Depleting environmental resources, poor air quality and climate change are underlining the urgent need for more environmentally-friendly, sustainable practices. According to the European Environment Agency (EAA), the transportation sector as a whole is responsible for more than 30% of CO2 emissions in Europe, of which road transportation accounts for around 72%.

As part of global efforts to control vehicular pollution, regulatory agencies and organisations have developed roadmaps to reduce tailpipe emissions. Emission reduction compliance targets have catalysed changes to powertrains over the last couple of decades. In this context, hybridisation and electrification are playing an important role in optimising internal combustion engine (ICE) operations, while enabling reduced fuel consumption and lowered emissions.

The rise of hybrid and electrified powertrains

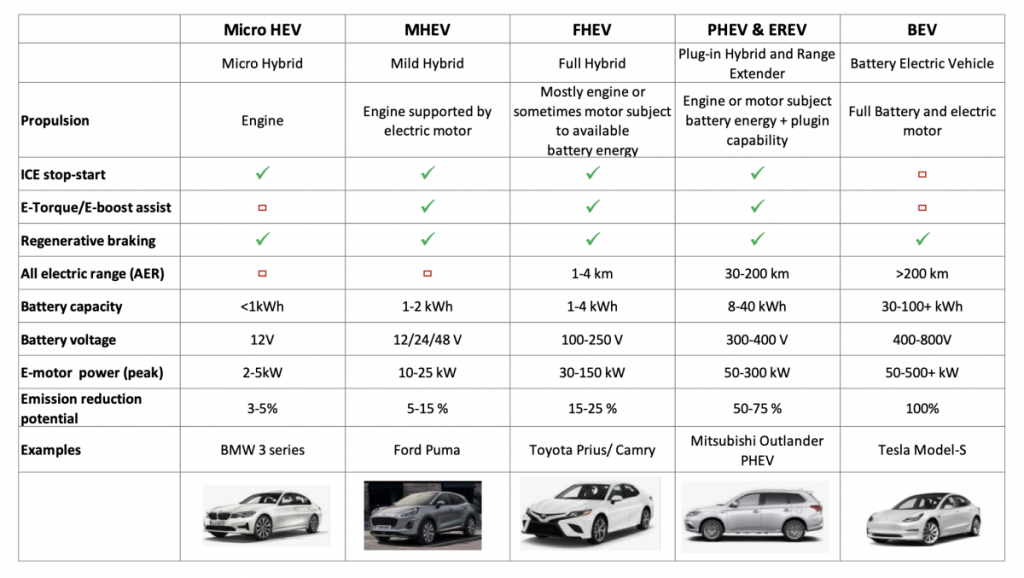

The term electrified vehicle (xEV) refers to vehicles with varying degrees of electrified powertrains. These hybridised vehicles cover the spectrum from micro hybrid electric vehicles (MuHEVs), mild hybrid electric vehicles (MHEVs) and full hybrid electric vehicles (FHEVs) to plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs).

While they support regenerative braking functionalities, each is distinct in terms of their e-motor and power, battery capacity and voltage, torque and range, engine design and emission reduction potential. Micro and Mild HEVs are essentially considered as advanced ICEs as they are low-voltage systems that do not have electric driving capability. The differences between the various types of hybrid vehicles are illustrated in the table below:

Factors such as emission regulations have driven phenomenal growth in the market for xEVs. Over the last decade, the sales of such vehicles have multiplied ten fold; from about 0.8 million in 2010 to about 8.8 million in 2020. In 2020, even as the pandemic pummelled the global automotive industry, the EV market held steady. COVID-19 resulted in global light vehicles sales plunging from 90 million in 2019 to 76 million in 2020, translating to a 15% decline in sales. In contrast, EVs had a marquee year: sales of BEVs and PHEVs increased by 30% from around 2.1 million in 2019 to 3.4 million to 2020, while sales of MHEV and FHEVs put together rose from approximately 4.1 million to 5.1 million during the same period.

Market distribution of xEVs differs by region and is a reflection of automaker strategies. For instance, the focus in the EU is on 48-volt (48V) MHEVs and BEVs, with PHEVs being viewed as a stop-gap solution. The success of 48V MHEVs dates back to their debut in 2017-2018 when they were hailed as being the saviour of the mass market which was struggling to improve fuel economy and reduce tailpipe emissions to meet short-term regulatory compliance targets.

Japan has remained a large market for FHEVs, primarily due to Toyota, the undisputed king of FHEVs. Toyota released its hybrid product range with the Prius in 1997, and by 2010, the Toyota Hybrid System (THS) full hybrid system dominated the Japanese and US markets. It continues its sway over the FHEV segment. Although BEVs continue to account for a major share of China’s xEV market, MHEV 48V offerings are also set to make gains in the near-term due to emission compliance obligations.

The role of hybrids in tackling emissions: are they clean?

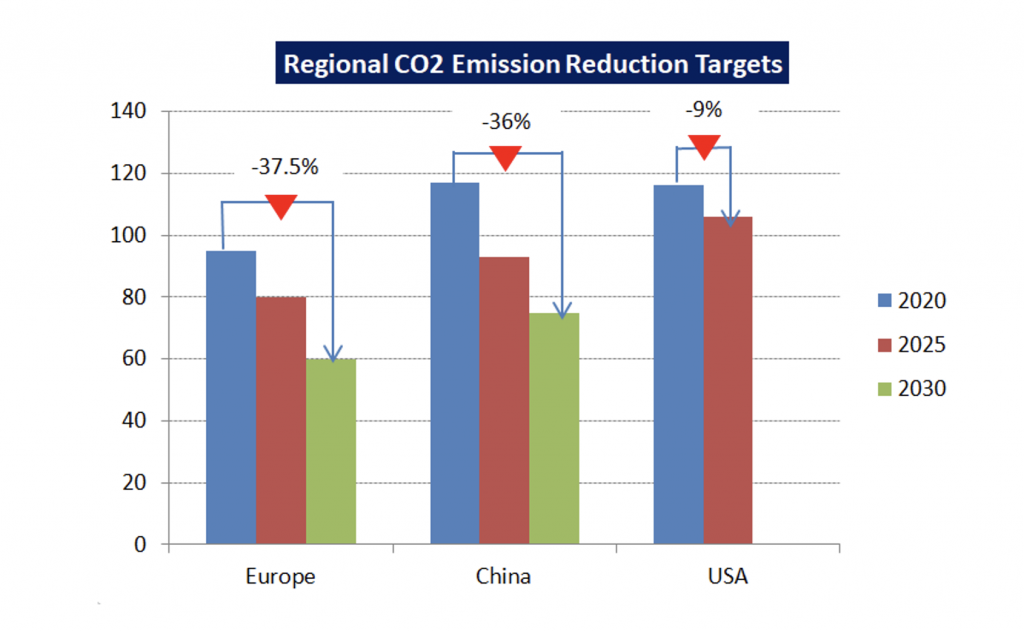

Hybridisation is seen as crucial to optimising ICE operations and, thereby, lowering fuel consumption and emissions. At 95g/km, Europe currently has among the most stringent emission norms for CO2, with targets for 2030 set at a stricter 60g/km, which equates to about a 37.5% reduction from the current baseline. China has established similarly stringent mandates that will require vehicle manufacturers to reduce emissions by about 36% from current levels. In contrast, the US has set relatively less demanding targets, requiring only a 9% reduction over the next five years.

In general, the lower the CO2 emissions value mandated, the greater the degree of electrification required to achieve compliance. In turn, the greater the degree of electrification required, the higher the technology cost. With such costs having to be borne either by the automaker or passed on to the customer, the end result has been high EV prices.

Against this backdrop, MHEVs have been witnessing significant growth due to their cost competitiveness on account of requiring less dollars per gram of CO2 reduced. However, MHEVs have the ability to reduce emissions by up to 5% only. In terms of the cost of technology per car, MHEVs are a highly attractive proposition in the short- to medium-term to meet emission targets. Likewise, FHEVs offer up to 15% emission reduction, but the cost of technology is four to six times that of MHEVs. Therefore, FHEVs too fail to meet long-term emission compliance obligations.

Today, one in two xEVs sold in Europe is a PHEV. Typically, fuel consumption and CO2 values of PHEVs are four to five times lower than that of conventional ICE driven vehicles and three to four times lower than that of FHEVs on the WLTP values, highlighting it as a clean technology with the potential to meet long-term emission goals.

However, the fact that PHEVs have two powertrain systems, each capable of driving the vehicle individually, means that inconsistent battery charging and utilisation lead to higher fuel consumption and emissions. Multiple studies have highlighted that the reduced utilisation of a PHEVs battery results in real world emissions being two to three times higher than type approval values, thus limiting the actual benefits.

BEVs are completely carbon-free in terms of tailpipe emissions, making them the cleanest among currently available alternatives and the go-to technology for long-term gains. In essence, therefore, one can conclude that the greater the degree of hybridisation, the cleaner the technology and the greater its potential to comply with emission targets. MHEVs, FHEVs and PHEVs are technologies for the short- and medium-term and will eventually be replaced by pure BEVs.

About the author: Anjan Hemanth Kumar is Research Director at Frost & Sullivan