Some say the ‘race for the robotaxi’ peaked in 2018, with developers since delaying their launch plans due to a range of technical, social and financial challenges. However, the novel coronavirus disease (COVID-19) has led many to reconsider the definition of safer, ‘driverless’ mobility.

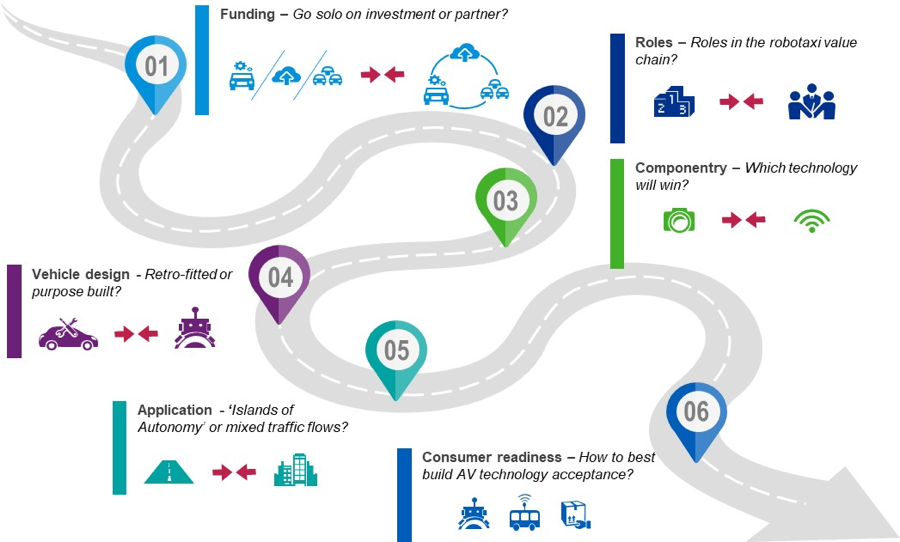

Due to its high dependency on complex technologies, the dynamics of the robotaxi value chain will be drastically different from the automotive value chain we know today. We identify six main decision points where players have begun taking different approaches to robotaxi development, from funding structures through to deployment strategies. Ultimately we expect these different approaches to converge around a limited number of robotaxi ‘archetypes’.

Regardless of which archetype dominates in future, it is clear that the path forward will involve high levels of competition and collaboration between organisations, and a number of bold plays when it comes to these decisions.

The COVID effect

As the impact of COVID-19 continues to be felt across the world, commuters are increasingly conscious of human contact. Public transport and ride-hailing ridership declined dramatically as countries imposed lockdown restrictions, and whilst there have been reports of an upturn since (e.g. Uber reported ridership recovering almost 80% from the lowest point in Hong Kong), volumes have still not fully recovered. Instead of strict mask rules and protective screens between the driver and passengers, driverless car technology might resolve part of the issue by removing the driver from the equation, although challenges around cleanliness of the vehicle between rides remains.

By removing one of the largest cost elements—the driver—robotaxi models are expected to reduce per-mile costs by up to 40%, leading to rapid growth in a market forecast to reach US$2tr by 2030. However, despite the hype, practical roll-out of robotaxis has proven more challenging than expected. If a provider wants to develop a compelling robotaxi offering, there are six key decisions they must make.

Decision one: go solo on investment, or partner?

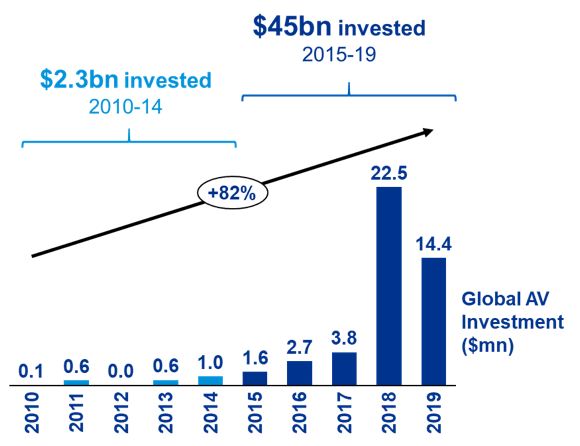

Autonomous vehicle (AV) technology is extremely expensive. Along with investments in complex vehicle hardware (e.g. sensors) and software (e.g. mapping data), players must also consider the integration of AVs into the broader transport network. This requires investments in R&D, testing, regulatory approvals, production and service development. It should not come as a surprise that in the past five years, over US$45bn has been invested in AV-related companies alone.

The first decision is therefore whether or not to go it alone, through organic investment and the development of a proprietary solution in the hope of reaping the exclusive benefits. For automakers, the increasing financial challenges of the market and a lack of heritage in software capabilities makes this very difficult at this stage. The trend for many has been to form consortia of investors or partner and share the burden, such as the Waymo-Renault-Nissan partnership to explore driverless Transportation-as-a-Service in France and Japan.

Big tech players, with significant cash reserves, represent the most likely candidates to go it alone, but given their portfolio of investments, in which mobility is not core, many have leveraged OEM partnerships to capitalise on their hardware and production capability.

Decision two: roles in the robotaxi value chain?

A future robotaxi company will require access to many competencies, including vehicle sourcing and operations: fleet management, customer services, infrastructure deployment and use, risk management and insurance will all be essential. Underpinning this, who will own the robotaxis? Will this be a player in the value chain, or could robotaxis become a new asset class?

It will be challenging for one player or sector alone to develop the solution. Instead, it will require cross-sector collaboration in order to balance risk and investment needs, but it will also be based on where capabilities, assets and appetite sit. Project Apollo, the AV taxi trial in London, is an example of cross-sector collaboration.

Legacy OEMs are understandably seeking a role; there is pressure on their 100-year old business model and they are looking to access new value streams. They are also still best placed to design and manufacture vehicles (or ‘pods’ in future) efficiently and at scale. However, OEMs are aware of the longer-term risk of commoditisation and are also seeking to make plays beyond vehicle hardware. One example is in AV software, such as BMW’s partnership with Intel and Mobileye.

OEMs won’t own the robotaxi (or AV) value chain and will have to battle hard to just capture share. Challenges will include concurrent investments by cash-rich, digital native players such as Apple-backed Didi Chuxing that typically operate at much faster ‘clock speeds’. Newer OEMs such as Tesla also provide a threat, given their lack of legacy challenges, whilst taxi, rental or leasing companies will pivot into fleet management or service delivery segments of the value chain, based upon existing competencies.

Decision three: which technology will win?

With AV technology in a nascent, developmental stage, questions have naturally arisen as to which format will successfully navigate the demonstration stage and eventually win out in deployment. There are a number of technological components at play but one of the most hotly debated decisions is in imaging technology, between LIDAR and cameras.

Whilst LIDAR has long-range accuracy, fine resolution and performs well in difficult weather conditions, its current cost remains prohibitively high for deployment. By contrast, camera technology is cheaper and can pick up colours (think traffic lights), but is less well-suited to measuring distances, struggles in bad light and requires significant computing power to function, to the detriment of its responsiveness.

Tesla has so far dismissed LIDAR technology, whilst most other notable players (e.g. Waymo, Baidu) have used a combination of LIDAR and cameras in their AV development. One technology may yet win out, but at this stage, it seems a combination of the two technologies is the emerging solution.

Decision four: retro-fitted or purpose built?

Another key decision is whether to use existing vehicle models and designs for AVs, or to introduce an entirely new design more suited to driverless travel. Three scenarios are likely.

The first would retrofit existing vehicles with AV componentry, software and interiors. Retrofits are most common when technology is in its infancy, typically undertaken by third-parties but also by OEMs and tech providers in this case. For OEMs, this means very little change to the existing manufacturing process, and tech providers retain the flexibility to adjust their offering independently from the manufacturer.

There is pressure on automakers’ 100-year old business model and they are looking to access new value streams. They are also still best placed to design and manufacture vehicles efficiently and at scale. They are also seeking to make plays beyond vehicle hardware

Option two means building AV capabilities into existing vehicle designs. AV capabilities are incorporated into vehicle design and manufacture but interior design largely remains focused on the driver. This is likely to be the next step for OEMs, as and when they decide to scale the technology, in order to ensure that their products can be used in the ‘transition’ period of AV technology. R&D and supply chain costs will be incurred, but these are likely to be lower than for option three.

Option three would see purpose-built ‘robotaxi’ models designed from scratch. For non-OEMs especially, given the lack of legacy supply chains and tied-up capital, it may be more feasible and attractive to design a vehicle from first principles. This can be seen in ‘pod’ concepts (e.g. Navya Autonom Cab), with no obvious steering wheel and an interior designed around the passenger and higher capacity shared mobility. Challenges will include additional safety testing and regulatory approval for a completely new design, and higher development costs. This is unlikely to be a viable option until the market is more mature.

Decision five: ‘islands of autonomy’ or mixed traffic flows?

Whilst great progress has been made with vehicle-related autonomous technology, integrating AVs into road networks remains one of the biggest challenges. To date, testing has largely taken place in dedicated facilities, such as MIRA in the UK, or in easier-to-map areas (e.g. US grid-systems). These trials must continue, and will increasingly need to be in higher traffic density areas to truly test the integration of the technology.

Longer-term, AVs will almost certainly need to have the ability to mix safely with non-AV traffic, and across a wide geographic area. However, there is a question as to whether initial launches of passenger AVs might be either restricted to limited geographical areas, such as certain districts of a city or, be isolated from non-AV traffic entirely. Both would be technically easier to execute.

Some players are looking to get ahead of the game here. In April, Apollo robotaxi, backed by Baidu, began offering services to the general public of Changsha across residential, industrial and commercial areas. Such examples demonstrate the possibility of robotaxis in some mixed-use urban environments.

Decision six: how to secure AV technology acceptance?

Much focus on robotaxis falls on the technology, but human factors are just as important for successful deployment. Without willing riders, a supportive regulatory scheme and cooperation from those that share the space, any robotaxi model will fail.

Safety concerns are front and centre (particularly given previous fatal incidents) and the hope is that extensive real-world testing, new simulated techniques and user feedback will help to overcome these concerns. Regulators have a role here in establishing new licensing criteria and liability to inspire public confidence, while allowing room to test and experiment.

However, would it be better to build confidence in AV technology through other use cases first? Autonomous deliveries or ‘on rails’ shuttle bus services for example, might provide an easier route.

User experience considerations are also important and must be thought through for robotaxi technology acceptance. Will riders be happy with only a handful of nearby options for pick-up and drop-off (e.g. like the Lyft trial in Las Vegas)? Will users expect dedicated interiors (e.g. for work and leisure travel) and how feasible is that? Can in-vehicle personal assistant technology replace the local knowledge of a taxi driver?

How to develop a successful robotaxi offer

Given these decision points, what will the ‘winning’ robotaxi model look like? In reality, several robotaxi archetypes will likely evolve in the near future, based upon the different decisions made and specific local market conditions. The following are some example archetypes.

Retro-fitted ride-hailing fleets: where tech players/ride-hailing platforms retrofit their AV tech onto OEM partner vehicles to offer integrated ride-hailing and delivery services. These are likely be funded by tech players’ large balance sheets, but with a potential profit share option for partners.

Integrated OEM mobility services: where certain OEMs use Level 4 AV technology integrated into their models, originally as driver assist features, to launch branded ride-hailing fleets, controlling most of the end-to-end value chain.

Autonomous mass transit: where purpose-built, shared-use AVs operate as a form of mass transit (either alongside or in competition with public transport companies), including as part of Demand Responsive Transit schemes using dynamic routes to replace regular bus timetables.

AV Management as a Service: where a company with traditional fleet management capabilities—including procurement, servicing, maintenance and risk management—and a strong balance sheet manages robotaxi fleets for operators, possibly also owning the vehicles. This would allow the operator to focus on the customer experience.

Regardless of the archetype, we think that there are some strategic steps and core competencies that any robotaxi organisation will need to succeed, in addition to the obvious requirements. For example, continued trials for AVs and robotaxi services, and engagement with governments and regulators.

Conclusion

As AV technology develops, the future of the robotaxi will depend on how individual competitive players and collaborative groups tackle and address the decisions outlined. Many approaches will be tested, and ‘competition between collaborations’ will increasingly become the norm. To be riding high once the services hit the road, organisations must assess and commit to a direction on the six decisions described, and then focus on the strategic steps and core capabilities outlined to go the extra mile.

Edwin Kemp and Yuan Zhang are Associate Directors, Mobility 2030, KPMG. Chen Pan is Assistant Manager, Mobility 2030, KPMG.