Tenneco Inc. (NYSE: TEN) today announced revenue guidance for 2013 and 2014. The company’s revenue guidance is based on projected customer production schedules and industry forecasts.

For 2013, IHS Automotive forecasts that global OE light vehicle production will be up 3% in the regions where Tenneco operates. Full-year production is estimated to increase year-over-year in North America (up 3%), China (up 9%), South America (up 4%) and India (up 8%), while estimates show a 3% decline in European industry production. In 2013, according to Power Systems Research, class 4-8 on-road commercial vehicle production in Europe and North America is expected to be essentially flat year-over-year, and up 31% in South America. The company anticipates little industry volume recovery during the year in the commercial vehicle off-road market.

Full-year estimates indicate an overall improving production environment in 2013. However, as Tenneco indicated in its last earnings call, macroeconomic uncertainty remains relatively high and while good full-year revenue growth is expected, it will be weighted toward the second half of this year. Additionally, the current effective implementation date for China’s pending commercial vehicle emissions regulation is July 2013; however, there is a great deal of uncertainty around actual implementation. Consequently, Tenneco’s revenue estimates reflect a conservative estimate of growth in this market although it remains a very significant opportunity as installation rates increase in the future. With this level of overall global uncertainty, Tenneco is providing its revenue guidance as a range instead of a specific estimate.

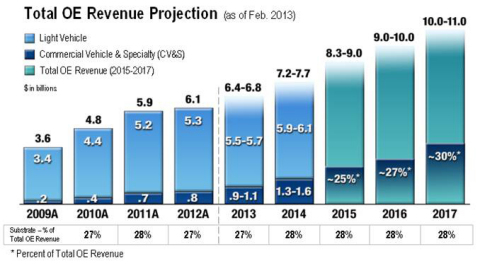

In 2013, Tenneco expects its total OE revenue to be in the range of $6.4 billion to $6.8 billion including commercial vehicle revenue of $.9 billion to $1.1 billion. This growth will be driven by the company’s excellent position on light vehicle platforms globally and leveraging higher light vehicle volumes in North America, South America and China. Tenneco’s commercial vehicle business will have a relatively quiet year in launches with the main launches occurring later in the year in preparation for regulatory changes taking place in 2014. As a result, commercial vehicle revenue in 2013 will be primarily driven by the strength and timing of any industry volume recovery without any significant changes to customers, programs or content.

In 2014, Tenneco expects total OE revenues in the range of $7.2 billion to $7.7 billion including commercial vehicle revenue of $1.3 billion to $1.6 billion. The increase will be driven by the anticipated further improvement in macroeconomic conditions globally resulting in stronger light and commercial vehicle volumes. Additionally, the company expects to benefit from significant incremental commercial vehicle content as U.S. Tier 4 final, Europe Stage 4 off-road and Euro VI on-road emissions regulations take effect.

“Our excellent position in light vehicle markets globally and our strong book of commercial vehicle business will drive revenue growth in 2013 in the face of macroeconomic conditions that continue to negatively impact production volumes, particularly early in the year, “ said Gregg Sherrill, chairman and CEO, Tenneco. “In 2014, we expect both the light and commercial vehicle production environments to strengthen, and with significant incremental commercial vehicle regulatory content, we are well-positioned to enjoy a year of high revenue growth. Additionally, our strong global aftermarket should continue to contribute stable revenues throughout this period.”

Additional guidance for 2013:

Capital expenditures are expected to be $260 million to $270 million

Annual interest expense is expected to be about $80 million

Cash taxes are expected to be between $90 million and $100 million

Tenneco is providing its financial guidance in advance of hosting an investor meeting in New York on February 14, 2013, beginning at 1:30 pm Eastern time. Senior management will review the company’s revenue guidance, strategy and business operations. The webcast can be accessed by going to the financial/investor section of the company’s website at www.tenneco.com.

REVENUE ASSUMPTIONS

Revenue estimates in this release are based on OE manufacturers’ programs that have been formally awarded to the company; programs where Tenneco is highly confident that it will be awarded business based on informal customer indications consistent with past practices; Tenneco’s status as supplier for the existing program and its relationship with the customer; and the actual original equipment revenues achieved by the company for each of the last several years compared to the amount of those revenues that the company estimated it would generate at the beginning of each year. These revenue estimates are also based on anticipated vehicle production levels and pricing, including precious metals pricing and the impact of material cost changes. Currency is assumed to be constant at $1.27 per Euro throughout the entire period. For certain additional assumptions upon which these estimates are based, see the slides accompanying the February 14, 2013 webcast, which will be available on the financial section of the Tenneco website at www.tenneco.com.