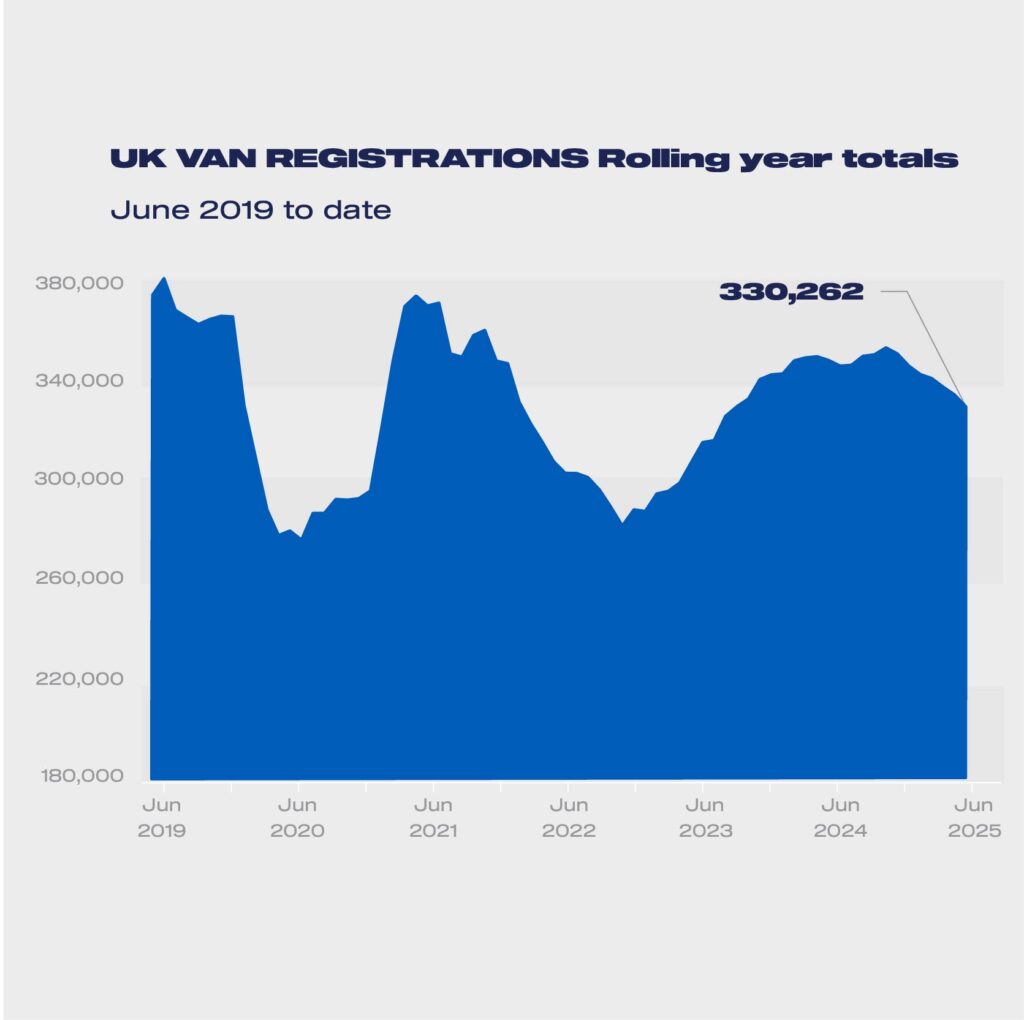

New light commercial vehicle (LCV) registrations shrank by -12.1% to 156,048 units in the first half of 2025, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). With a -14.8% drop in June, the market declined for the seventh consecutive month,1 rounding off the worst opening half-year performance since 2022 amid a tough economic environment and weak business confidence to invest in fleet renewal.2

Year-to-date performance was led by declining demand for the largest vans, by -14.8% with 99,790 registered, as well as deliveries of medium sized vans, down -20.9% to 26,408 units. 4×4 uptake also fell, by -6.0% to 4,041 units. There was growth, however, in demand for small vans, up 30.7% to 4,907 units, but could not soften the overall market decline as a lower volume segment.

Registrations by segment in June

| Jun-25 | Jun-24 | % change | |

| Pickups | 2,754 | 2,776 | -0.8% |

| 4x4s | 742 | 638 | 16.3% |

| Vans <=2.0T | 983 | 806 | 22.0% |

| Vans > 2.0-2.5T | 4,193 | 7,169 | -41.5% |

| Vans >2.5-3.5T | 19,501 | 21,677 | -10.0% |

| All Vans to 3.5T | 28,173 | 33,066 | -14.8% |

| Rigids > 3.5 -4.25 t (BEV only) | 175 | 48 | 264.6% |

| Rigids > 3.5 – 6.0t (Other) | 880 | 556 | 58.3% |

| All rigids | 1,055 | 604 | 74.7% |

Registrations by segment year-to-date 2025

| YTD-25 | YTD-24 | % change | |

| Pickups | 20,902 | 19,008 | 10.0% |

| 4x4s | 4,041 | 4,297 | -6.0% |

| Vans <= 2.0t | 4,907 | 3,753 | 30.7% |

| Vans > 2.0 – 2.5t | 26,408 | 33,398 | -20.9% |

| Vans > 2.5 – 3.5t | 99,790 | 117,164 | -14.8% |

| All Vans to 3.5T | 156,048 | 177,620 | -12.1% |

| Rigids > 3.5 -4.25 t (BEV only) | 928 | 492 | 88.6% |

| Rigids > 3.5 – 6.0t (Other) | 4,520 | 3,465 | 30.4% |

| All rigids | 5,448 | 3,957 | 37.7% |

Top new models in June

| Best sellers | June | |

| 1 | TRANSIT CUSTOM | 4555 |

| 2 | TRANSIT | 2878 |

| 3 | TRAFIC | 1477 |

| 4 | SPRINTER | 1414 |

| 5 | HILUX | 1163 |

| 6 | TRANSPORTER | 1130 |

| 7 | EXPERT | 1083 |

| 8 | CRAFTER | 1002 |

| 9 | RANGER | 961 |

| 10 | TRANSIT COURIER | 902 |

Top new models year to date 2025

| Best sellers | Year-to-date | |

| 1 | TRANSIT CUSTOM | 24826 |

| 2 | TRANSIT | 13886 |

| 3 | RANGER | 10327 |

| 4 | VIVARO | 6266 |

| 5 | SPRINTER | 6250 |

| 6 | TRAFIC | 5793 |

| 7 | HILUX | 5302 |

| 8 | PARTNER | 5205 |

| 9 | BERLINGO | 5128 |

| 10 | CRAFTER | 4792 |

There was also robust uptake of new pickups in the half-year period, up 10.0% to 20,902 units, however, that obscures two consecutive months of decline following April’s introduction of new fiscal measures to treat double cabs as cars for benefit in kind and capital allowance purposes. The change in treatment is putting additional costs on key business sectors, constraining new orders of the zero and lower emission models which are entering the market, and keeping more polluting vehicles on the road for longer. The change will also reduce total tax revenues given the lower registration volumes. SMMT continues to urge government to postpone the measure for at least one year so that industry and operators can better plan and prepare for the change.

Manufacturers continue to invest massively in cutting-edge zero emission LCVs and there are now almost 40 different battery electric van (BEV) models to choose from – up from 28 in the first half of last year.3 The market is responding, with BEV demand up 52.8% and 13,512 units registered in 2025,4 boosted by a 97.0% jump in deliveries in June. In the year to date, new BEV purchases remain at just 8.6% of the overall market, however, little more than half the 16% share mandated by government for 2025 with substantial ground to make up in the second half of the year – a gap which government must help to plug.

Registrations by fuel type in June 2025

| Fuel Type | Jun-25 | Jun-24 | % change | % MTD Total | % MTDLY TOTAL |

| BEV < 3.5t | 2,828 | 1,476 | 91.6% | 10.0% | 4.5% |

| BEV Rigids > 3.5 -4.25 t | 175 | 48 | 264.6% | 0.6% | 0.1% |

| DIESEL < 3.5t | 23,719 | 30,803 | -23.0% | 83.7% | 93.0% |

| OTHERS < 3.5t | 1,626 | 787 | 106.6% | 5.7% | 2.4% |

| Total | 28,348 | 33,114 | -14.4% | ||

| Fuel Type | YTD-25 | YTD-24 | % change | % YTD Total | % YTDLY Total |

| BEV < 3.5t | 12,584 | 8,353 | 50.7% | 8.0% | 4.7% |

| BEV Rigids > 3.5 -4.25 t | 928 | 492 | 88.6% | 0.6% | 0.3% |

| DIESEL < 3.5t | 135,040 | 164,601 | -18.0% | 86.0% | 92.4% |

| OTHERS < 3.5t | 8,424 | 4,666 | 80.5% | 5.4% | 2.6% |

| Total | 156,976 | 178,112 | -11.9% |

The Plug-in Van Grant remains a lifeline for industry, so we await further details of the ongoing support announced in the Comprehensive Spending Review. Many businesses are still being held back, however, by a lack of access to suitable commercial vehicle charging at public, depot and shared hub locations. Market regulation is only workable if sufficient operators can switch so government must ensure greater access to LCV-suitable infrastructure across the country. Preferential treatment for depot grid connections is also a necessary step, given some sites could face waits of up to 15 years, and consistent and efficient implementation of local planning policy would give fleets the confidence they need to transition their operations to zero emissions.

Mike Hawes, SMMT Chief Executive

Half a year of declining demand for new vans reflects a difficult economic climate and weak business confidence and the fact that this downturn comes just as industry invests heavily to expand its zero emission LCV offering is particularly concerning. Decarbonisation remains a shared ambition but with the EV market more than a third below this year’s target, bold measures are needed to drive demand. Accelerated CV infrastructure rollout, quicker grid connections and streamlined planning are now critical.

1Since a -8.3% decline in December 2024.

2New LCV registrations, January-June 2022: 144,384 units.

3https://www.smmt.co.uk/demand-for-new-vans-down-in-july-but-2024-market-remains-at-three-year-high/.

4SMMT’s BEV LCV registration data reflects the Vehicle Emissions Trading Scheme, in which BEVs weighing >3.5-4.25t contribute towards each manufacturer’s target, in addition to those weighing ≤3.5t.

SOURCE: SMMT