The car factory of the future will be highly efficient, flexible and digital, leveraging huge amounts of data and sophisticated machines to create a range of electrified models that will be personalised to suit individual customer needs. But carmakers face several challenges if they are to ensure their factories are operating smoothly in 2030.

Flexibility and digitisation

“Flexibility and digitisation are the two keywords that will define the transformation of car production through this decade,” states Ignazio Dentici, Vice President of Global Automotive & eMobility Industry at Hexagon’s Manufacturing Intelligence division. “OEM’s need to be flexible so they can react to the demands of the market. In the past, car production was rigid and inflexible as cars were made to type, but as the electric vehicle (EV) has evolved and consumer demand changes, OEMs need to have the ability to change their manufacturing processes and adapt quickly to create different models, which also involves engaging with external consumer electronics providers.”

Dentici thinks that old legacy plants with fixed assembly lines capable of producing just one or two models will soon be extinct. Instead, factories must be able to roll out a large portfolio of models and will need to be easily adaptable to house production of new models should market demand require. To do this, he thinks that the car factory needs to be meticulously designed and tested in a virtual environment.

“The other key trend is the digitisation and the utilisation of data to optimise the manufacturing process before production,” Dentici continues. “I don’t think any discussion of smart manufacturing in a whole vehicle production and assembly context can omit the design phase anymore. To be smart in 2030, manufacturers will need to apply the best insights they have from virtual design, virtual manufacturing, virtual testing and virtual prototyping data and processes.”

Raul Arredondo, Director of Global Industry Strategy & Marketing at Rockwell Automation, agrees with Dentici, and emphasises the need for carmakers to be both flexible and agile as growth in the EV segment rises. “Flexible and agile production in 2030 will mean production of both internal combustion engine (ICE) vehicles and EVs, in low and high volumes, must be able to happen at the same plant on the same assembly lines,” he confirms. “It also means efficient production of highly customised vehicles.”

Data will likely play a key role in making sure factories are flexible and operating as effectively as possible. It could also help mitigate disruption by reducing errors and downtime, aid workers in decision making, and identify issues along the assembly line. With robots and machines used at every stage of production, the amount of data that can be gathered in plants is staggering, but not all of it will be useful. Therefore, powerful data centres will be needed to sift through information and glean important highlights before presenting it in a legible manner for plant directors or line managers.

“Data is already important today, and it will become more important in the future,” Arredondo predicts. “It has the potential to make the production footprint smaller, to make the factory more modular, flexible, and to shorten the time to build a vehicle.”

The EV world

With the rise of the EV set to accelerate in 2030 and beyond, all carmakers have made promises to offer more electrified models in their portfolios. Some have even outlined plans to only make new EVs. Mercedes-Benz hopes to phase out sales of gasoline and diesel models by 2030, while General Motors plans to only sell EVs by 2035. Most other OEMs have targets to significantly reduce gasoline and diesel sales by 2030. But there are several key challenges that must be addressed to ensure global large-scale EV production can go ahead in 2030.

Old legacy plants with fixed assembly lines capable of producing just one or two models will soon be extinct

Dentici thinks that there is a considerable amount of work to be done on the manufacturing side, particularly for battery packs. “The challenge for manufacturers is about achieving battery manufacturing process maturity so every battery meets quality targets,” he notes. “Scaling up to meet the costs required means eliminating scrap and improving efficiency. It also means avoiding very expensive safety-critical defects such as anode overlap by scrutinising pilot processes and using all available data to iron these remaining issues out for higher volume production. Once the capacity to produce critical parts is achieved—which includes on-board vehicle electronics and powertrain—economies of scale can be achieved and EVs can become more widely available.”

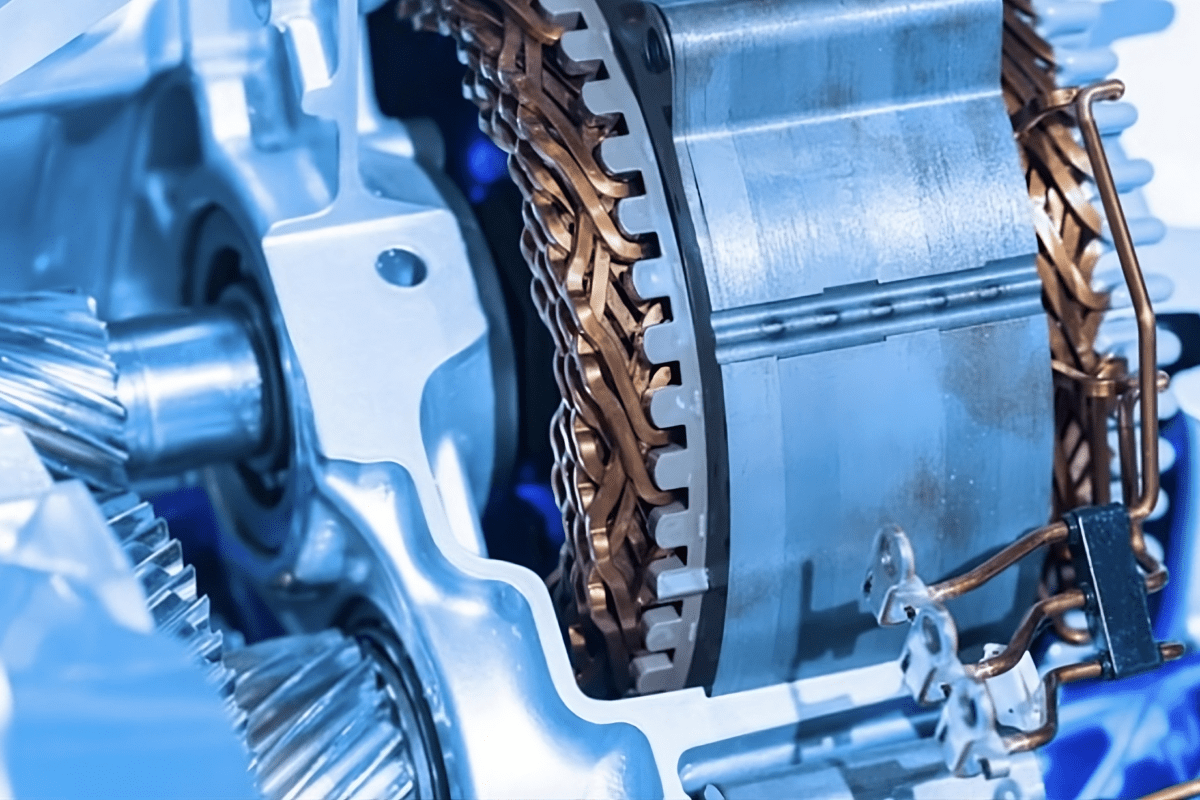

There is also the consideration that making EVs in a plant that has traditionally only centred on production of ICE vehicles could require changes. Although he explains that there are many commonalities between producing ICE vehicles and EVs, Arredondo insists that carmakers must focus on optimising their assembly plants before ramping up production of EVs. He expects there to be some notable changes to body-in-white (BiW) production and final assembly. This is due to the battery pack forming a structural part of the BiW rather than simply sitting within it.

The BiW refers to the skeletal structure of the vehicle architecture, and is usually divided into three main parts: front engine bay, passenger cabin, and rear boot. Replacing the engine with an electric motor and adding battery packs means that the BiW of an EV can be very different to that of an ICE vehicle, having a potential impact on numerous factors like dimensions, weight distribution and vehicle crashworthiness. This could all translate to changes in the body and press shop of car plants, with different robots needed to provide the necessary solutions and processes. For example, parts of the BiW on an EV may need to be welded differently to ensure the front section of the vehicle performs as needed in crash tests.

Dentici also expects there to be changes to accommodate EV production, highlighting final assembly as the key area. “From a final assembly point of view, I believe there will be greater emphasis on modular production and less sequential production lines,” he suggests. “I expect large numbers of manufacturers will follow this roadmap because it is much less expensive than the volume production assembly line model and they can adapt to change faster. I also think we will see an increase in more decentralised production.”

Human workers

The role of the human worker on the assembly line is also changing. Robots and digital tools are present on today’s production lines, and more will likely be used in the future. Both Arredondo and Dentici think that production line workers will still be present in the factories of 2030, although they will likely be confined to specific areas.

“There will be more automation because the issue of finding skilled workers will continue to be a problem,” Arredondo explains. “However, people will continue to be important. I expect that they will work in assembly and quality control – areas of the factory where there is a higher degree of variation.”

Shortages of skilled labour forces have been impacting several industries, including automotive, since the outbreak of the COVID pandemic. In an article published by Forbes, Dave Opsahl, Chief Executive of Actify—a software company with solutions that help companies with vehicle manufacturing—outlined the battle to retain talent and find new skilled workers. He warns that vehicle production could soon “slow to a crawl” if the problem remains unsolved, and while technology could help reduce worker burnout and stress, he underlines the importance of training new staff and making a career in vehicle production more enticing.

Sustainability

As carmakers look to 2030 and beyond, one of the biggest challenges for their entire business is sustainability. Lowering the environmental impact of production facilities plays a partial but significant role. Statistics from the European Automobile Manufacturers’ Association (ACEA) suggest that the average car factory in Europe saw a fall in CO2 emissions by 45.9% between 2006 and 2021. However, a 2022 report from NGO Transport & Environment claims that carmakers vastly under-report their life cycle emissions. Taking into account every part of the process, from sourcing raw materials and production through to end of vehicle life, the T&E paper suggests that lifetime global CO2 emissions of vehicles are 46% higher than reported.

“To be effective and deliver carbon neutrality, manufacturers need to consider the full lifecycle design of the vehicle, the materials used, and the type of energy required for the production process,” Dentici remarks.

It is clear that sustainability will remain a vital challenge for car companies, but Arredondo thinks it could be a tall ask. “Many car factories could be carbon neutral by 2030, but it will depend on investments in the grid. Automakers can install renewable energy technologies and implement solutions like energy management systems, but large factories producing EVs may require more energy and water than what is feasible to produce locally,” he predicts.