Market growth for electric vehicles (EVs) continues to accelerate as companies improve battery technology and public recharging infrastructure and overcome barriers to purchase, such as high prices. Surging EV sales are testimony to this fact.

During H1 2022, sales of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) stood at 4.3 million, up 62% against H1 2021. For the full year 2022, the number of BEVs is expected to reach 8 million, while PHEVs will reach 2.6 million, according to the EV-Volumes report.

The growing adoption of EVs has gradually dispelled consumers’ concerns about their range, price, and reliability. Many consumers, however, are unaware of post-purchase service scenarios, especially those related to batteries. The battery is the most expensive part of an EV. Its failure, or gradual decay, can make repairing a working EV with many potential years of life uneconomical. Though battery failures would be rare, lost capacity, consequently leading to range drop, is the most likely possible event foreseen in the battery repair/service ecosystem.

OEMs are offering protracted battery warranties (typically eight years or 160,000 kms) to assuage consumers’ concerns. Below are some battery warranty offerings by prominent OEMs.

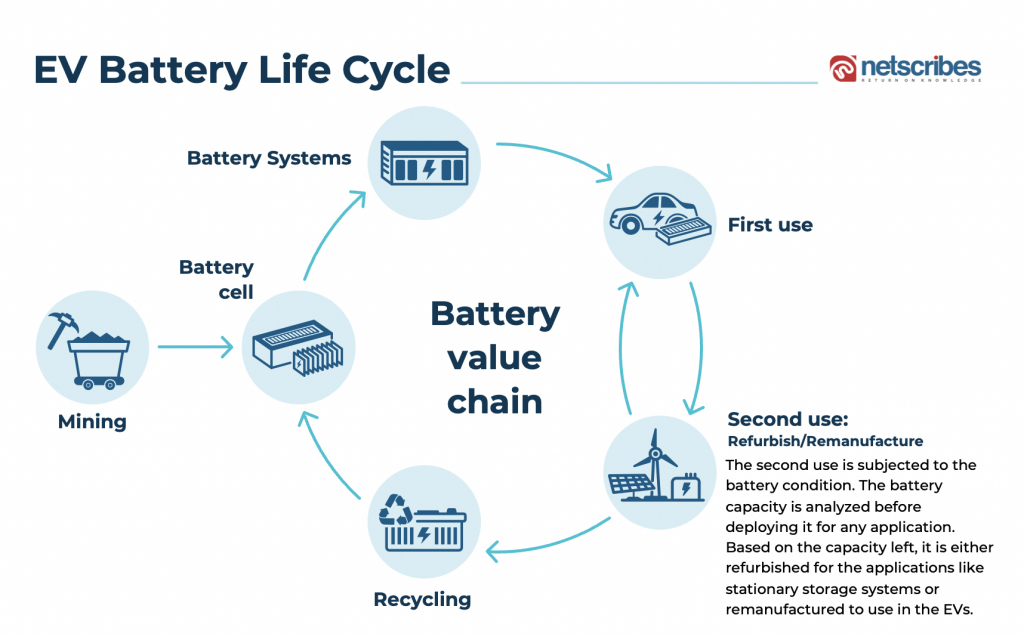

Batteries are typically covered by OEM warranties but throwing away battery packs that are no longer fit for purpose represents a failure of any sustainable technology. It will likely damage consumer confidence and raise questions about the eco-friendliness of EVs. There is a high cost associated with EV batteries, they contain rare-earth raw materials, and they are environmentally hazardous when thrown away.

After the warranty period ends, automakers are addressing the post-warranty scenario and putting systems in place to repair, service, and remanufacture batteries. According to an EY report, new batteries currently cost around US$200 per usable kWh, with the battery accounting for more than 50% of the cost of an EV. Second-life batteries, repurposed from EVs, could slash that cost to only US$49 per usable kWh.

The picture below shows a lifecycle of an EV battery.

Emerging models to tackle EV service/repair needs

Given the urgency of a strong EV repair ecosystem, OEMs like Volkswagen and Tesla have taken some aggressive moves in this area. As of 2020, Volkswagen Germany had 1,850 service partners qualified to maintain and repair EVs. There are also specific support centres that specialise in battery repair/service. Until 2020, the German service network included 265 such centres and was poised to reach 450 by the end of 2021.

Tesla is following a franchise-based model, where it partners with garages with capabilities to service its EVs. Gruber Motors has partnered with the company to provide battery repair services.

The complex EV service/repair ecosystem

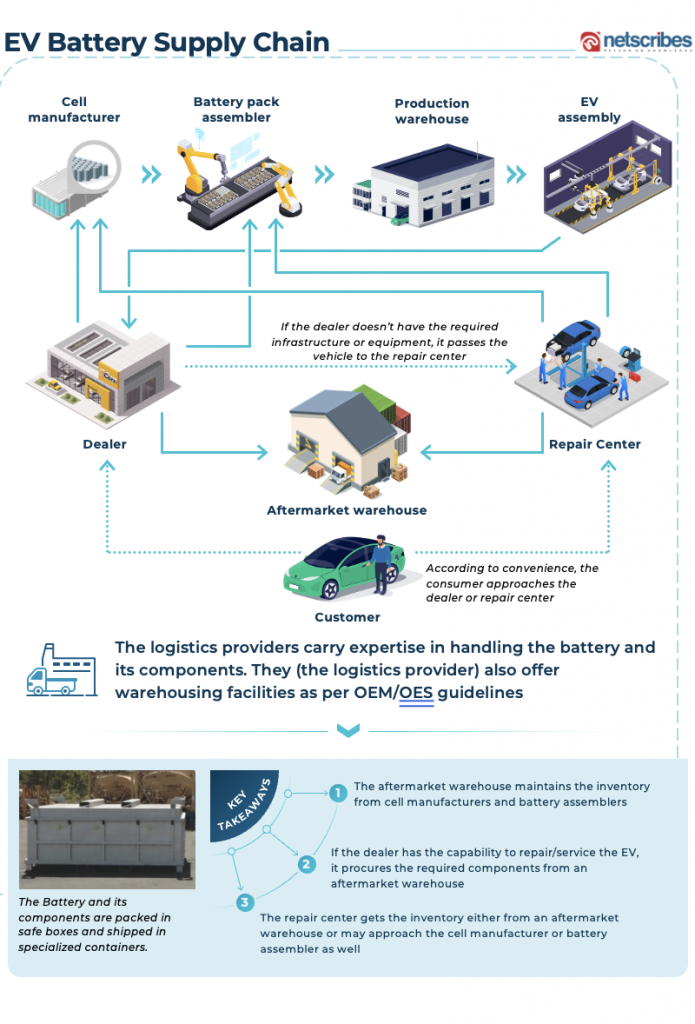

Since EVs are still in the growth stage, automakers have ample opportunities to set up a repair/service ecosystem. Using current data and developments, we have visualised what a typical battery repair ecosystem would look like:

Source: Netscribes Analysis

Possible operating models

The types of battery repair models for which automakers will opt will likely be based on the kind of battery repair models that have evolved so far.

That includes the OEM-dealer model, in which the customer approaches dealers with the required infrastructure/equipment for battery repair/service. It is worth noting that not all dealers will be qualified as EV battery service stations. The OEM will either build such stations or upgrade existing ones. Dealer-operated service stations will diagnose the state of health of a battery by performing checks like cell failure. Vehicles that have been involved in a crash may also be inspected for battery casing deformations and leaks. Whenever a potential risk is found, the car is moved to a quarantine area, where it is isolated and monitored.

The service/repair outsourced model can either be franchise-based or multi-brand, where the OEM can partner with qualified service centres to take care of its customers. However, this model will be entirely subjective, based on the kind of agreement service centres sign with OEMs. As with OEM dealerships, service centres can agree based on their capacity to repair EVs. For instance, not all service centres may offer battery repair services for vehicles that were in a collision, as it may require a different setup altogether, especially in terms of the quarantine area.

Then there are the individual service providers (ISPs). This is the traditional garage model, where ISPs provide batteries of multiple brands without being bound by OEM repair and service guidelines. However, given that this is a young ecosystem, the operators (ISPs) would follow the standard practices only.

“It took nearly 100 years to establish a robust service/repair ecosystem for the conventional ICE vehicle,” notes Siddharth Jaiswal, Practice Head at Netscribes. “EV OEMs need to do this all over again but in less than five years given the rapid adoption of EVs globally. It is interesting to see a new ecosystem emerging as EV battery repairs are completely different from what we are all used to.”

About the author: Pranjal Markale is Lead Analyst at Netscribes