This is a summary of the fourth quarter and full year 2012 interim report published today. The complete fourth quarter and full year 2012 interim report with tables is available at http://www.results.nokia.com/results/Nokia_results2012Q4e.pdf. Investors should not rely on summaries of our interim reports only, but should review the complete interim reports with tables.

FINANCIAL AND OPERATING HIGHLIGHTS

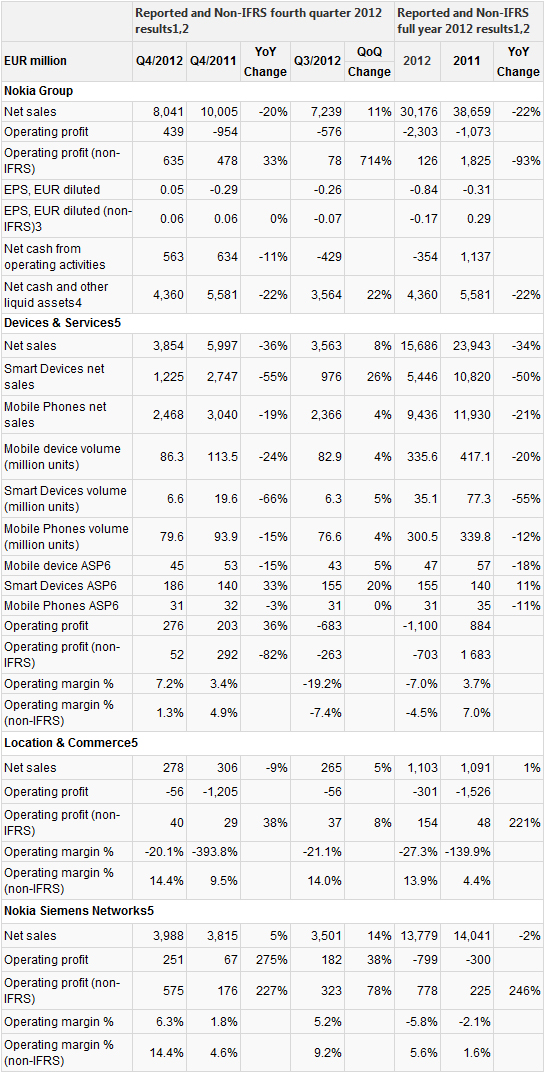

Fourth quarter 2012 highlights: Nokia Group non-IFRS EPS in Q4 2012 was EUR 0.06; reported EPS was EUR 0.05. – Nokia Group achieves underlying operating profitability, with Q4 non-IFRS operating margin of 7.9%. – Nokia Group strengthened its net cash position by approximately EUR 800 million sequentially, of which approximately EUR 650 million was generated by Nokia Siemens Networks. – Devices & Services Q4 non-IFRS operating margin improved quarter-on-quarter to 1.3%, due to an increase in gross margin as well as a decrease in operating expenses. – Nokia Siemens Networks non-IFRS operating margin improved quarter-on-quarter and year-on-year to a 14.4% in Q4, the highest level of underlying operating profitability since its formation in April 2007, primarily due to an increase in gross margin.

Full year 2012 highlights: Nokia Group full year 2012 non-IFRS EPS was EUR -0.17; reported EPS was EUR -0.84. – Nokia Group achieves underlying operating profitability, with full year 2012 non-IFRS operating margin of 0.4%. – Nokia Group ends 2012 with a strong balance sheet and solid cash position. Gross cash was EUR 9.9 billion and net cash was EUR 4.4 billion, after incurring cash outflows related to restructuring of approximately EUR 1.5 billion and dividend payment of approximately EUR 750 million. – To ensure strategic flexibility, the Nokia Board of Directors will propose that no dividend payment will be made for 2012 (EUR 0.20 per share for 2011). Nokia’s Q4 financial performance combined with this dividend proposal further solidifies the company’s strong liquidity position.

Commenting on the results, Stephen Elop, Nokia CEO, said: “We are very encouraged that our team’s execution against our business strategy has started to translate into financial results. Most notably we are pleased that Nokia Group reached underlying operating profitability in the fourth quarter and for the full year 2012.

While the first half of 2012 was difficult for Nokia Group, in Q4 2012 we strengthened our financial position, improved our underlying operating margin in Devices & Services, introduced the HERE brand to expand our mapping and location experiences, and drove record profitability in Nokia Siemens Networks.

We remain focused on moving through our transition, which includes continuing to improve our product competitiveness, accelerate the way we operate and manage our costs effectively. All of these efforts are aimed at improving our financial performance and delivering more value to our shareholders.”

SUMMARY FINANCIAL INFORMATION