Toyota Motor Corporation (Toyota) and the MS&AD Insurance Group’s Aioi Nissay Dowa Insurance Co., Ltd. (Aioi Nissay Dowa Insurance) jointly developed the Telematics*1 Damage Service System (the “Service”), a new accident response service that uses driving data acquired from connected cars*2 to enable visualization of driving conditions such as driving route and driving behavior at the time of an accident, and uses AI to achieve advance accident detection. The Service will be made available starting in March 2020 on Toyota and Lexus brand connected cars*3, with supported models to be expanded in stages.

Toyota and Aioi Nissay Dowa Insurance will continue their efforts to achieve a safe and secure traffic environment for society through the use of data acquired from connected cars.

*1 Derived from the words “telecommunications” and “informatics,” “telematics” refers to systems that provide various types of information and services using vehicle onboard devices, such as navigation systems and GPS, and mobile communications systems.

*2 Vehicles equipped with onboard Data Communication Modules (DCM) that can acquire driving data.

*3 Toyota brand connected cars launched in June 2018 or later and all Lexus vehicles launched in September 2015 or later are eligible. Inquire with an Aioi Nissay Dowa Insurance agent or Toyota dealer for details on eligible vehicles.

1. Background

As a result of recent advances in automobile connected technologies and other areas, it has become possible to gather and use vehicle data from connected cars and provide new mobility services. Toyota and Aioi Nissay Dowa Insurance jointly developed Japan’s first telematics automobile insurance “TOUGH Connecting Car Insurance” that reflects driving behavior*4 offering services such as customer safe driving support functions and insurance premium discounts for safe driving based on driving data acquired from connected cars. This insurance product was developed in 2017 and launched in January 2018.

As of November 2019, over 25,000 customers have enrolled in the “TOUGH Connecting Car Insurance”*4 Compared to customers with Aioi Nissay Dowa Insurance’s “TOUGH Vehicle Insurance,” another automobile insurance product, the accident rate is about 30 percent lower, confirming the accident reduction effects.

Source: Accident Reduction Effects on “TOUGH Connecting Car Insurance”

Note: totaled from accidents occurring from April 2018 at the inception to June 2019 (totaled covering the same model insurance)

In addition to the above accident reduction efforts, Toyota and Aioi Nissay Dowa Insurance jointly developed the telematics system to provide support for prompt and appropriate accident resolution in the event a customer is involved in an accident.

*4 This product is offered to Toyota dealers under the name Toyota “Tsunagaru” (Connected) Car Insurance Plan and to Lexus dealers under the name G-Link Automobile Insurance. Toyota brand connected cars launched in June 2018 or later and all Lexus vehicles launched in September 2015 or later are eligible. Inquire with an Aioi Nissay Dowa Insurance agent or Toyota dealer for details on eligible vehicles.

2. Overview

Previously, accident response was conducted by reaching a private settlement through negotiation concerning the attribution of negligence with the other party to the accident based on information gathered from the customer through telephone and written interactions.

The Service makes use of driving data acquired from Toyota’s connected cars, making it possible for insurance companies to accurately and objectively ascertain accident conditions. As a result, the burdens of insurance claim procedures can be greatly reduced.

In addition, customers have access to “I’m ZIDAN”,*5 Aioi Nissay Dowa Insurance’s 24-hour, 365-day accident response service, and Toyota’s connected cars can link to Aioi Nissay Dowa Insurance at any time for prompt accident response.

The Service will be offered to customers who have enrolled “TOUGH Connecting Car Insurance” as a new service.

*5 A service that enables expert accident response including negotiation on the allocation of responsibility and settlement at any time including late at night and on holidays.

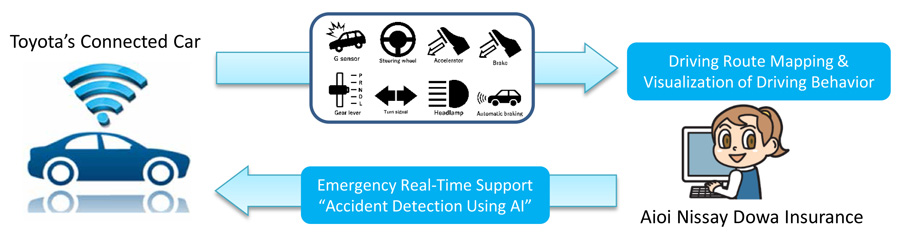

Reference: Image of Service Provision

Service Details

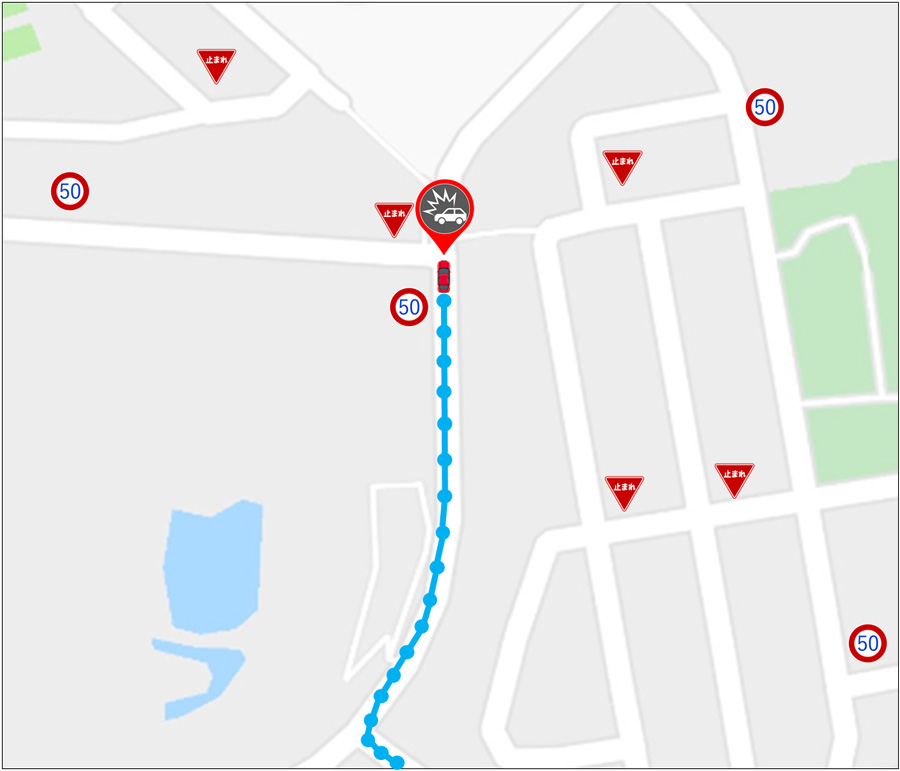

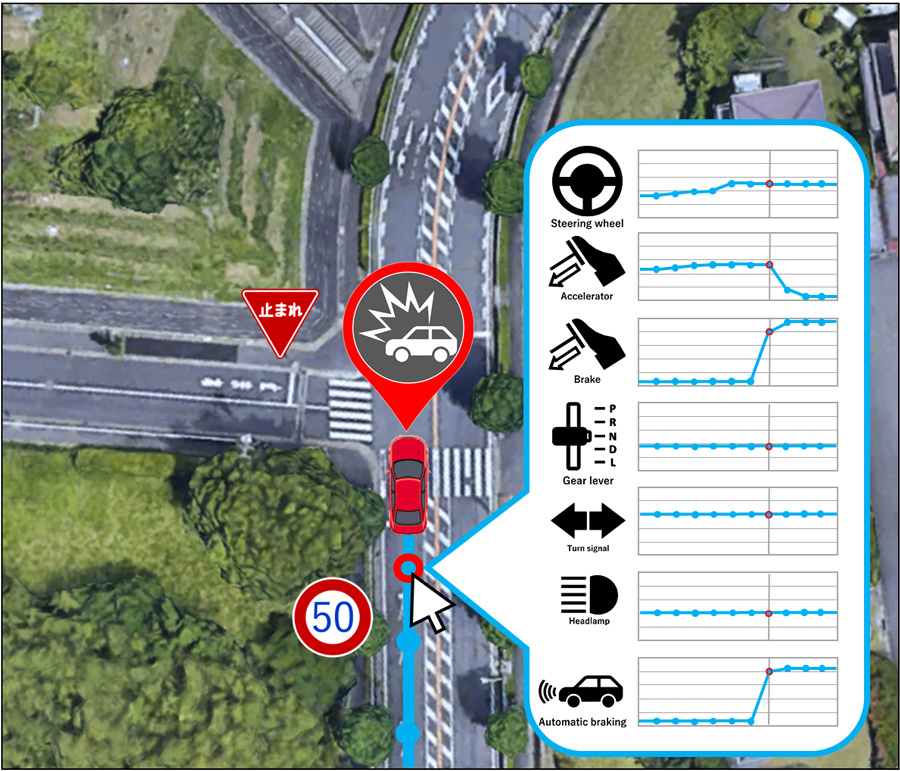

1. Driving Route Mapping and Visualization of Driving Behavior

By mapping the driving route according to driving data based on information acquired from a connected car and visualizing vehicle data relating to the operating status of the accelerator, brake pedal, shift position, and steering wheel as well as the operating status of various devices including indicators and safety equipment, it is possible to reduce customer burdens to explain the accident and the accident circumstances, which could lead to prompt accident settlement.

Examples of Accident Response using Connected Car Information

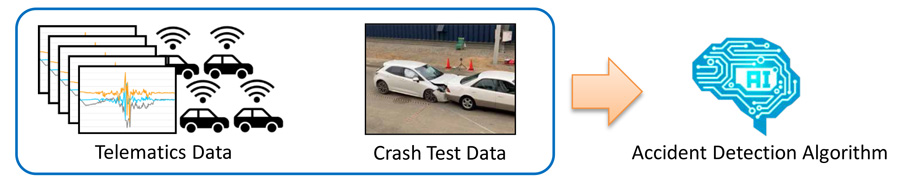

2. Accident Detection Using AI

The Emergency Real-Time Support, which contacts the customer to confirm customer’s safety from an Automatic Reporting Desk and makes any necessary arrangements when a major collision is detected, was supplemented with an accident detection function that uses AI. This function uses an algorithm that was developed by Aioi Nissay Dowa Insurance. This algorithm utilizes machine learning using accident data of vehicle installed with telematics device and collision data acquired by crash test. This makes it possible to properly recognize the occurrence of accidents and the location of the accident, and to promptly respond to accidents.

SOURCE: Toyota