Last month, Mercedes-Benz sold a very rare 1955 SLR Uhlenhaut Coupe for US$142m, making it the most expensive car in history. Someday, that record too will fall, and it’s reasonable to ask whether it will be broken by a physical or digital mobility design object.

It’s no secret that the metaverse and web3 are on their way, taking early shape now and on course to influence all industries—including the automotive sector. According to a whitepaper by JP Morgan, which recently opened a bank in the metaverse known as Onyx Lounge, “the metaverse will likely infiltrate every sector in some way in the coming years, with the market opportunity estimated at over US$1tr in yearly revenues.” NFT sales alone eclipsed US$17.7bn in 2021.

The influence of the metaverse, and web3 more broadly, stand to impact all facets of the auto industry, including manufacturing, product customisation, community, and brand loyalty. Additionally, these technologies will enable a myriad of new opportunities for the digital and physical worlds to converge. Even grander still, such shifts will bring to the fore existential questions on where responsibilities lie between individuals, the auto sector, and web3 developers when it comes to sustainability and ethical operations.

Innovations feed into existing culture

In many respects, the auto industry is among the sectors most ripe for to embrace the promise of the metaverse, as one of its the defining features—and that of web3 more broadly—is its potential to empower users to assume a greater role in the creation and customisation of products, in turn opening new opportunities for engagement with brands and product developers. The automotive world already has a thriving culture of building, rebuilding, and modifying vehicles. Specialty Equipment and Market Association (SEMA) estimates the market for specialty equipment to reach US$57.16bn by 2024.

The existing demand for and pride in owning unique vehicles is fit to be harvested by automakers both through expanded opportunities to customise physical vehicles, and new digitally based opportunities to tap into the same consumer desires, like NFT-based strategies and partnerships.

The metaverse will likely infiltrate every sector in some way in the coming years, with the market opportunity estimated at over US$1tr in yearly revenues

Decentralising and transforming manufacture and design

We are already beginning to see the metaverse’s ability to influence how cars are designed and manufactured. Today, it is possible to design a car in the metaverse and produce it in the real world—and to do so in a decentralised manner. In fact, Chinese smart car development and manufacturing company PIX Moving is known for holding hackathons to advance ways to develop, manufacture, and apply self-driving technologies. In 2022, PIX Moving held a DeAuto Hackathon (Decentralised Auto Hackathon), in which collaborators used VR and the metaverse to build a mini passenger car suitable for production. Further, to protect the creative rights of the participants, PIX Moving also set to confirm the NFT rights of the entrants.

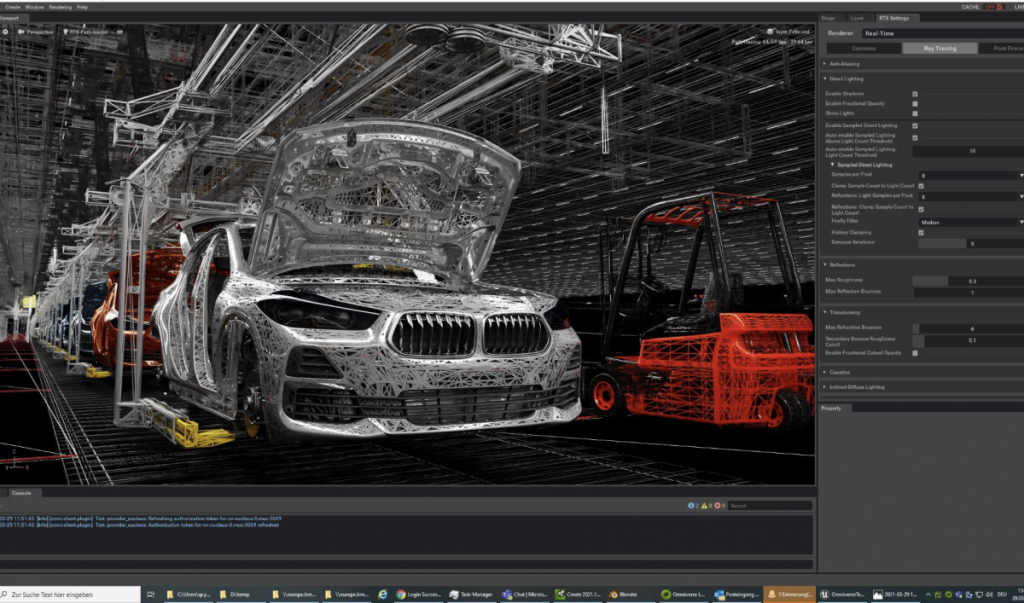

More mainstream automakers are leveraging virtual environments to speed prototyping and using digital twins to enhance and optimise production processes. BMW’s virtual factory uses NVIDIA’s Omniverse software, which enables the creation of digital twins for every vehicle manufactured. Hyundai has partnered with Unity, a platform for developing games and other 3D content, to build a meta-factory, a digital twin of the company’s physical plant, supported by a metaverse platform.

Digital vehicles as a source of value and customer engagement

Digital twins aren’t the only technology connected to virtual vehicles. The more consumer-facing side of the same coin presents virtually infinite possibilities for NFTs to evolve the relationship between automakers, customers, their vehicles, and a diverse universe of additional potential partners, as digital and physical worlds converge and dynamics around community and brand loyalty grow evermore complex.

Perhaps buying a limited edition virtual car gives consumers access to an exclusive run of physical cars, similar to what Nike is doing with NFTs and sneakers. Similarly, buying a physical car could give access to an NFT of that car for use in the metaverse or simply as an asset. It’s easy to imagine drivers earning virtual badges, distinct NFTs, or exclusive skins for their digital car-vatar by making real life trips to specified destinations or using their car for worthwhile causes. Partnerships with game developers could emerge, in which users unlock opportunities to build or buy special edition physical cars through the completion of virtual challenges with their digital cars. What is possible will only continue to expand as the metaverse further evolves and integrates with evolving web3 technologies like blockchain.

Automakers looking to thrive in a world with a rich metaverse supported by web3 technology will need to consider digital vehicles and NFTs as important opportunities to create valuable assets, expand and diversify revenue streams, and grow brand equity.

Preparing for change

To be ready to execute in a world of increased customisation and digital commodities, automakers should think strategically about building the “aftermarket and resale infrastructure” for their digital commodities. They’ll need to craft and control unique and valued user experiences and avenues for collaboration, develop platforms, communications, and touchpoints to remain a part of the relationship between customers and their vehicles in ways that they are often excluded from in the physical vehicle aftermarket.

Truly succeeding in this space will require OEMs to develop many new types of technical, financial, and cultural expertise. They’ll have to learn to shape and navigate more diverse and intensive customer journeys, and evolving dynamics around community management and brand loyalty. They will need to deeply understand digital, and especially web3, culture and economies in ways that will enable their physical and digital offerings to maximise each other’s value instead of competing. Digital commerce, ownership, tradability, interoperability, licensing, and so forth are just a few strategic decisions facing OEMs seeking the foresight to prepare for long term success in a web3 world.

Automakers looking to thrive in a world with a rich metaverse supported by web3 technology will need to consider digital vehicles and NFTs as important opportunities to create valuable assets, expand and diversify revenue streams, and grow brand equity

Lastly, they’ll need to consider if and how these new worlds and skills may translate back into the physical world to increase consumer engagement and deepen relationships. One of the most intuitive ways to achieve this will be through expanding customers’ abilities to customise their products. Expect current staples of auto customisation to be taken to the next level. Instead of simple colour selection or choices between the V6 and V8 engine, consider exclusive NFT skins, which could come through exclusive partnerships, of the ability to choose how the controls within the car are arranged and spaced. Auto manufacturers can capitalise by developing the options and partnerships, as well as the collaborative platforms themselves.

Supporting sustainability

In addition to having to master areas of digital technology, finance, and culture, the evolution and intersection of the auto industry and web3 is likely to raise the spotlight on some truly existential questions. Increased consumer engagement will likely result in stronger demands for transparency from manufacturers, bringing increased attention to issues like corporate social responsibility, sustainable sourcing and manufacturing, and climate change.

The environmental impact of the technologies associated with web3 is already a cause of hesitance for many to embrace the shift. Similarly, the auto industry has long been intertwined in discussions around sustainability and climate change. In light of this, it’s critical that manufacturers not pursue the metaverse, or web3 broadly, at the expense of a commitment to increased sustainability. In addition to using web3 technology to develop products, the industry could invest in developing tools like analytics to optimise mobility patterns, saving energy and reducing emissions.

So much of how the metaverse and web3 will impact the world remains unknown. However, what we do know is this—as these technologies grow in capability and influence, it will be critical to establish norms and incentives in line with our responsibilities to our fellow human and planet. Individuals, corporations, governments, and societies at large will all have huge roles to play in defining the trajectories and boundaries of these powerful new technologies.

About the author: Katrin Zimmermann is the Managing Director off TLGG, which advises global companies in the auto space on digital strategy, business model innovation and organisational transformation