American manufacturer Rivian Automotive, Inc. (NASDAQ: RIVN) today announced its second-quarter 2025 financial results. Following its second quarter of gross profit in Q1 2025, Rivian received a $1 billion equity investment from Volkswagen Group on June 30 at an effective price of $19.42 which represents a 33% premium to the $14.56 30-trading day volume-weighted average stock price. The investment is part of the up to $5.8 billion agreement associated with the Rivian and Volkswagen Group Technology joint venture.

As previously announced, in the second quarter Rivian produced 5,979 vehicles at its manufacturing facility in Normal, Illinois and delivered 10,661 vehicles. Production during the second quarter for both R1 products and commercial vans was limited primarily due to a variety of supply chain complexities partially driven by shifts in trade policy.

RJ Scaringe, Rivian Founder and CEO, said:

“This quarter we made significant progress in R2 development and testing. We also substantially completed the expansion of our Normal, Illinois facility and have begun installing manufacturing equipment in preparation for our start of production. Along with R2, our autonomy platform continues to be one of our major focus areas, and we’re excited to share more of our roadmap later this year.”

Preparations for the launch of R2 currently remain on track. The 1.1 million square foot plant expansion at the Normal, Illinois site is now substantially complete and installation of production tooling equipment for component manufacturing is underway. Rivian expects to commission the new R2 line in the third quarter of this year to start validating the equipment and production processes. Rivian is currently producing R2 design validation builds on its pilot production line in California which helps validate the design and optimize cost. As part of R2 preparations, Rivian expects to shutdown the existing factory in Normal for approximately three weeks in September to increase the manufacturing capacity to approximately 215,000 units.

This quarter Rivian started deliveries of its second-generation Quad-Motor R1. Rivian’s new Quad-Motor system is designed to be more capable, powerful and more fun to drive than any of the company’s previous R1 models.

In July, in partnership with the State of Georgia, Rivian announced that later this year it is planning to open an East Coast headquarters in Atlanta. The headquarters will be a focal point for Rivian’s global growth strategy and a key investment in a top state for electric mobility. This site will complement Rivian’s upcoming Georgia manufacturing facility in Stanton Spring North, outside Atlanta.

While Rivian believes its long-term opportunity to drive meaningful growth and profitability remains strong, some of the recent policy actions have had and are expected to continue to have an impact on its results and cash flows of its business. Rivian remains focused on developing world class technology and efficiently scaling its manufacturing capacity in the United States in light of these policy changes.

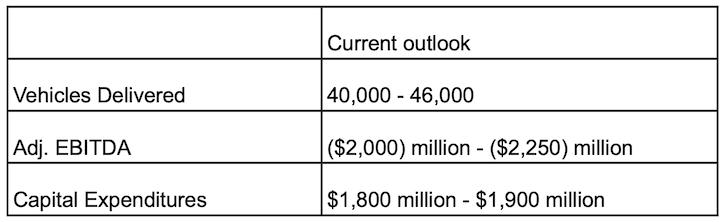

The company is maintaining its 2025 delivery guidance range of 40,000 to 46,000. Because of some of the recent changes associated with regulatory credits and its second quarter performance, the company is increasing its guidance for adjusted EBITDA losses to ($2,000) million – ($2,250) million.

2025 Guidance

SOURCE: Rivian