In its latest report, OEM Hybrid and Electric Vehicle Strategies: Plug-In Hybrid and Tesla Gigafactory to Widen the Market, Strategy Analytics sees two main trends that will affect the electrified powertrain market in the next few years: firstly, plug-in hybrids are being touted as a stop-gap before new battery chemistries provide the breakthrough for pure electric vehicles; and secondly, attempts to limit air pollution are raising the profile of hybrid powertrains in China.

Plug-in hybrid stop-gap

It is well-known in the automotive industry that battery chemistries need to be developed further in order to overcome the high cost, lack of thermal stability and low energy capacity (resulting in short driving range) from current technologies. According to Strategy Analytics, vehicle manufacturers are turning their attention to plug-in hybrid models as a means of addressing this issue in the short-term.

While battery chemistries such as lithium-air, lithium-sulphur and zinc-air are being touted as the solution for pure electric vehicles, such chemistries will not appear until 2018 at the very earliest – more likely towards the 2025 timeframe. In the meantime, vehicle manufacturers are still pressured to comply with the tougher mandates on raising fuel economy and limiting harmful emissions.

Although other fuel-saving technologies are increasingly being deployed to the market, they cannot provide the large savings that a plug-in powertrain can provide. These large savings are especially prized by luxury brands, whose large capacity engines and sales in mostly large model segments make these brands particularly vulnerable to the new mandates.

Additional legislative measures are also being looked at to eliminate tailpipe emissions altogether and effectively ban the use of combustion engines in city centres:

- European cities, such as London, are proposing “Ultra-Low Emission Zones” in an effort to limit air pollution. The recent proposal by London’s mayor, Boris Johnson, has resulted in a number of plug-in hybrid taxi cab concepts being previewed. More European cities have since made announcements proposing to form a ULEZ;

- Beijing had instituted a ban on combustion-powered motorcycles and scooters at short notice, resulting in the preview of a plug-in hybrid BMW 5 Series concept at the 2011 Shanghai Motor Show – its production in China will start by 2016. To prevent the loss of sizeable sales in the key China market, luxury brands have announced new model ranges to satisfy any potential combustion engine ban.

Furthermore, the nascent charging infrastructures are not extensive enough to provide the convenience consumers demand when owning a pure electric vehicle. The combustion engine in a plug-in hybrid offers the comfort of a secondary drive source, if a nearby charging facility is not available. This is particularly important for consumers who do not own a large driveway or a garage – particularly those consumers living in apartments, which is common in the Chinese market. The plug-in capability also means that they may still being eligible for government incentives.

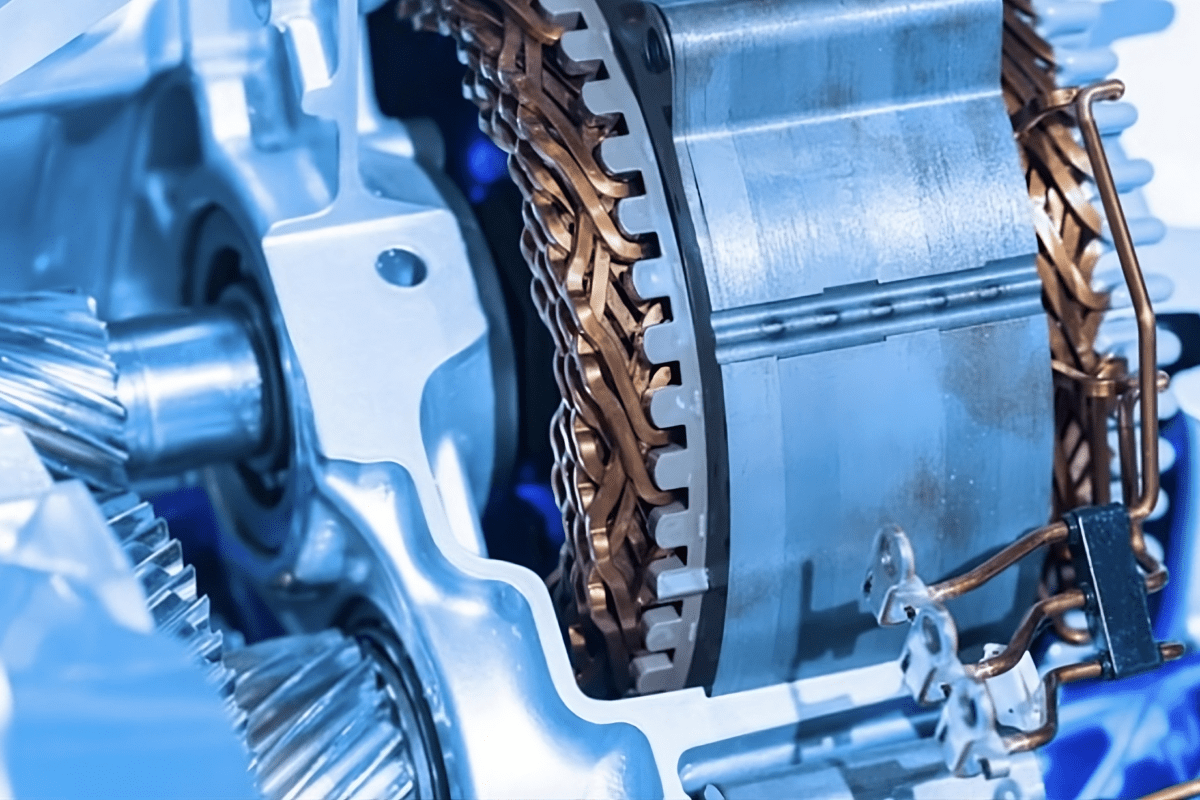

As a result, some car manufacturers are beginning to design their future model ranges to be electrified vehicles from the ground-up. All powertrain platforms are now designed to allow some form of electric drive, which includes plug-in hybrid systems that can be installed on the same assembly lines as conventionally-powered variants.

- Examples include the Volkswagen Group having plug-in hybrid variants on almost all models on both the MLB and MQB platforms. The compact MQB platform already has plug-in hybrid variants on the new Audi A3 etron, Volkswagen Golf and Passat GTE.

- Toyota is currently developing the next generation Prius hybrid model. As with the current generation, there will be a plug-in hybrid variant. It is expected to see more advanced features, such as a wireless charging system.

China hybrid boost

While the Chinese Government had initially focused its automotive industry towards pure electric vehicles, the high battery cost and lack of charging infrastructures have meant that it could now be more willing to accept hybrid vehicles as a means of tackling the chronic air pollution in its cities.

Fuel efficiency subsidies are offered to purchasers of vehicles that can achieve a certain level of fuel economy for that vehicle’s weight category. Furthermore, the price of fuel is likely to be released further from government controls, making fuel economy a more important factor in vehicle purchasing decisions by Chinese consumers. Both measures could boost hybrid vehicle demand in China.

“As corporate average fuel emission standards get stricter, we believe that hybrids will become the mainstream among green cars” – Seiji Kuraishi, China Chief Operating Officer, Honda

As a result, two major global motor manufacturers have announced their intention to raise hybrid vehicle production in the country. Honda is to begin assembling the Fit Hybrid (with GAC) in 2016. Toyota has been assembling the Camry Hybrid (with its joint venture partner, GAC) and the Prius (with FAW) since 2013. The recent announcement reveals plans to add the Corolla and Levin Hybrids in Toyota’s China line-up from 2015 onwards. To support its effort, Toyota has opened a technical centre in Changshu. Both vehicle manufacturers have a commitment to localise component sourcing to circumvent import tariffs. Key localised components include the battery packs; Toyota’s are supplied by Hunan Corun. Hybrid concepts with designs specifically aimed at the Chinese market have also been previewed by Honda and Toyota.

To counter the lack of charging infrastructure, plug-in hybrids have also been targeted by foreign luxury OEMs. The Volkswagen Group has identified ten models in order to increase its sales of electrified vehicles in China, most of which are plug-in hybrids. In 2016, two specially-designed plug-in hybrid models for the Chinese market will begin local production – the Audi A6 e-tron (assembled by FAW-VW) and another sedan under the Volkswagen brand (assembled by Shanghai-VW).

China’s BYD is also widening its hybrid offerings with a platform strategy, aimed at raising plug-in hybrid variants in all future models.

The wider benefits of plugging in

As well as hybrid powertrain growth, production capacity for traction batteries will grow in China. Hunan Corun is poised to benefit from Toyota’s growth plan. Backed by local investment, LG Chem broke ground on a new production facility in Nanjing, close to a current facility making batteries for smartphone handsets and other portable consumer electronic devices. Samsung SDI also broke ground on another facility in Xi’an, to be jointly operated with its partner, Anqing Huanxin Group.

As well as hybrid powertrain growth, production capacity for traction batteries will grow in China. Hunan Corun is poised to benefit from Toyota’s growth plan. Backed by local investment, LG Chem broke ground on a new production facility in Nanjing, close to a current facility making batteries for smartphone handsets and other portable consumer electronic devices. Samsung SDI also broke ground on another facility in Xi’an, to be jointly operated with its partner, Anqing Huanxin Group.

Semiconductors are another beneficiary of China’s push for hybrid powertrains. NXP had earlier formed China’s first automotive semiconductor company, Datang NXP Semiconductors, from the partnership with Datang Telecom. Datang NXP develops application-specific mixed signal chips, mainly destined for hybrid and electric powertrains. Freescale had established joint laboratories to develop hybrid powertrain control units for Dongfeng and Foton (BAIC). Infineon also has an automotive technical centre and an IGBT (Insulated Gate Bipolar Transistor) stack manufacturing facility. STMicroelectronics, too, has joint laboratories but with Chang’an, FAW and Great Wall, while ON Semiconductor recently announced the formation of a joint research laboratory with Keboda, a Chinese Tier 2 supplier of ECUs (Electronic Control Units) and electric motor inverters, and Tongji University in Shanghai.

The Q3 2014 Strategy Analytics System Demand Forecast points to a growth in plug-in hybrids, rising from 73,000 units globally in 2013 to nearly 2.9 million units by 2021. For all hybrid and electric vehicles, these will grow from 2.2 million in 2013 to nearly 12 million units by 2021.