- Third quarter net sales of $1.062 billion; operating income of $38 million

- Company raises fiscal 2013 EPS guidance to $3.00 from previous guidance of $2.70 – $2.90

- Restructuring program on track to deliver $30-35 million in annualized savings starting in fiscal 2014

- Martin acquisition expands Professional Division portfolio

- iOnRoad acquisition accelerates the roll-out of advanced safety infotainment solutions

Harman International Industries, Incorporated, the leading global infotainment, audio and lighting group (NYSE: HAR), today announced results for the third quarter ended March 31, 2013.

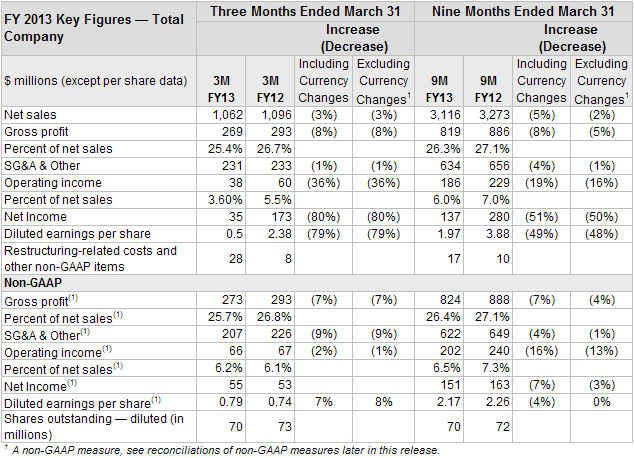

Net sales for the third quarter were $1.062 billion, a decrease of three percent compared to the same period last year. Net sales decreased due to the lower automotive production in Western Europe as a result of the economic slowdown partially offset by sales growth in home and multimedia products in the Lifestyle Division and in the Professional Division.

Third quarter operating income was $38 million, compared to $60 million in the same period last year. Excluding restructuring and non-recurring charges, operating profit in the third quarter was $66 million, compared to $67 million in the same period last year. On the same non-GAAP basis, earnings per diluted share were $0.79 for the quarter compared to $0.74 in the same period last year. On a GAAP basis, earnings per diluted share were $0.50 for the quarter compared to $2.38 in the same period last year. In the third quarter last year, the Company released a deferred tax asset valuation allowance, which increased EPS by $1.71.

The Company today also announced it has raised its fiscal 2013 operational earnings per share guidance to $3.00 from its previous range of $2.70 – $2.90. HARMAN now expects revenue to be at the mid- to high-end of its previously announced range of $4.175 – $4.250 billion. The Company also expects operating profit and EBITDA to meet the high end of its previously announced range of $265 – $280 million and $385 – $400 million, respectively.

Dinesh C. Paliwal, the Company’s Chairman, President and CEO, said, “I am pleased with the double digit growth in our Lifestyle Division’s home and multimedia product lines and the expansion of our Professional business with the acquisition of Martin. Despite the prolonged economic slow-down in Europe, we are successfully executing our operational and cost management programs and delivered improved earnings per share. As a result, we have raised our earnings per share guidance for fiscal 2013.”

Mr. Paliwal continued, “We are on track to complete the restructuring program that we announced last quarter and these actions will further improve the Company’s competitiveness over the long-term. We continue to pursue accretive, bolt-on acquisitions that expand our market opportunities and expedite our top-line growth. With our powerful portfolio of brands and technologies, along with our higher margin order backlog, we are confident that fiscal 2014 and 2015 will be stronger years for HARMAN.”

Summary of Operations — Gross Margin and SG&A

Non-GAAP gross margin for the third quarter of fiscal 2013 decreased 110 basis points to 25.7 percent. The decline was primarily due to the impact of lower sales volume on fixed production costs.

SG&A and Other expense as a percentage of net sales on a non-GAAP basis in the third quarter of fiscal 2013 decreased 110 basis points to 19.5 percent. This change was primarily related to higher recovery of customer project engineering costs.

Investor Call Today, May 2, 2013

Today, May 2, 2013 at 11:00 a.m. EDT, HARMAN’s management will host an analyst and investor conference call to discuss the fiscal third quarter results. Those who wish to participate via audio in the earnings conference call should dial 1 (800) 918 9476 (U.S.) or +1 (212) 231 2902 (International) ten minutes before the call and reference HARMAN, Access Code: 21654797.

In addition, HARMAN invites you to visit the Investors section of its website at: www.harman.com where visitors can sign-up for email alerts and conveniently download copies of historical earnings releases and supporting slide presentations, among other documents. The fiscal third quarter earnings release and supporting materials will be posted on the site at approximately 8:00 a.m. EDT, Thursday, May 2, 2013.

A replay of the call will also be available following its completion at approximately 1:00 p.m. EDT. The replay will be available through August 2, 2013 at 1:00 p.m. EDT. To listen to the replay, dial:

- 1 (800) 633 8284 (U.S.) or

- +1 (402) 977 9140 (International), Access Code: 21654797.

If you need technical assistance, call the toll-free Global Crossing Customer Care Line at: • 1 (800) 473 0602 (U.S.) or • +1 (303) 446 4604 (International).