly around the availability of raw materials. In the new publication “The lithium-ion (EV) battery market and supply chain”, Roland Berger analyzes these challenges and shows how companies can overcome them.

“The battery pack is a key component of electric mobility. The cost depends on the precise cell technology used, where the battery is produced and to a very large extent on the price of the raw materials,” says Wolfgang Bernhart, Partner at Roland Berger. “Increased raw material costs have already made electric car batteries massively more expensive to produce in recent months. The war in Ukraine is exacerbating things even further. While this will not halt the trend towards electric vehicles, it may slow it down.”

New risks in the supply chain

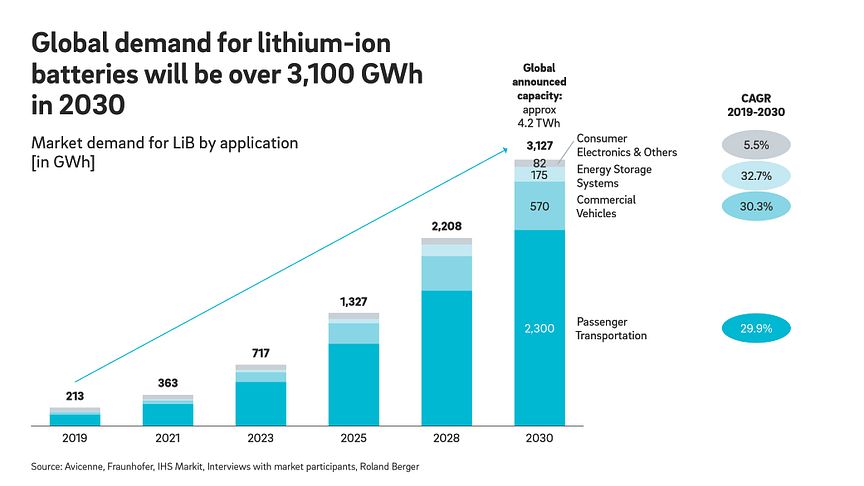

The global lithium-ion battery market is expected to show an annual growth of 30 percent through to 2030. The increase in production will significantly add to the strain on the battery supply chain. Most critical is the dependency on certain raw and refined materials such as cobalt and nickel sulphates as well as lithium. These materials account for more than 30 percent of the cell costs, with cells in turn making up about 75 percent of the total cost of the battery pack.

In this publication, Roland Berger experts identify four main areas of supply chain risks:

Geopolitical factors: The extraction and processing of crucial resources like lithium is concentrated in a small number of countries. About one-tenth of all nickel comes from Russia – thus leading to massive price reactions on the commodity markets with the beginning of the war in Ukraine.

ESG: Battery manufacturing has a significant environmental and social impact. Lithium extraction uses high quantities of water and some production processes emit large amounts of CO2.

Price: Next to the fluctuating raw material prices, the costs of the additional production capacities in the “mine to cell” value chain must also be considered. Capital expenditure of EUR 250-300 billion over the next eight years is forecast, a third of which will go towards meeting European demand.

Supply: The availability of certain materials will become critical. Shortages of both a temporary and a long-term nature are expected for nickel and cobalt or their sulphates, and for lithium in particular.

Countering shortages with recycling, regionalization and vertical integration of raw material supply

Avoiding these shortfalls will require changes throughout the entire battery supply chain. “On a production level, an integrated approach between metallurgy and chemistry will help reduce costs,” states Bernhart. “Greater regionalization and co-location of multiple steps in battery manufacturing can also mitigate geopolitical and ESG risks. Recycling, too, will take on an increasingly important role from the end of the decade onward.”

As regulatory requirements evolve, companies throughout the value chain will find themselves more and more obligated to implement a circular battery economy. The potentially recoverable materials from batteries will be vital in ensuring that supply can meet the rising demand. “Strategically, OEMs and battery manufacturers can also increase their involvement in the upstream supply chain. This may range from long-term supply agreements to partnerships or investments,” says Bernhart. “Positioning oneself at all critical control points along the supply chain is a complex and costly undertaking, but it will provide a strong competitive advantage.”

SOURCE: Roland Berger