- Exceeded 2022 FY financial outlook (upgraded in July 2022)

- Significant improvement in profitability: 5.6% operating margin vs a guidance above 5% and up €1.4bn vs 20211 (+2.8 pts)

- Record Automotive operating margin per vehicle

- Record free cash flow generation: €2.1bn vs a guidance above €1.5bn (+€1.2bn vs 20211)

- Strengthening of the financial structure: return to net cash financial position at +€549m at December 31, 2022 (+€1.6bn vs 20211)

- Orderbook at record levels and success of new vehicles

- 2023 FY financial outlook:

- Group operating margin superior or equal to 6%

- Automotive operational free cash flow superior or equal to €2bn

- A dividend of €0.25 will be proposed to the vote of the Annual General Meeting on May 11, 2023

“2022 has more than kept its promises: with results above our initial objectives and market expectations, we completed the “Resurrection” phase three years ahead of schedule. This performance reflects the energy and hard work of the Renault Group’s teams even as we have faced strong headwinds related to the disposal of our operations in Russia, the semiconductor crisis and cost inflation. Renault Group’s fundamentals have been thoroughly cleaned up and there will be no turning back. 2023 financial outlook and the return of a dividend illustrate this. In addition, we have achieved our target of a 25% reduction of our global carbon footprint since 2010.

I would like to thank the teams for these good results. We have confidence in the future of the Group. The outstanding participation of our employees in the shareholding plan illustrates this and makes me particularly proud.

The second phase of the plan, “Renovation”, focused on products, is already largely under way and will allow Renault Group to have its best vehicles line-up in 30 years. The successes of Renault Megane E‑TECH Electric, Renault Austral and Dacia Jogger are the first of this wave.

Our advance in the implementation of Renaulution’s first strategic and financial milestones allows us to open, as of today, the most exciting chapter of our plan: “Revolution”.

Finally, as announced on February 6 with our partners Nissan and Mitsubishi, the new foundations of our Alliance will be deployed as of this year with operational projects that create value for all stakeholders.

Go 2023!“ said Luca de Meo, CEO of Renault Group

[1] The results presented relate to continuing operations (excluding Avtovaz and Renault Russia whose disposals were announced on May 16, 2022)

16 February 2023 07:00

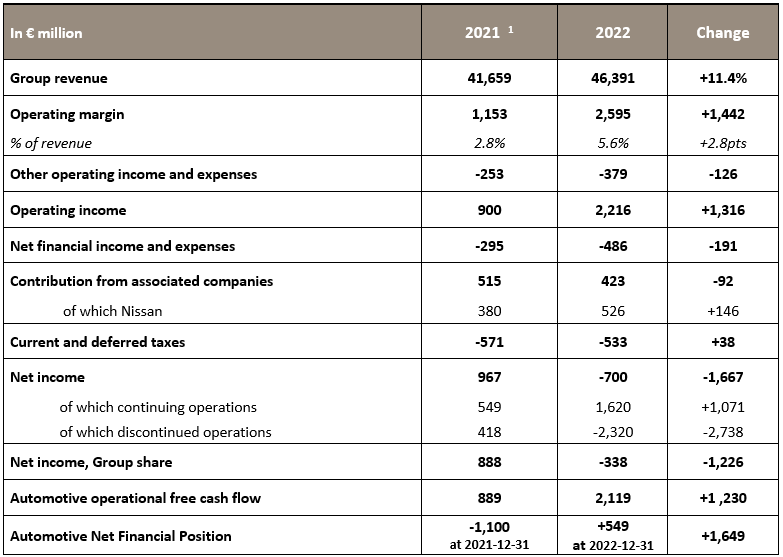

- 20221 results: exceeded 2022 FY financial outlook (upgraded in July 2022)

- Group revenue at €46.4bn: +11.4% vs 2021

- Group operating margin at €2.6bn (5.6% of revenue): up €1.4bn vs 2021 (+2.8 pts), reaching 6.4% in 2022 H2 (+2.9 pts vs 2021 H2)

- Automotive operating margin at €1.4bn (3.3% of revenue): up €1.4bn vs 2021 (+3.3 pts), reaching 4.2% in 2022 H2 (+3.5 pts vs 2021 H2)

- Record Automotive operating margin per vehicle

- Net income from continuing operations at €1.6bn, up €1.1bn compared to 2021

- Net income from discontinued operations at -€2.3bn due to the non-cash adjustment related to the disposal of the Russian industrial activities announced on May 16, 2022

- Record Automotive operational free cash flow at €2.1bn (including a €800m dividend from Mobilize Financial Services): up €1.2bn vs 2021

- Automotive net cash: back to positive at +€549m at December 31, 2022 compared to -€1.1bn at December 31, 2021, ie an improvement of €1.6bn

- Breakeven point lowered by 50% vs 2019

- 2022 Global carbon footprint2 reduction target of -25% versus 2010 achieved

- Orderbook at record levels and success of new vehicles

- Group orderbook in Europe at record levels: 3.5 months of sales at the end of the year

- Sales mix to retail customers in the 5 main European countries (France, Germany, Spain, Italy, UK): 67% (+9 pts vs 2021, +15 pts vs 2019)

- Growing performance of E-TECH3 sales, representing 39% of Renault brand passenger cars sales in Europe (+9 pts vs 2021). Renault is the 3rd brand on pure EV market and 2nd brand on full-hybrid market in Europe

- Success of models:

- Renault Arkana recorded 86,000 sales in more than 50 countries in 2022. In Europe, 65% of sales are in E-TECH version, 74% on the highest versions and 56% on the retail channel

- Renault Megane E-TECH Electric reached over 33,000 sales in 2022, since its launch at the end of 2022 Q2. It was number 1 EV in France in 2022 H2. As of today, 49,000 orders have been recorded since its launch with more than 70% of these on the highest versions and more than 80% on the most powerful engines

- Dacia Sandero, with 229,500 sales, remained the best-selling vehicle to retail customers in Europe since 2017

- Launched mid-2021, Dacia Spring 100% electric recorded 48,900 sales, up 75% vs 2021 and was number 3 EV sold to retail customers in Europe

- Dacia Jogger recorded almost 57,000 sales and was number 2 of C-segment (ex. SUV) sold to retail customers in Europe

- Alpine reached a record level of sales, up 33% versus 2021

- Product mix effect of +2.8 pts on the Automotive revenue vs 2021 thanks to new launches (Renault Arkana, Dacia Jogger and Renault Megane E-TECH Electric)

- Acceleration of the pricing effect, which reached +9.7 pts on the Automotive revenue vs 2021 (+12.1 pts in 2022 H2 after +7.4 pts in 2022 H1), thanks to the Renaulution commercial policy

- 2023 FY financial outlook

In a still challenging environment, the Group is aiming to improve its performance in 2023 with:

-

- a Group operating margin superior or equal to 6%

- an Automotive operational free cash flow superior or equal to €2bn

Boulogne-Billancourt, February 16, 2023

The consolidated financial statements of Renault Group and the company accounts of Renault SA at December 31, 2022 were approved by the Board of Directors on February 15, 2023 under the chairmanship of Jean-Dominique Senard.

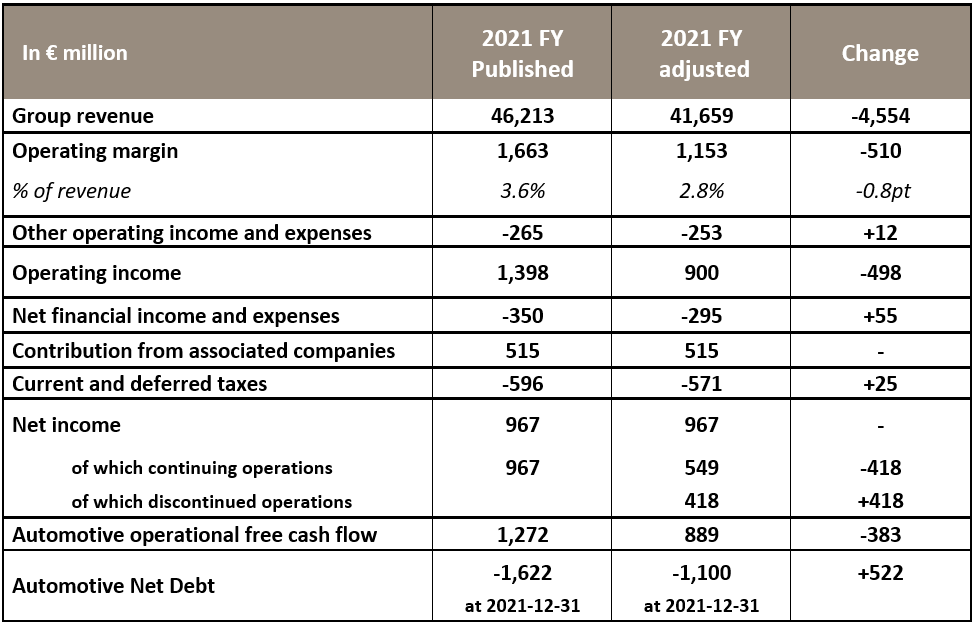

Reminder relative to the impacts of the disposal of Russian automotive activities on financial statements:

In May 2022, the Board of Directors of Renault Group unanimously approved the signing of agreements to sell 100% of Renault Group’s shares in Renault Russia to the City of Moscow and its 67.69% stake in AVTOVAZ to NAMI (the Central Institute for Research and Development of Automobiles and Engines). In addition, the agreement provides for a call option for Renault Group to buy back its stake in AVTOVAZ, exercisable at certain periods over the next 6 years.

As a result of these agreements:

- The Russian activities were deconsolidated in Renault Group’s 2022 financial statements and treated as discontinued operations under IFRS 5 with retroactive effect from January 1st, 2022.

- The financial aggregates of continuing operations for 2022 therefore no longer include the Russian industrial activities and the year 2021 has been adjusted in line with this new scope of activity.

- The result of discontinued operations represents a loss of -€2.3 billion in 2022, mainly due to the impairment of the property, plant and equipment, intangible assets and goodwill of AVTOVAZ and Renault Russia as well as the impairment of specific assets held by the other entities of the Group and the result of disposals on the Russian entities sold.

- The Automotive net debt was reduced by €0.5 billion from -€1.6 billion to -€1.1 billion at December 31, 2021.

Group revenue reached €46,391 million, up 11.4% compared to 2021. At constant exchange rates4, it increased by 12.4% (-1 point of negative exchange rates effect).

Automotive revenue stood at €43,121 million, up 11.4% compared to 2021. At constant exchange rates5, it increased by 12.6% (-1.2 points of negative exchange rates effect mainly related to the Turkish lira and Argentinean peso devaluation).

Volume effect stood at +3.4 points thanks to the commercial success of vehicles coupled with an improved availability of EC components. Invoices outperformed sales because of delays in the delivery of vehicles ordered by and invoiced to the independent dealers to answer their customers’ demand. These delays were due to outbound logistic tensions at the end of the year.

The price effect, positive by +9.7 points, reflected the continuation of the Group’s commercial policy, launched in 2020 Q3, focused on value over volume, as well as price increases to offset cost inflation, and an optimization of commercial discounts. It amounted to +12.1 points in 2022 H2 after +7.4 points in H1.

The success of Renault Megane E-TECH Electric launched at the end of 2022 Q2, Renault Arkana launched in 2021 Q2, as well as Dacia Jogger launched in 2022 Q1, evidenced the renewal and the offensive of Renault and Dacia brands in the C-segment. It generated in 2022 a +2.8 points positive product mix effect.

The impact of sales to partners, negative by -1.4 points, was mainly due to the decrease in production of diesel engines and vehicles for Renault Group’s partners (end of contracts of Master for Opel and Traffic for Fiat at the end of 2021).

The “Others” effect, of -1.8 points, was due to a decrease in the contribution of sales from the Renault Retail Group (RRG) network following the disposals of branches and lower sales of used cars, partially offset by strong performance in the aftersales activity.

The Group recorded a positive operating margin of €2,595 million (5.6% of revenue) versus €1,153 million (2.8% of revenue) in 2021 (+€1,442 million and +2.8 points). It improved sequentially to 6.4% in 2022 H2 versus 4.7% in 2022 H1.

Automotive operating margin stood at €1,402 million (3.3% of Automotive revenue) versus -€3 million in 2021 (+3.3 points).

The positive mix/price/enrichment effect of +€3,539 million illustrated the success of the commercial policy focused on value over volume. It largely offset the increase in costs which amounted to -€2,288 million. The latter was mainly explained by the impact of inflation on raw materials (-€1,916 million), on purchasing costs, and on manufacturing and logistic costs, despite continuous productivity gains. The volume effect stood at +€199 million.

The contribution of Mobilize Financial Services (Sales Financing) to the Group’s operating margin reached €1,223 million, up €38 million compared to 2021. It was positively impacted by non-recurring impacts on the swaps valuation mainly coming from the interest rate increase in Europe and by the focus on the most profitable customer channels bringing higher margins.

The 6.4% decrease of the number of new financing contracts in retail business, mainly linked to the evolution of Group’s registrations, was more than offset by the 10.4% increase in the average financed amount. Thus, new financings increased by 3.3% versus 2021.

Other operating income and expenses were negative at -€379 million (versus -€253 million in 2021) and were mostly explained by restructuring provisions for -€354 million and impairments for -€257 million mainly related to a Chinese facility, partially offset by asset disposals (+€202 million) related to the sale of several commercial subsidiaries of the Group and branches of RRG, in line with the announced strategy.

After taking into account other operating income and expenses, the Group’s operating income stood at €2,216 million versus €900 million in 2021 (+€1,316 million versus 2021).

Net financial income and expenses amounted to -€486 million compared to -€295 million in 2021. Most of this deterioration is explained by the accounting impact of hyperinflation in Argentina despite the decrease in financial interests on the net debt.

The contribution of associated companies amounted to €423 million compared to €515 million in 2021. This included €526 million related to Nissan’s contribution, which more than offset the negative contribution from other associates (-€103 million), notably in connection with the impairment of Renault Nissan Bank shares in Russia.

Current and deferred taxes represented a charge of -€533 million compared to a charge of -€571 million in 2021. The increase linked to the improvement of the pretax income was more than offset by net year-over-year one-offs.

Net income from continuing operations was €1,620 million, up €1,071 million compared to 2021.

Net income from continuing operations, Group share, was €1,650 million (or €6.07 per share).

Net income from discontinued operations amounted to -€2,320 million due to the non-cash adjustment related to the disposals of the Russian industrial activities.

Thus, net income was -€700 million and net income, Group share, was -€338 million (or -€1.24 per share).

The cash flow of the Automotive business reached €4,818 million, up €519 million compared to 2021 (including €800 million of Mobilize Financial Services dividend versus €1,000 million in 2021). This cash flow largely covered the tangible and intangible investments before asset disposals which amounted to €2.5 billion (€2.1 billion net of disposals) and the restructuring expenses (€590 million).

Excluding the impact of asset disposals, the Group’s net CAPEX and R&D amounted to €3,451 million in 2022 (7.4% of revenue) stable compared to 2021 (€3,579 million and 8.6% of revenue).

Automotive operational free cash flow6 was positive at +€2,119 million taking into account a positive change in working capital requirement of +€7 million.

As of December 31, 2022, total inventories of new vehicles (including the independent dealer network) represented 480,000 vehicles compared to 336,000 at the end of December 2021. This increase is explained by higher independent dealers’ inventories notably due to outbound logistic tensions at the end of the year. This level of inventories has to be put into perspective with the record level of the orderbook.

The Automotive financial position is now positive at +€549 million on December 31, 2022 compared to -€1,100 million adjusted from the operations of AVTOVAZ and Renault Russia at December 31, 2021, an improvement of €1.6 billion.

In 2022, Renault Group made an early repayment of €1 billion and reimbursed €1 billion for the mandatory annual repayment of the loan of a banking pool benefiting from the guarantee of the French State (PGE). As announced, the entire loan will be reimbursed by the end of 2023 at the latest.

In 2022, Renault SA issued 2 Samurai bonds:

- c. €560 million Samurai bond (¥80.7 billion), on June 24, 2022, 3-year maturity with a coupon of 3.50%;

- c. €1.4 billion Samurai retail bond (¥210 billion), on December 22, 2022, maturity December 2026 with a coupon of 2.80%. This transaction represents Renault Group’s first-ever issuance of retail bond targeted to individuals and stands as the second largest public offering of Samurai bond for individuals.

Liquidity reserve at the end of 2022 stood at a high level at €17.7 billion up €1 billion compared to December 31, 2021.

As announced during its Capital Market Day on November 8, 2022, Renault Group is willing to share value creation with its stakeholders through an employee shareholding plan and by reinstating a dividend.

Renaulution Shareplan

Renault Group has started taking steps to increase the share of employees in its capital to reach 10% by 2030.

More than 95,000 employees benefitted from 6 free shares. Among them, more than 40,000 also subscribed to shares at a preferential price of 22.02 euros per share.

In total, with nearly 2.7 million additional shares held by employees, the Renaulution Shareplan operation represents 0.9% of Renault Group’s capital and employees hold around 4.7% of the capital after the operation.

Dividend

The proposed dividend for the financial year 2022 is €0.25 per share. It would be paid fully in cash and will be submitted for approval at the Annual General Meeting on May 11, 2023. The ex-dividend date is scheduled on May 17, 2023 and the payment date on May 19, 2023.

As announced during its Capital Market Day, the dividend policy will gradually grow, in a disciplined manner, up to 35% payout ratio of Group consolidated net income – parent share, in the mid-term. To do so, the Group must achieve its first priority: return to an “investment grade” rating.

2023 FY financial Outlook

In a still challenging environment, the Group is aiming to improve its performance in 2023 with:

- a Group operating margin superior or equal to 6%

- an Automotive operational free cash flow superior or equal to €2bn

Renault Group’s consolidated results

Adjustments of AVTOVAZ and Renault Russia activities in 2021

[1] The results presented relate to continuing operations (excluding Avtovaz and Renault Russia whose disposals were announced on May 16, 2022)

[2] Tons of CO2 eq/vh. @150 000 km, Renault, Dacia, Alpine, Renault Korea Motors

[3] E-Tech range: electric and hybrid vehicles

[4] In order to analyze the variation in consolidated revenue at constant exchange rates, Renault Group recalculates the revenue for the current period by applying average exchange rates of the previous period

[5] In order to analyze the variation in consolidated revenue at constant exchange rates, Renault Group recalculates the revenue for the current period by applying average exchange rates of the previous period

[6] Automotive operating free cash flow: cash flow after interest and taxes (excluding dividends received from listed companies) less tangible and intangible investments net of disposals +/- change in working capital requirement

SOURCE: Renault Group