The war in Ukraine has had a significant impact on debates in Washington over public policy issues with important implications for the automotive industry. In many cases, the Ukraine war helped solidify shifts in public policy that began during the pandemic or as part of the growing competition between the US and China. Those policy trends will continue in the year ahead, regardless of the future direction of the war in Ukraine.

Most notably, the war has intensified the Biden administration’s commitment to policies aimed at increasing domestic manufacturing and strengthening domestic supply chains. Many of those policies were launched early in the administration, before the Russian invasion of Ukraine, with a focus on competition with China.

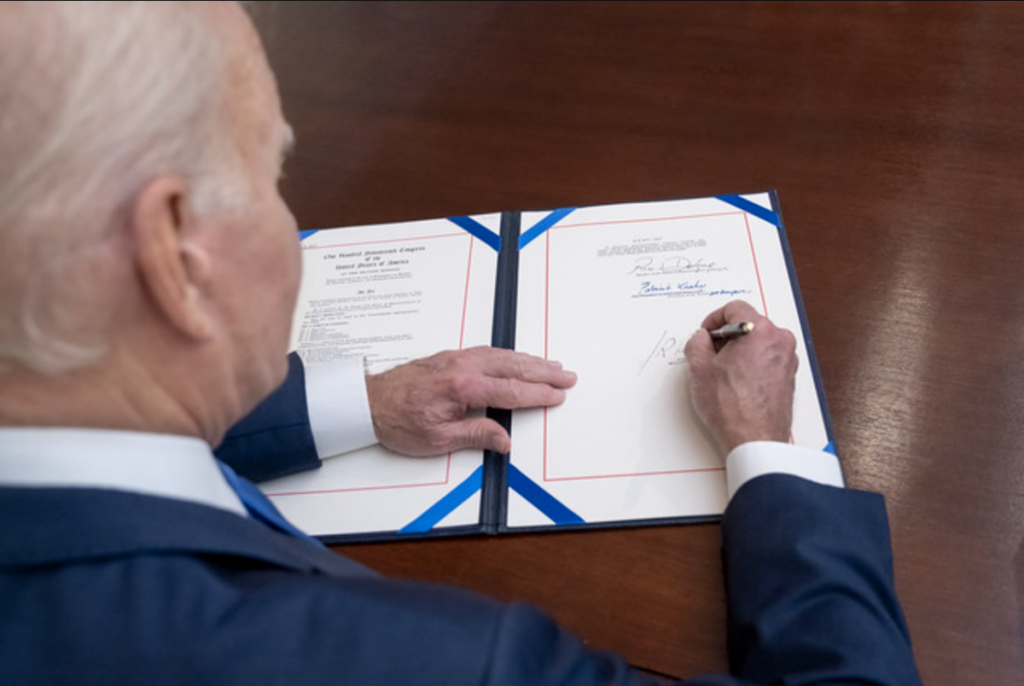

During his first week in office, for example, President Biden signed executive orders designed to increase the use of federal financial assistance and procurement to boost production of key technologies in the US. He launched a six-month review of how to reduce dependence on foreign suppliers in six key sectors, including advanced batteries, critical minerals, and semiconductors. Pandemic-driven shortages of semiconductors, which had a significant impact on automotive production, increased interest in supply-chain issues.

The Russian invasion of Ukraine served to heighten such interest, expanding support for policies to reduce US exposure to global supply-chain disruptions or volatility in global markets for key minerals and materials. Given the Biden administration’s strong support for vehicle electrification, a significant goal of those policies has been to increase domestic production of electric vehicles (EVs) and components, including batteries. The impact of the war in Ukraine on global energy markets and prices has added to the administration’s support for boosting domestic production and sourcing of electric vehicles, batteries, and critical minerals, while serving to increase domestic EV demand.

One notable impact of the Ukraine war, for example, has been to raise prices for nickel, platinum, palladium, lithium, cobalt, aluminium, copper, and other minerals used in production of EVs, batteries, solar panels, smart-grid infrastructure, and wind turbines. In response, President Biden in March invoked the Defense Production Act (DPA) in an effort to increase domestic production and mining of critical minerals needed to manufacture batteries and other renewable energy technologies. The DPA allows the president to use emergency authority to place orders of a product or expand productive capacity and supply. The White House said the administration seeks to reduce dependence on Russia, China, and other sources for these key materials.

Non-defence spending programmes like those providing support to the automotive industry could face severe competition for funds

Efforts to boost domestic investments in clean-energy technologies and vehicle electrification were also at the heart of the Inflation Reduction Act (IRA), which was signed by President Biden in August. The IRA includes tax incentives and other provisions that aim to increase investments in clean-energy technologies, including wind, solar, nuclear, and hydrogen, as well as energy storage and domestic production of critical minerals and energy components.

The IRA contains several provisions related to vehicle electrification, including extension of the federal EV tax credit, creation of new clean-vehicle tax credits for used and commercial vehicles, and extension of tax credits for EV-charging and other alternative-fuel refuelling infrastructure. Many of these provisions, including the extended EV tax credit, add new North American or domestic content requirements designed to boost domestic production and reduce reliance on global supply chains. These provisions have raised concerns among US trading partners who argue that the IRA’s tax provisions, including those related to EVs and batteries, discriminate against foreign producers. Addressing these issues will be a major challenge for the Biden administration in the coming year, particularly since Congress seems unlikely to rewrite the law to ease the content requirements.

The war in Ukraine also helped advance Congressional consideration of the CHIPS and Science Act, a bipartisan bill that was signed into law by President Biden in August. The law provides more than US$52bn in incentives for investments in semiconductor manufacturing facilities and equipment in the US, creates a new 25% tax credit for investments in US semiconductor manufacturing, and authorises nearly US$170bn in R&D funding across federal agencies. The bill includes a US$2bn fund for the more traditional semiconductors that automakers and suppliers use. Support for such efforts to increase domestic semiconductor production and create a resilient domestic technology supply chain, initially driven by the goal of reducing dependence on China, received added support in the aftermath of the Ukraine invasion and its impact on global technology supply chains.

While the war in Ukraine has boosted support for policies to expand domestic supply chains for EVs and other products, it has also created challenges for funding those efforts. The war is already having a significant impact on budget debates in Washington by increasing support for higher defence spending at a time when the federal government already faces severe deficit and debt challenges. As a result, non-defence spending programmes like those providing support to the automotive industry could face severe competition for funds in the absence of higher revenues.

In many cases, the Ukraine war helped solidify shifts in public policy that began during the pandemic or as part of the growing competition between the US and China

This is particularly true since future defence needs will come in conflict with potentially slower economic growth and higher energy prices and borrowing costs. The war in Ukraine thus likely sets the stage for more intense budget debates in the coming fiscal years, with lawmakers looking to find ways to control future deficits and debt while increasing defence spending—all in a time when higher interest rates are adding to the cost of servicing the federal debt. This will put a great deal of pressure on the non-defence ‘discretionary’ spending, including on R&D, loan-guarantee, and other federal programmes designed to support the automotive industry and speed development of advanced vehicle technologies.

Looking ahead, the Biden administration will continue efforts to expand domestic automotive production and strengthen domestic supply chains for EVs, batteries, and other key components and materials, as the US moves to reduce its exposure to global supply-chain disruptions and market volatility. Passage of major new legislation may be more difficult in the incoming Congress, with partisan control split between Democrats and Republicans, but the administration can use executive actions and recently enacted programmes to advance its policy goals. The Ukraine war and its impact on global energy and critical-minerals markets have helped solidify support for such policies.

Ian Graig, Chief Executive of the Washington-based public policy consultancy Global Policy Group, has written for AutomotiveWorld on a wide variety of US public policy trends and their implications for the automotive industry