The Brand Group Core delivered robust financial results in the first quarter of 2024. With stable vehicle sales and slightly lower sales revenue, the Brand Group Core reported a significant year-on-year increase in operating profit and operating return. At 6.4%, operating return was well within the target corridor of 6-7% for 2024. All brands contributed to this achievement, reporting higher returns on the basis of focused cost management as well as increased implementation of synergy and efficiency measures within the Brand Group. The financial performance in the first quarter felt the impact of offsetting effects – these included, for example, the abrupt termination of government incentives for electric cars in the German market and the related discount measures at the beginning of the year. Furthermore, there was high depreciation attributable to investments in product campaigns and the related ramp-up of electric products.

The Brand Group Core was, however, able to counteract these effects in the first quarter of 2024 with a balanced product mix. The slight dip in demand for all-electric vehicles (BEV) was offset by higher deliveries of ICE models. Overall, stable Q1 unit sales figures at Brand Group level reflect these effects.

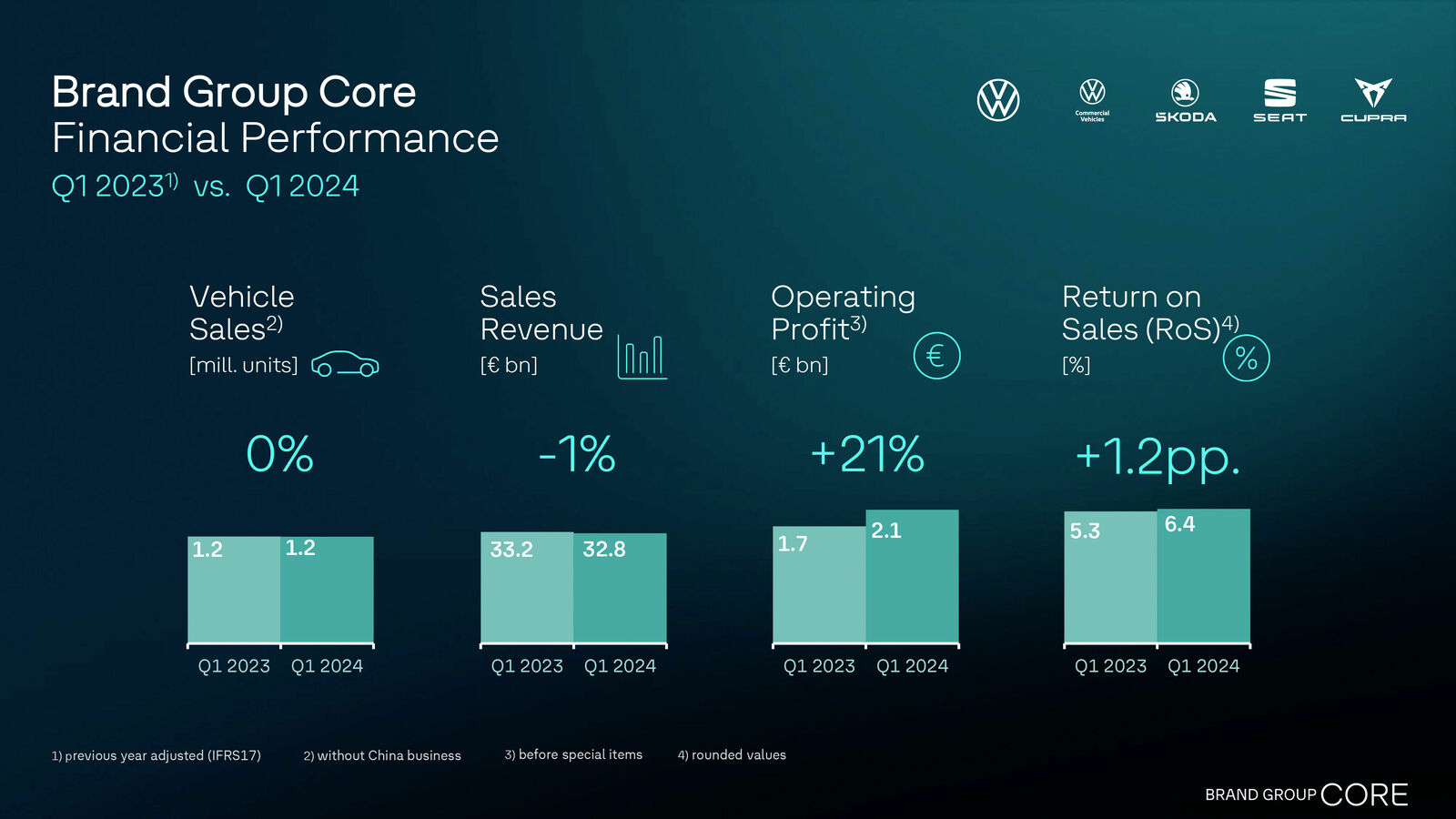

Key financial performance indicators confirm the strength and resilience developed by the Brand Group Core: with unit sales of 1,191,926, the Brand Group’s vehicle sales almost matched the high prior-year level (Q1 2023: 1,192,974 vehicles). Even though sales revenue came in at 32.8 billion euros – thus slightly lower than the very strong sales level of the previous year (Q1 2023: 33.2 billion euros) – operating profit before special items grew 21% to 2.1 billion euros (Q1 2023: 1.7 billion euros).

The operating return (before special items) improved by 1.2 percentage points to 6.4%. Cash outflows in the first quarter were mainly attributable to preparations for new model ramp-ups.

The Brand Group Core delivered 1,543,500 vehicles to customers in the first quarter of the year, 6.2% more than the same prior-year quarter (Q1 2023: 1,453,500 vehicles). All-electric models accounted for an important share of deliveries: the most successful all-electric models from the Group delivered worldwide in the first quarter of 2024 were the ID.4, ID.3, Škoda Enyaq and ID. Buzz. Škoda delivered 12.3% more all-electric vehicles in Q1 2024 compared with the same prior-year quarter. At Volkswagen Commercial Vehicles, the increase was as high as 29.4%.

Key figures for the Brand Group Core:

| Key financials | Q1 2024 | Q1 2023 | Change 24/23 |

| Unit sales (in thousands) (incl. other vehicles from other brands) |

1,192 | 1,193 | 0% |

| Sales revenue | 32.77 billion euros | 33.16 billion euros | -1% |

| Operating profit before special items | 2.11 billion euros | 1.74 billion euros | +21% |

| Operating return before special items | 6.43% | 5.25% | +1.2%-points |

The Volkswagen Passenger Cars, Škoda, SEAT/CUPRA and Volkswagen Commercial Vehicles brands each contributed to the robust Brand Group Core Q1 results for fiscal 2024.

Unit sales at the Volkswagen Passenger Cars brand in the first quarter of fiscal 2024 ran at 694,617, 5% down on vehicle sales for the same prior-year quarter (Q1 2023: 730,797 vehicles). Given the generally challenging market environment, a very strong performance in the first quarter of the previous year and model changes in key volume drivers (Golf, Tiguan, Passat), sales revenue at the beginning of the year came in at 19.3 billion euros, 6% lower than the prior-year figure (Q1 2023: 20.5 billion euros). At the same time, however, the operating profit before special items improved by 26.8% to 770 million euros, confirming the Volkswagen brand’s stable position overall in a volatile market. At 4.0%, the operating return (before special items) was noticeably higher than the prior-year figure of 3.0%, driven by a positive regional mix and price effects that in turn were counteracted by pay increases.

Patrick A. Mayer, Member of the Board of Management of the Volkswagen Brand responsible for “Finance”, commented: “The solid results for the first quarter of 2024 show that our cost optimization measures are having an effect and the brand is successfully strengthening its resilience. Implementation of the Volkswagen brand’s comprehensive performance program continues to gather momentum and will make us even more effective and faster in this challenging year of 2024.”

Škoda Auto delivered 220,500 vehicles worldwide in the first quarter of 2024, an increase of 5.2% compared with the previous year. The order intake remains promising. Sales revenue came in at 6.6 billion euros, slightly down on the figure for Q1 2023 (6.8 billion euros). This is in part attributable to higher material costs. The operating profit before special items ran at 535 million euros and the operating return (before special items) was 8.1%, slightly above the level for the same prior-year quarter

(Q1 2023: 8.0%). With deliveries running at 61,200 (+36%), the Octavia remained the brand’s best-selling model.

SEAT/CUPRA reported a positive start to business 2024. First-quarter vehicle sales by the brand ran at 164,300 units, an increase of 6.2% compared with the first quarter of the previous year. SEAT/CUPRA generated sales revenue of 3.8 billion euros, an increase of 6.8% on the figure for Q1 2023. The operating profit before special items developed particularly well, growing 57% to 226 million euros. The operating return (before special items) improved to 5.9%, corresponding to a rise of 1.9 percentage points on the figure for Q1 2023. These positive figures reflect the successful market penetration of SEAT/CUPRA and the growing popularity of SEAT/CUPRA models.

Business development at the Volkswagen Commercial Vehicles brand in the first quarter of 2024 was positive. Vehicle sales of 121,906 units represented 17% growth compared with same quarter in 2023. There was corresponding 16% growth in sales revenue to 4.2 billion euros. Particularly noteworthy is the increase in operating profit before special items, which more than doubled to 400 million euros (+ 134%). The operating return (before special items) came in at 9.6%, an increase of 4.8 percentage points.

Outlook

The subdued economic prospects, increasing competition and political challenges will continue to shape the current fiscal year. Against this backdrop the Brand Group Core as the “core of the Volkswagen Group” has defined its key priorities: to boost its financial strength and innovativeness as well as improve its resilience. 2024 is also a year of comprehensive model change. The Volkswagen brand began the current year with the market launch of the three most important volume models: Tiguan, Golf und Passat. The Brand Group Core will further strengthen its market position by debuting further attractive new models such as the all-electric Volkswagen ID.7 Tourer, the long-wheelbase ID. Buzz02 and the CUPRA Tavascan03. The Brand Group Core’s operating return in Q1/24 was within the full-year target corridor of 6-7%. With a clear focus on further reducing complexity, shortening development cycles and systematically tapping into synergy potentials, the Brand Group Core is on track to meet its target of an operating return of 8% by 2026.

SOURCE: Volkswagen