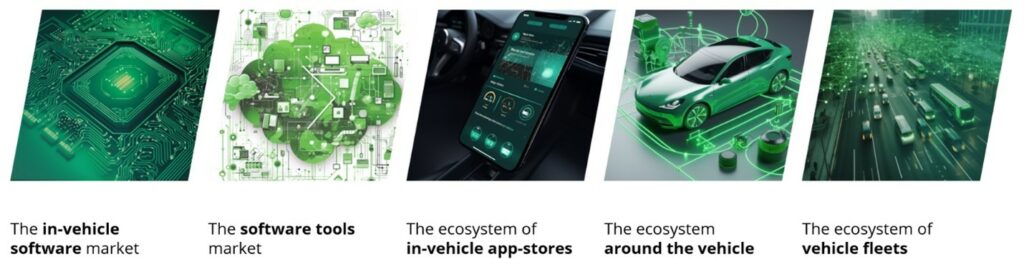

Looking at the classic automotive software industry, there are essentially two markets today: the market for in-vehicle software and the market for software tools. There is a variety of options in both markets, from infrastructure software such as operating systems and middleware, to end-user-facing applications. The software is either generic, like AUTOSAR, or domain-specific, like Android Auto and CarPlay. There are off-the-shelf software products, and there is custom software developed in-house or as an engineering service.

In either case, the software is created for professionals to develop vehicles and vehicle functionality—a business-to-business market within the automotive domain. The primary revenue stream to finance this market is vehicle sales.

These traditional two markets are under immense pressure. As the traditional vehicle evolves into the software-defined vehicle and customer expectations shift, new value needs to be delivered more quickly, independent of buying a new vehicle. The goal is to deliver value through software separate from vehicle sales to monetise software, a brand-new concept for the industry.

Ultimately, the industry could see the rise of five markets or ecosystems for vehicles. The two traditional markets discussed above will undergo considerable transformation, and three new markets will emerge. However, before this can happen, OEMs must achieve three key transformations.

The goal is to deliver value through software separate from vehicle sales to monetise software, a brand-new concept for the industry

For software to be delivered independent of vehicle sales, it must be updateable. Therefore, the lifecycles of software and hardware need to be decoupled. The lifecycle of hardware in a vehicle is within the range of ten to 15 years whereas the lifecycle for software is expected to be in the range of a few months to one or two years. Partial updates of individual functions will be necessary, and updates can be delivered remotely. To address the complex issue of updating a distributed system of ECUs and networks, OEMs are developing a single software platform that will span all (or many) of its vehicle lines. This is the transformation towards automotive operating systems (OSes such as the vw.os) and zonal architectures taking place today.

The second key transformation demands that OEMs must deliver value through software that customers are willing to pay for. Unlocking existing hardware features, like the controversial heated seats subscription, for example, is not a valuable way to deliver on this promise. However, providing the next generation of an ADAS function to a vehicle is. So far, Tesla has been the only OEM to accomplish this. OEMs must transform to allow for overallocation of hardware resources to enable future updates, which may require them to change the way business cases are calculated. A narrow focus on bill-of-materials will not enable this step. It requires software functions to be thought of as products rather than simply as a feature of a device to be sold.

Once an OEM is able to separate the lifecycle of software-hardware and deliver actual value to its customers, it needs to be able to capture value to monetise the software functions. If new software functions are no longer bound to vehicle sales, the investment needs to be monetised in another way.

For example, Apple would likely not be able to maintain the ecosystem of iOS apps if each app were bound to a specific iPhone generation. A new iPhone today would not achieve market success without the app store, as the capability for value delivery would be missing. Google would certainly not have developed Android if it couldn’t continue to monetise the investment via data or its own app store.

The road to software monetisation

Achieving these three key transformations is essential to creating a truly software-defined vehicle. The first two will have tremendous impact on the existing markets for in-vehicle software and software tools and are already shaking up the automotive ecosystem. Developing harmonised automotive OS platforms is causing a shift in the supply chain, allowing OEMs to take ownership of software platforms and source software directly from vendors rather than from ECU suppliers.

The need for fast development is fostering the push towards open-source collaboration and fuelling the shift to cloud-based development requiring OEMs, Tier 1s and Tier 2s to undergo a challenging evolution in terms of offerings as well as internal organisation and business models. Still, both in-vehicle software and software tools must serve automotive-specific requirements. Safety, security and homologation are all still relevant. While pressure mounts from new entrants into the market, the capabilities and expertise of incumbents are important, which is a great catalyst for new cooperation among companies. Proof points are initiatives such as Eclipse SDV, SOAFEE and Covesa, as well as the multitude of partnerships being forged among individual companies.

The third transformation of capturing value is creating opportunity for new markets and ecosystems. In-vehicle software and software tools remain a business-to-business market among largely automotive companies. Although it’s highly contested and undergoing a process of enormous change, it is transforming the industry.

New market opportunities

Beyond the two existing (and transforming) in-vehicle software and software tools markets, the three new markets that will or are already starting to form are in-vehicle app stores, connected services around vehicles and vehicle fleet ecosystems.

In-vehicle app stores will sell new or upgraded functionality to customers outside of the vehicle sale. OEMs will attempt to replicate the success of smartphone app stores for vehicles. So far, this type of activity has been mainly limited to infotainment systems (except for Tesla). As an example, software upgrades will not be used to install a trendy social media app into a vehicle, but instead will be used to provide additional capabilities beyond what is provided by a smartphone. In any case, this trend introduces a business-to-consumer market for software, which will likely be operated by OEMs.

The second emerging market is related to services around a vehicle, such as connecting data or vehicle functions to outside services. Current prominent examples are pay-per-use insurance, delivery-to-trunk services, or connecting a vehicle to home energy management to control charging, and plenty of other opportunities exist as well. These will require OEMs to shift to not only target end customers beyond the initial vehicle sale, but also partners from other industries to build an ecosystem of services around the APIs of a vehicle.

Fragmentation of the automotive industry will become a major hurdle, similar to the current state of the home automation market. This market is a two-sided business, connecting service providers on one end to consumers on the other, using the vehicle as the platform. Ecosystem size is essential to success, and the first open-source initiatives and standards are forming to overcome the fragmentation.

OEMs must deliver value through software that customers are willing to pay for

The third new market is centred around managing vehicle fleets and monetising fleet data. This market is hugely attractive in the commercial sector as it may have a significant financial impact on rental car companies and delivery services, among other players. Typical examples include predictive maintenance, fleet routing or collecting road condition data. Again, to address this market, OEMs need to transform their business to target different customers with new business models. The market is a business-to-business relationship; however, OEMs will not necessarily be the dominant party.

While the established two markets of in-vehicle software and software tools are highly contested and are undergoing tremendous change, the three emerging markets offer new opportunities for OEMs to unlock the full potential of the software-defined vehicle.

About the author: Moritz Neukirchner is Senior Director, Strategic Product Management, Software-Defined Vehicle, at Elektrobit