Establishing meaningful relationships with customers is essential to building brand loyalty, and new technology promises to reshape the process. The stakes are high. According to data from General Motors, a 1% increase in customer retention is worth US$700m. Mark Taylor, Global Lead for Customer Experience Transformation at Capgemini Consulting, believes that successfully harnessing Big Data will prove a game changer in today’s increasingly complex industry.

Meaning in complexity

This notion of an opportunity for a relationship in today’s environment is challenged by the fragmented nature of the territory. “The relationships between the OEMs and the end customers, the end customers and the dealers, and the end customers and the aftersales service providers makes it a pretty complex ecosystem of relationships,” he explained. “This accounts for some of the complexity in establishing meaningful relationships and building loyalty with customers. The thing that’s going to change the customer relationships and loyalty with automotive manufacturers more than anything else is going to be the connected car. This gives the automotive manufacturers an incredible opportunity to build those kind of trust-based relationships with their end customers.”

This notion of an opportunity for a relationship in today’s environment is challenged by the fragmented nature of the territory. “The relationships between the OEMs and the end customers, the end customers and the dealers, and the end customers and the aftersales service providers makes it a pretty complex ecosystem of relationships,” he explained. “This accounts for some of the complexity in establishing meaningful relationships and building loyalty with customers. The thing that’s going to change the customer relationships and loyalty with automotive manufacturers more than anything else is going to be the connected car. This gives the automotive manufacturers an incredible opportunity to build those kind of trust-based relationships with their end customers.”

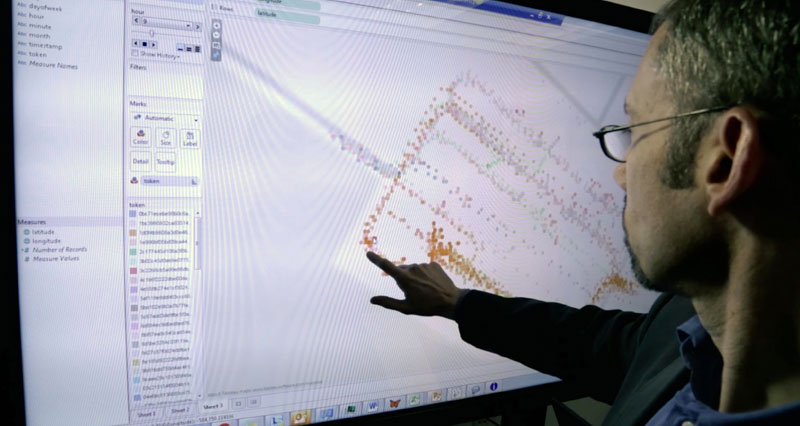

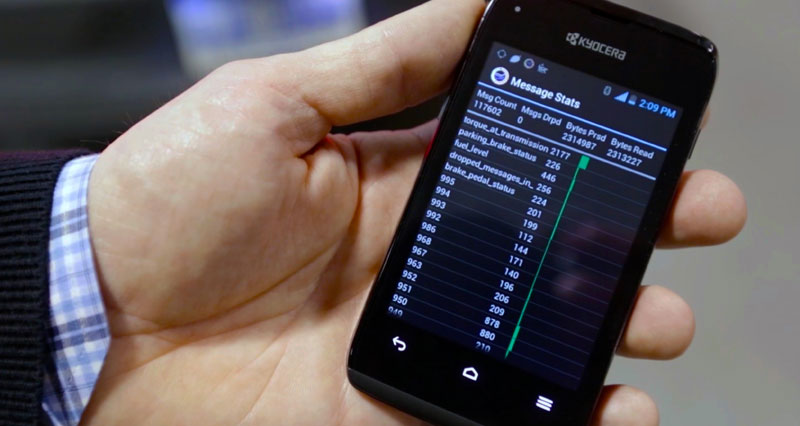

As cars collect data on such areas as driver habits and vehicle performance, the OEMs can – and should, argues Taylor – use that for commercial reasons. “This increase in data that will flow between the car itself, and therefore the driver, and the OEM, is an extraordinary opportunity to change the dynamics of customer relationships and therefore loyalty in the industry.”

For most owners, their relationship with the brand is limited to the immediate lead up to a sale, after which point they pass on to deal primarily with the service side of operations. With the connected car, there is the opportunity for the brand to engage with the customer on a much more frequent basis, and not just when he can be expected to make another purchase. “If I’ve got an ongoing relationship with my OEM as opposed to a once-every-three-years, end-of-lease or general-purchase-cycle relationship, it could revolutionise the way automotive manufacturers think about customer relationships. And the way they think about loyalty,” added Taylor.

At the moment, it’s still early days on the connected car front, so Taylor believes this is a brand new approach. “We have not seen people thinking about the connected car as a way of reinforcing the relationships between OEMs and customers. We think it’s an enormous opportunity,” he explained.

Loyalty and identity – two sides of the same coin

Leading the way in this revolution will be the luxury segment, in large part because these are the cars that will have the technology first. “These will be the cars that are at the forefront of the technology, but also they are higher consideration purchasers. In this sector, loyalty and identity are two sides of the same coin. When I buy a luxury car, there’s something I’m saying about myself,” said Taylor, noting that this new data source represents a value opportunity for brands to reinforce that identity point. “And as well, they have more money to spend on the customer relationship.”

Tapping into this data effectively is going to require a hefty investment, but as Taylor observed, investment are going to be made anyway: “What we’re talking about isn’t an additional investment. It is recognising that this newly available data is a gold mine for customer relationships. It’s a focus point rather than an additional investment.”

Avoiding the creep factor

However, there’s a fine line between a valued personalised customer service and a creepy one. “You have to be very focused on staying north of the creepy line,” conceded Taylor. “If what you do has for an objective creating value for the customer, you’re more likely to stay north of that line. Where brands may move into the creepy zone is when it’s their interests that are out of balance with the customer interests. The whole privacy point is critical and very sensitive.”

Taylor likens this opportunity to early days of database marketing, where sales staff suddenly had access to customer data for the first time. “In some cases they overused it. The opportunity here for the OEMs is a new universe of customer connectivity. Fortunately, many of the lessons around privacy have been learned.”

Retention and acquisition

As this data is used more effectively, overall industry loyalty rates should rise. “It’s already hard to gain that conquest customer,” noted Taylor, pointing to estimates that it costs five to seven times more to acquire a customer than to retain a customer. “It’s hard and expensive. Those brands who are doing all of the basics right – quality, customer service, overall experience – will be the ones that can build relationships which reinforce that identity point.”

Taylor is keen to emphasise that this approach represents much “more than a retention play” – in fact, the benefits will spread to acquisition marketing. “If you can increase the number of interactions you have with the customer over time, that’s going to enable you to learn more about your customer. Learning more about those customers who value you as a brand will enable you to target your acquisition efforts against similar customer types, making acquisition marketing easier,” he added. “You’ve learned over the relationship what they care about, what they value, what they don’t value, and that should shape your acquisition efforts. Any good loyalty programme should operate both on the retention level but also on the acquisition level.”

Megan Lampinen