Automakers and suppliers alike are adjusting their corporate strategies in the wake of growing interest in electrification. According to estimates from AlixPartners, global automakers expect to invest US$330bn in electric vehicle (EV) development between 2021 and 2025, and a growing number of brands are even committing to fully-electric ranges in the future. For their suppliers, many of which have been focussed on internal combustion engine (ICE) technology for decades, it’s a call to action.

A product pivot

For fluid management specialist dlhBOWLES, the industry trend could prove more of a lucrative revenue opportunity than a threat. The company provides all sorts of fluid-related systems for vehicles, and today about one-quarter of its products are linked to diesel and gasoline engines, which require circulation or displacement for various fluids and gases. “We supply components for positive crankcase ventilation and evaporative emissions control, and with full EVs these components will go away,” admits Daniel Konrad, Vice President of Engineering at dlhBOWLES.

On the other hand, EVs will demand other sorts of components from dlhBOWLES. “One of the big ones for us is battery cooling,” he tells Automotive World. “In fact, compared to ICE the content with fluid management is higher on EVs, where the coolant systems stretch out to the whole vehicle. In comparison, these tend to be small and compact for gas powered vehicles.” Notably, the materials, tubes and connectors used with EVs are very similar to what dlhBOWLES uses in fluid management on ICE engines. “We see this as an opportunity for product expansion, not so much a radical pivot,” Konrad emphasises. “That part of the business has immense growth potential while ICE slowly fades away.”

A gradual decline

And it will be a very gradual fade, Konrad expects. He points to industry forecasts that assume EV/ICE cost parity by 2026 or 2027, at which point EVs will start to see stronger market penetration. With an average US fleet age of about 11 years, it will still take another decade to work through the existing vehicle parc. “I expect it will be far into the 2040s before EVs make up the majority of the market,” he adds. Certain regions and vehicle segments will move slower than others, such as rural areas which lack charging infrastructure or long-distance heavy trucks, where carrying a heavy battery pack isn’t feasible. For these applications in particular, ICE-related components will remain in demand.

Automakers are still developing new ICE generations today, though they may be the last. These new engines are poised to launch in 2023 or 2024, and will be used in pure ICE models and hybrids. “This is probably the last generation of engines from the big OEMs,” Konrad predicts. Moving forward, engine strategies will increasingly become simplified as volumes decline. He expects to see lower numbers overall with fewer variants. Gone will be the days where automakers offer a wide range of 1.6-, 1.8-, 2.0-litre, etc variants. Instead, Konrad envisions the options will be limited to a three-, four- and six-cylinder option with just one displacement. For the peripheral components, things suddenly become much more simplified. “In the past every engine variant had slight differences. Now it will be just the state of tune,” he notes. This new environment will demand supporting components for at least another decade.

The long-term play

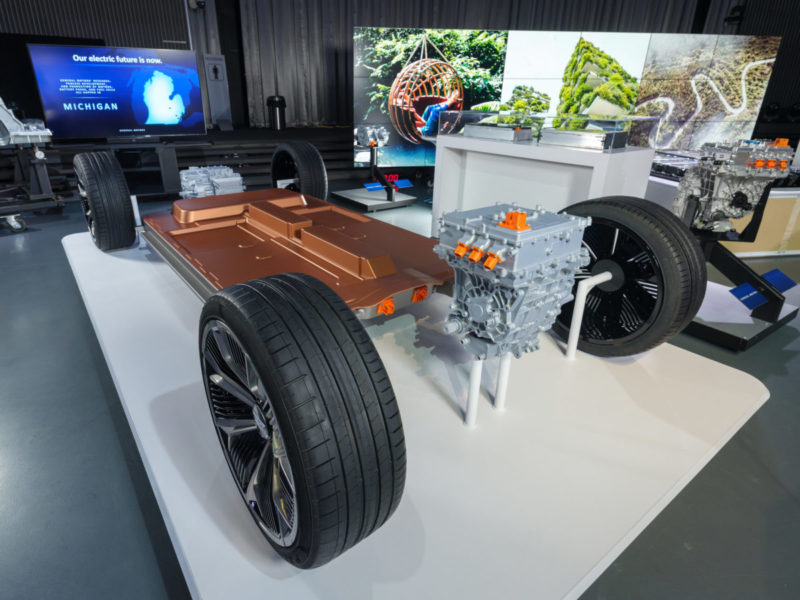

Despite lingering demand for ICE-related parts, the momentum towards EVs is clear and suppliers are positioning themselves for an electric future. In some cases, they will have to move quickly. General Motors is a key customer for dlhBOWLES, and the automaker has dramatically accelerated its EV strategy in the wake of COVID. GM bundles together funding for electric and autonomous vehicles, but the direction of its investment tells a clear story. In March 2020, it committed US$20bn for R&D in EVs and AVs. Eight months later it boosted that to US$27, then upped it again in July this year to US$35bn.

Compared to ICE the content with fluid management is higher on EVs, where the coolant systems stretch out to the whole vehicle

“GM has strongly accelerated its electrification drive, redoubling efforts to get these vehicles into production faster than it had planned pre-COVID,” says Konrad. “The development timeframe was essentially cut in half. We have typically now less than 18 months to bring these products into production.” For a supplier, participating in these vehicle platforms is clearly challenging but simultaneously an opportunity too promising to walk away from.

dlhBOWLES also supplies Ford’s Mustang Mach-E and has a strong share on Stellantis’ hybrid models. It has worked with EV pioneer Tesla in the past, though not on the battery side. But are these players the ones that will dominate an electric future or will newer players take over? Konrad sees particular promise for new arrival Rivian, another customer and one whose upcoming electric van has attracted a major order from Amazon. Players in the last-mile delivery segment, with return-to-base operations, could be early success stories in the EV revolution, but other start-ups may struggle long term.

“There are a number of companies that will probably not have the financial strength to make it,” Konrad cautions. “There won’t be another Tesla. That’s just because the major existing automakers are already pivoting to EVs and they have the established brands and the infrastructure in place. It’s not as if they have to build customer relationships from the ground up. It will be tough for everyone outside of speciality areas like autonomous delivery.” He also expects to see investor appetite diminish, and warns that the “Gold Rush feeling” of recent years is waning.

Regional adjustment

Adjusting the product portfolio in response to growing EV momentum is one thing, but what about regional footprint? dlhBOWLES is based in the US with a strong market focus on North America. However, markets in Europe and China currently hold the most near-term promise for EVs.

“China is definitely a focus area for our future activities due to our customers presence there,” says Konrad. GM, in particular, is betting heavily on China for EV momentum. dlhBOWLES also has its eye on Europe and is currently “exploring” opportunities with partners. “Looking forward, we see the ongoing necessity for more global development and the need to be open to partnerships and collaborations. It will be essential as platforms grow,” he says. This sort of flexible approach to megatrends and emerging market requirements will prove a substantial asset for all suppliers attempting to navigate increasingly uncertain waters in the mobility revolution.