Brazil’s heavy commercial vehicle sector, including trucks and buses, faced a troubled 2012, contracting by a massive 19.3% to 167,400 vehicles, despite the total industry – including cars and light commercial vehicles – expanding by 4.6% to 3.8 million vehicles.

There were two main factors that impacted heavy vehicle sales in 2012: first, the pre-buy of Euro III vehicles in 2011 ahead of the implementation of Euro V in January 2012; secondly, the slowdown of the Brazilian economy, which grew only 0.9% in 2012 after increasing by 2.7% in 2011. A reduction in GDP implies reduced industrial activity and therefore less transportation, which is almost exclusively truck-based in Brazil.

However, the good news is that several indicators point to the country’s economy recovering in 2013. According to the Central Bank of Brazil, GDP grew by 1.29% from December to January 2013, the best month to month growth since June 2008. In addition, the 2012-2013 grain crop, mainly soy bean and corn, is set to grow 13.2% to 183 million tons this year, requiring massive truck transportation from inland areas of Brazil to the seashore ports.

OEM investment is also up, with many vehicle manufacturers now incorporating Brazil’s anticipated growth into their business plans

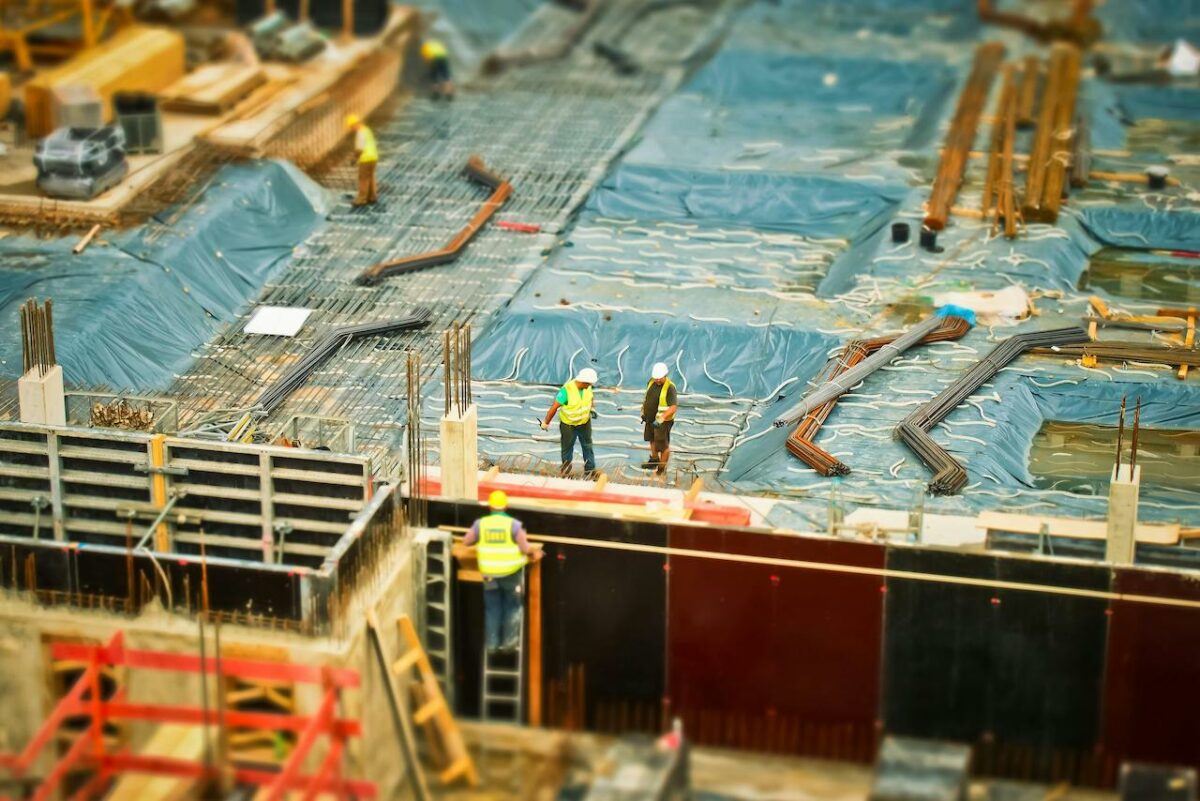

Also worth noting is the long term infrastructure investment of US$257bn planned for 2013 to 2016 in ports, airports and highways, which will drive the demand for heavy vehicles. According to BNDES, the Brazilian investment bank, total investment in the country will reach US$1.9trn by 2016, including events such as the new construction projects required for the 2014 FIFA World Cup and the 2016 Olympics in Rio de Janeiro.

OEM investment is also up, with many vehicle manufacturers now incorporating Brazil’s anticipated growth into their business plans, boosting the number of new plants and installed capacity. MAN, for example, is investing US$500m in new products and expansion at its Resende plant in the state of Rio de Janeiro. Ford is investing US$350m in expanding its product line to include the heavy trucks it has developed together with its Turkey JV, Ford Otosan.

Mercedes-Benz will this year be completing its four-year, US$750m investment scheme for new heavy vehicles and plant expansion, which includes localisation of the Actros line of heavy trucks. Volvo will invest US$550m from 2013 to 2015 in local capacity expansion, and possibly launch another truck brand from the group that includes Renault, Mack and UD.

Worth noting is the long term infrastructure investment of US$257bn planned for 2013 to 2016 in ports, airports and highways, which will drive the demand for heavy vehicles

In addition to the OEMs that have long been present in Brazil, several newcomers are investing in local production in order to avoid the heavy import taxes. Paccar’s DAF is investing US$200m in a new heavy truck plant, which is set to open in the state of Paraná by September 2013. Foton Aumark is also planning to invest US$100m in heavy vehicle production by 2015; Metro-Schacman’s US$550m investment will enable it to build heavy vehicles from 2013; and Chinese OEM Sinotruk is investing US$150m in CKD assembly from 2014.

Major producers in Brazil stated this week at an industry seminar held in São Paulo that they forecast an eight to 10% increase in heavy vehicle sales in 2013.The first three months of 2013 have already given a flavour of the heavy vehicle market’s recovery, with truck production up 42% to 53,500 units in the first quarter of 2013 from around 37,700 produced in the same period of 2012. . And with full year GDP growth expected to be around 3%, the outlook for Brazil’s M/HCV market is once again very bright.

The opinions expressed here are those of the author and do not necessarily reflect the positions of Automotive World Ltd.

Julian Semple is a Senior Consultant and Manager at CARCON Automotive in Sao Paulo, Brazil. Learn more about CARCON Automotive at www.carcon.com.br. Email: jgsemple@carcon.com.br.

The AutomotiveWorld.com Comment column is open to automotive industry decision makers and influencers. If you would like to contribute a Comment, please contact editorial@automotiveworld.com.