TomTom’s chief executive officer, Harold Goddijn –

“Our Location Technology business performed according to expectations in the second quarter, recording solid growth in Enterprise, and performing in line with the Automotive market.

In the Enterprise business we secured several deals, underlining the versatility and competitiveness of our technology and offerings. Deal activity in Automotive, meanwhile, remains strong this year.

We have made significant progress with the automation of our mapmaking platform and are in the process of realigning our Maps organization. With these higher levels of automation and the integration of a variety of new digital sources, we will have fresher and richer maps, with wider coverage.”

Operational summary

- We launched our Navigation SDK for mobile, enabling companies and developers to build professional navigation applications that can be customized for end users

- Our full stack navigation solution supports the Opel Astra and Citroën C5 launched by Stellantis, featuring advanced driver assistance technology

- We partnered with the Dutch Ministry of Infrastructure and Water Management to provide traffic services with more extensive and effective safety warnings to drivers

- We announced improvements in our mapmaking process, resulting in a realignment of our Maps organization

Financial summary second quarter 2022

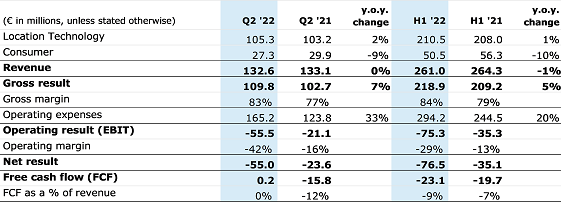

- Group revenue remained constant at €133 million (Q2 ’21: €133 million)

- Location Technology revenue increased by 2% to €105 million (Q2 ’21: €103 million)

- Automotive operational revenue increased by 12% to €71 million (Q2 ’21: €63 million)

- Operating expenses included a restructuring charge of €31 million

- Free cash flow is an inflow of €0.2 million (Q2 ’21: outflow of €16 million)

- Net cash of €329 million (Q1 ’22: €331 million)

Key figures

TomTom’s chief financial officer, Taco Titulaer –

“We had a solid first half of the year, despite external uncertainties such as high inflation and strained supply chains. In the second quarter, group revenue was flat year on year. Stable performance in Automotive and growth in Enterprise offset a foreseen decline in Consumer.

Our operating expenses were impacted by a €31 million restructuring charge related to the realignment of our Maps organization. In addition, underlying operating expenses increased due to continued investments we are making to support our application roadmap.

Free cash flow for the quarter improved year on year, resulting from positive working capital development and a marked increase in Automotive operational revenue.

Despite the uncertainties in the market, we remain confident that we can deliver on our initial guidance. We expect relatively flat Location Technology revenue for 2022, and growth for 2023. The expected FCF increase between 2022 and 2023 is driven by a combination of efficiency gains following the improvements in our mapping technology and operational revenue growth, whereby the latter accounts for more than half of the effect.”

SOURCE: TomTom