It’s always entertaining to look back on the unique traits of old cars. Twenty years ago, it wasn’t uncommon to see cars with hand-crank windows—each roll up or down serving as a makeshift workout for a driver’s arm and back muscles. Witnessing how far the industry has come just two decades later, aside from hovering and speeding through the air, it’s safe to say the cars of 2020 are meeting and even exceeding the wildest ambitions we may have had back in 2000. It’s easy for drivers to be in awe of the latest automation feats. After all, how can you not take notice when a vehicle is driving itself?

What many drivers don’t realise is that automation has almost always been a part of their experience behind the wheel. The first power windows were introduced way back in 1940. The earliest version of cruise control was patented in 1950. You could even purchase a car with hands-free phone capabilities back in 1988. These features are now so common in consumer vehicles that we forget the subtle role automation has already been playing in making our everyday car experience possible. There are even six levels of vehicle autonomy that outline the progress and what’s on the horizon for the vehicles of the future.

Perhaps the most impactful automation capability was voice interface technology. Cars were the first mass market product with the technology implemented at scale, because of the safety benefits it could produce to keep drivers’ hands on the wheel and distractions to a minimum. Creating that touchless, automation-driven experience for drivers led the auto industry to jump on voice technology earlier than most, and now, it’s paying even more dividends. Safety has always been the top priority for car manufacturers, but since March 2020, the focus on safety has expanded to encompass an additional threat.

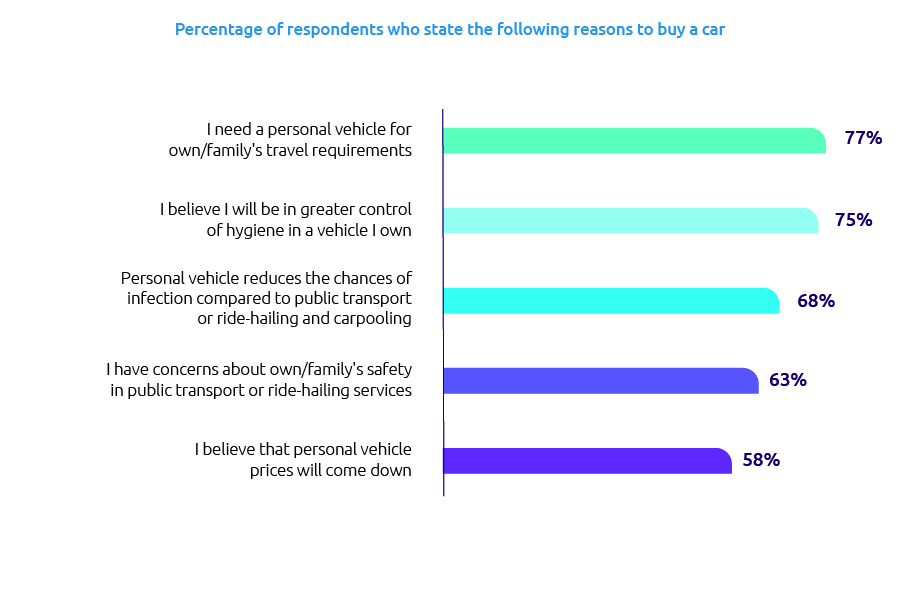

The pandemic has rapidly shifted transportation behaviors. For instance, 75% of new car buyers say they’re purchasing a car to get more control over their hygiene. Due to health and safety concerns, 46% of consumers say they’ll use public transportation less, and 40% say they’ll use ride-hailing services less.

Those passengers who previously utilised their time effectively when riding public transportation or ride-hailing services now may find themselves behind the wheel of their own vehicles. How can those passengers-turned-drivers reimburse the time they’ve now lost? Instead of paying attention to traffic and directions, these consumers want to optimise that time to do other activities that are either more valuable or more enjoyable. The responsibility of getting from point A to point B hasn’t been theirs to bear, and they want that scenario to continue—while also in an environment that keeps them safe from health risks.

Artificial intelligence (AI) is the answer. The pandemic has accelerated the auto industry’s innovative development, putting us far closer to “Level 5 Autonomy” than we were at the beginning of 2020. Self-driving ride-sharing services, or self-driving personal vehicles, could give consumers safer means of transport, while returning the time they would have lost if they were required to operate a vehicle as the manual driver.

The auto industry is among the leaders in deploying AI at scale, but most functions still have a long way to go on their AI journeys. According to recent research from Capgemini, just 22% of auto organisations have scaled AI within their digital and mobility services. Just 13% have scaled it within their IT, and 12% within manufacturing and operations.

Still, there is a disconnect in what automakers and consumers perceive as “technology within the vehicle.” To an original equipment manufacturer (OEM), technology within the vehicle could be an automated braking system, cruise control that can slow down or speed up based on sensors, or steering assist capabilities. Car buyers, on the other hand, focus on things like 4G, the number of devices that can connect to Wi-Fi, and dashboard touch screens.

Extensive research and development into autonomous vehicle engineering is underway, with the potential to produce substantial value to drivers. Those touch screen dashboards and Wi-Fi connections don’t just magically appear, and the convenient, seamless, personalised experience that the vehicles of the future can provide to drivers will be driven by AI’s capabilities within the cars themselves. Vehicle manufacturers and automotive suppliers have identified affordable ways to install high-resolution data that automatically senses depth. Altran, a Capgemini company, has even co-developed a software solution that can update and customise vehicles like we do with our smartphones today, with built in safety and cyber security protections.

The pandemic has had an enormous impact on AI’s progress within the automotive industry, with an accelerated view of AI capabilities and interest in electric vehicles that could run autonomously. Within the next year, automakers will continue to incorporate AI into their product offerings, and the additions will be highly noticeable to drivers. Not only will 2021 see a massive influx of electric vehicles, but by 2026, the market is expected to reach US$567bn. 100% of Capgemini’s automotive clients are already investing in the research and testing of electric vehicles.

While AI usage is increasing, the automotive industry cannot afford to ignore customer satisfaction. With signs pointing toward the pandemic increasing the number of car buyers and drivers, OEMs must scale AI around issues that benefit the driver in order to keep the momentum going on this rising wave of autonomous innovation.

About the author: Daniel Davenport is Senior Director, North American Automotive, at Capgemini