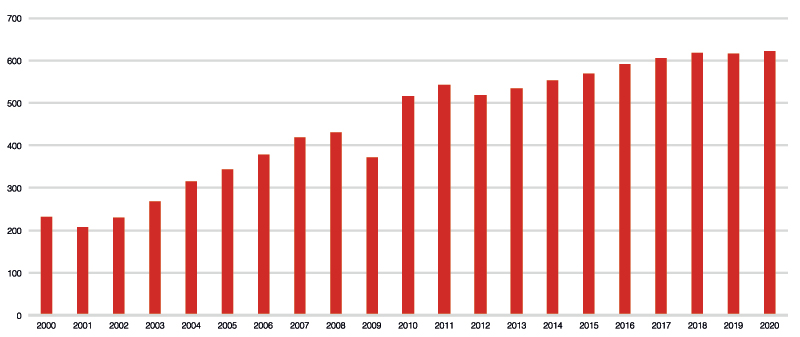

Power Systems Research is predicting that the global medium and heavy truck market is going to grow slowly and steadily in the next five years before flattening out slightly in line with the business cycle by 2020 (chart 1). We are predicting a five year compounded growth rate of 2%.

This may look unexciting, but delve deeper into expected production by Gross Vehicle Weight (GVW) and by region, and some very interesting trends are visible. The biggest issues in 2014 are related to economic conditions and high inventory in China, Brazil and Eurasia (Russia, Belarus, Turkey and Ukraine).

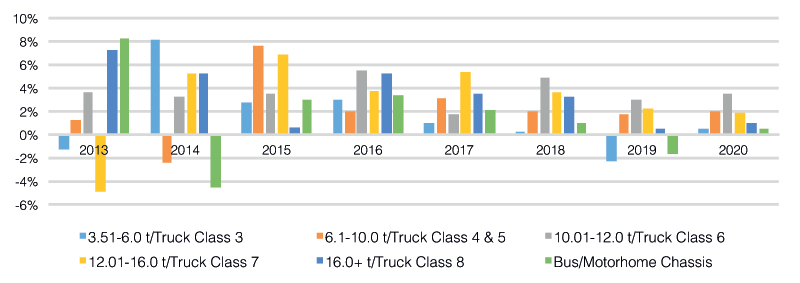

In the medium term, the most significant production fluctuations are in the 3.5-6 tonnes, 6-10t (Class 3 & 4) and 12 -16t (Class 7) segments (chart 2).

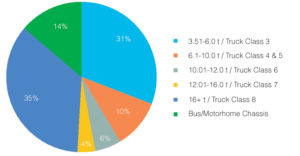

In volume terms, Class 3 represents 31% of total production, whereas Classes 4 and 5 together only account for 10% (chart 3).

However, from 2015, production of Class 4 and 5 is forecast to grow at a higher rate than Class 3. The main reasons for this shift are fleet rightsizing strategies, increasing urbanisation leading to hub and spoke distribution models, and improvements in product range in the developing economies of China, South America, India, Eurasia and South East Asia.

Truck production in the 12-16t / Class 7 category was poor in 2013, due mainly to weak performance in India, Japan and Korea. Prospects have brightened and will continue to improve as mining and export conditions improve.

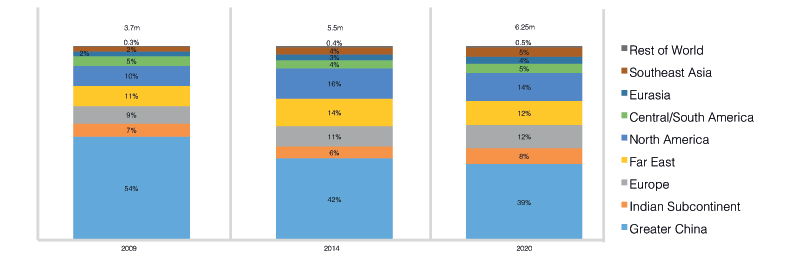

Overall, global production has recovered from the effects of the great recession of 2009. By 2020, the global truck market will total 6.25 million units, compared with 3.7 million in 2009. Looking at volume growth, the variations between the mature and developing countries remain. China’s truck production will continue to dominate, but share will decline from 42% today to 39% by 2020, a sign that there will be a shift to larger but fewer trucks as labour costs and congestion increases. Production will increase at a higher pace in other developing markets, including the Indian Sub-Continent, South East Asia, South America and Eurasia. The mature markets of Europe (EU28 + EFTA) and North America (USA and Canada) are also expected to grow slightly in volume terms.

Regional variations will continue to be heavily influenced by changes in regulation. Today, fleets in the mature markets are adapting to the implementation of Euro VI/EPA GHG 2014, whereas in China preparations are under way to implement the Euro IV equivalent, and in India there are plans to expand BSIV to 50 cities by 2015 and implement BSV by 2020. To counteract increased acquisition costs (€4,000 – €6,000 per vehicle) there is continuing focus on improving the total cost of ownership and fuel economy.

To address these concerns, OEMs and manufacturers of engines and components are working on several innovative product development solutions to reduce the weight of truck and space taken by components. There are several initiatives under way to improve efficiencies, including:

- Engine efficiency;

- Tyres and wheels;

- Transmissions;

- Hybridisation and alternative power.

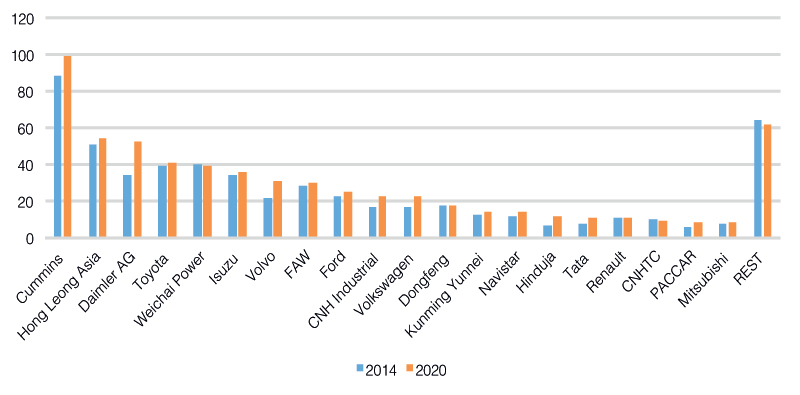

The top 20 engine manufacturers supply 88% of global volumes

These initiatives are impacting the complete value chain for of global truck production, whether it’s the powertrain, body, infrastructure or fleet management.

The high cost of research and development required for these initiatives has led to many collaborations and some consolidation in engine supply, and the market continues to become more concentrated at the top end. Today, the top 20 engine manufacturers supply 88% of global volumes. In the opinion of Power Systems Research, this trend towards more consolidated engine supply will continue to 2020.

The top 20 manufacturers are a mix of US, European and Asian suppliers. Cummins, including its Asian joint ventures, dominates global engine supply in medium and heavy trucks.

An important trend is the adoption of natural gas engines to improve fuel economy and lower costs, and many fleets in North America have switched to natural gas engines. Adoption by other regions remains heavily reliant on improvements in natural gas pricing and infrastructure. The US is leading the way, but global natural gas engine production is expected to double as other regions – Europe, Asia and Eurasia – develop appropriate infrastructure.

SuperTruck

Another significant factor in the Class 8/16 tonnes+ truck segment in the next five years is the SuperTruck programme. This initiative, funded by the US Department of Energy and OEMs, consists of vehicle and component manufacturers working together to improve fuel economy and carbon emissions through improvements in powertrain and aerodynamics, weight reduction, tyre rolling resistance, etc. This five year research and development initiative has a goal to improve fuel efficiency by 50% (30% by changes to the tractor-trailer and 20% from the engine). Daimler Trucks North America, Cummins, Navistar, Volvo and several component manufacturers are working together and they are close to achieving their research goal by 2015.

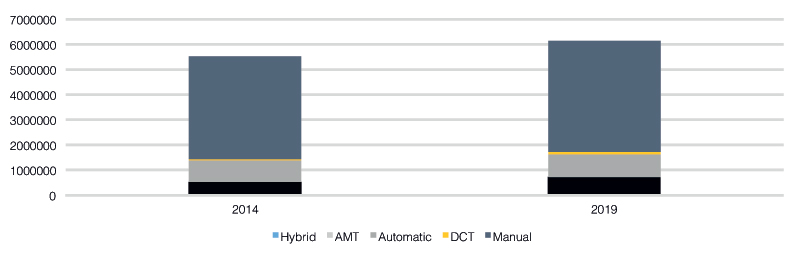

Notably, Volvo and Daimler have developed and introduced automated manual transmissions (AMT) which provide a 5% improvement in fuel economy. As a result, transmission technology shifts are already apparent across the mature markets. According to a Power Systems Research transmissions forecast, transmissions will grow at a compounded growth rate of 8% over the next five years (see chart 6).

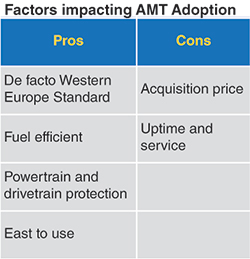

The highest shift to AMT is in the 16 tonnes+/ Class 8 segment. Today, Europe and North America represent around 76% of total AMT installation. Brazil is beginning to follow, mainly due to the presence of European manufacturers. Overall, AMT is substituting manual transmissions at a faster pace compared to other transmission designs in both the USA and Europe. The latest voice of customer research from Power Systems Research indicates that AMT transition in the medium and heavy truck markets in other regions will be influenced by a favourable regulatory environment, improved cost structure and thus pricing, and better end user awareness. Our forecasts beyond 2020 show double digit growth in Class 8 AMT production in Eurasia, China and the Indian subcontinent.

Like the engine production market, the supply of transmissions is also increasingly concentrated. Most OEMS are vertically integrated and produce their own AMT products. Only two key component manufacturers, Eaton and ZF (includes ZF-MAN, ZF Meritor), have a significant share of the Class 8 AMT market.

In summary, Power Systems Research expects global production of medium and heavy trucks and buses (3.5 tonnes/Class 3) to grow at a slow and steady pace until 2018, after which production will remain flat in line with the business cycle up to 2020. Growth by gross vehicle weight class will continue to fluctuate, affected by economic conditions, regulation and innovative product platform technologies to reduce the total cost of ownership and improve fuel economy. The result of several collaborative initiatives between key engine, equipment, and component manufacturers will begin to bear fruit across regions. The market for engine supply and major components will continue to consolidate as manufacturers collaborate and vertically integrate to reduce R&D costs.

In summary, Power Systems Research expects global production of medium and heavy trucks and buses (3.5 tonnes/Class 3) to grow at a slow and steady pace until 2018, after which production will remain flat in line with the business cycle up to 2020. Growth by gross vehicle weight class will continue to fluctuate, affected by economic conditions, regulation and innovative product platform technologies to reduce the total cost of ownership and improve fuel economy. The result of several collaborative initiatives between key engine, equipment, and component manufacturers will begin to bear fruit across regions. The market for engine supply and major components will continue to consolidate as manufacturers collaborate and vertically integrate to reduce R&D costs.

Overall, growth may look unexciting, but looking deeper by gross vehicle weight class highlights the significant activity by manufacturers to develop innovative product solutions. Across the truck production value chain, companies are working diligently to comply with regional regulations, improve the total cost of ownership and fuel economy.

As a result, we expect the global truck market to continue to remain innovative through to 2020.