Vehicle connected services – from infotainment apps to self-driving functionality – have been in the slow lane for years. But they may now finally be on the verge of mass adoption. A new research by Roland Berger, the Connected Vehicle Systems Alliance (COVESA) and Geotab suggests the technology is in place, and many former obstacles to widespread acceptance, such as costs and a lack of user-friendliness, have been largely overcome. In addition, carmakers and suppliers now view connected services as a priority, core product and not just an afterthought. The study is based on insights from 27 industry experts including OEMs, suppliers, research institutions, and dealerships.

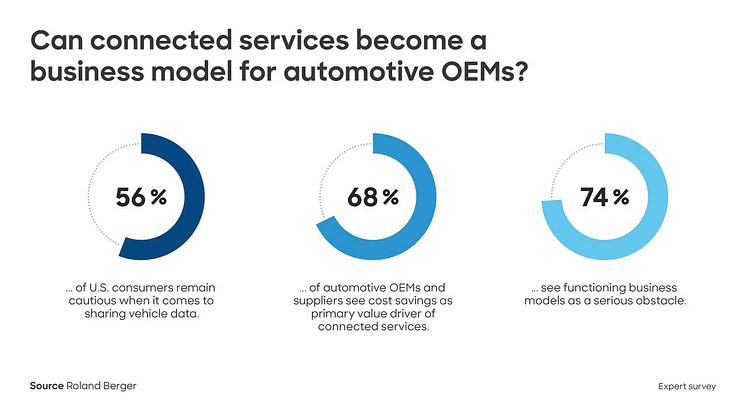

It found that the number of respondents citing a lack of connected vehicles as a primary blocker to the rollout of connected services in 2015 compared to 2025 falls from 84 percent to 0 percent, while only half of those surveyed perceive customer acceptance and willingness to pay for connected services as a barrier in 2025, compared to almost 100 percent in 2015. The survey also revealed that the main barrier to widespread adoption of connected services remains a lack of functioning business models (74%). Experts recommend strategies to address this, including embedding connected services costs within vehicle prices and developing differentiated models to target the specific requirements of fleet managers and consumers.

“Achieving these aims will require some radical transformations in the industry,” said Konstantin Shirokinsky, Partner at Roland Berger. “Our study outlines a potential new operating model based around three major shifts away from current practice: decoupling monetization from value creation; developing cross-functional teams that span automotive and software engineering; and industry-wide collaboration to drive system interoperability.” The key message for OEMs and suppliers? Ditch trying to develop the next great feature and instead work together to create a standardized platform that offers users simple and frictionless access to popular digital services.

Different customer groups need targeted approaches

While customer acceptance and willingness to pay for connected services has risen markedly, 54 percent of survey respondents still regard it as a primary obstacle to roll-out today (compared to 96% in 2015). Some believe it’s only a matter of time until customers become hooked on new services, while others believe subscriptions will never take off. Suppliers are more positive than OEMs about their chances. “Interestingly, suppliers are bigger believers in connected services as revenue drivers. Fifty percent of suppliers told us they believe connected services will drive more than 10 percent of OEM revenue in 10 years, while only 33 percent of OEMs share the same level of optimism,” said Shirokinsky.

Most experts believe producers should target fleet managers and consumers differently, for example, offering fleet managers services that enhance safety and optimize costs, and consumers more choice of apps. Consumer services are likely to have more appeal if they create value rather than generate revenue as willingness to pay remains rather low. Overall, customers mostly want a few connected services that are useful and work well, such as being able to tune into their favorite streaming services while they are on the road.

Operating model adoption is key

For automotive OEMs and suppliers to achieve a successful roll out of connected services, the challenge will be to adopt a new operating model that fuses new value creation models with software product development processes and traditional automotive engineering. This can be achieved using the three-pronged approach. “Ultimately, there is every reason to believe that an industry with over a century of experience in knowing the consumer and their deepest aspirational values, will find a personal connection that endures long after the customer has driven the car home,” said Shirokinsky.

SOURCE: Roland Berger