Prior to the global economic crisis, Russia was on track to become the largest single vehicle market in Europe. In 2009, Russian GDP fell by 7.8% due to the credit crisis and the drop in the price of oil – a major component of Russia’s exports. The crisis saw the bottom fall out of the Russian vehicle market, with passenger car sales falling by 49.8% in 2009.

According to a new report by AutomotiveWorld.com, entitled Forecast: The Russian new vehicle market: prospects to 2015, and two associated webinars on the Russian light vehicle and commercial vehicle markets, Russia is once again expected to become the largest individual market in Europe, overtaking Germany by mid-decade.

According to a new report by AutomotiveWorld.com, Russia is expected to become the largest individual market in Europe, overtaking Germany by mid-decade.

In 2010, passenger car sales rose by 30% to 1.78 million units; sales of light commercial vehicles (<6t) rose by almost 32% to 139,000 units, and sales of all trucks over 3.5t, at around 56,000 units, were up by just over 40%.

In the first five months of 2011, the Russian light vehicle market stood at 989,013 cars and LCVs, a rise of 60% year-on-year.

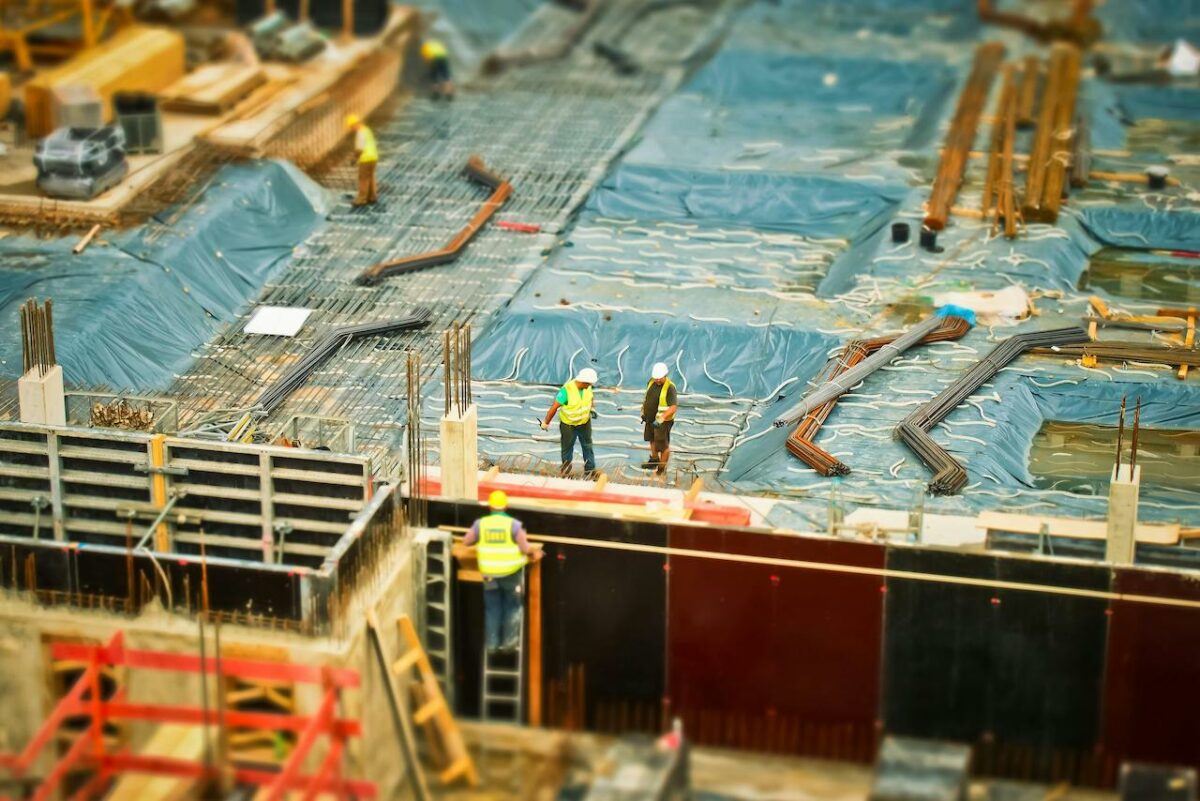

In the last 12 months, there has been a significant number of manufacturing investment announcements, a key indicator of the confidence that the major OEMs and suppliers have in the Russian market. Almost all of these investments are to satisfy local demand. This flurry of investments has been fuelled not only by growing confidence in the market, but also by a June 2011 application cut-off date set by the Russian government for exemptions or minimal import duties until 2020. Under the terms of Decree 166, in order to be eligible for these incentives, vehicle manufacturers had to agree by that date to set up facilities with annual production capacity of 300,000upa within the next four years, or upgrade existing facilities with annual output capacity of 350,000upa in the next three years.

Two domestic OEMs which faced near collapse in Russia in recent years are AvtoVAZ and KamAZ. Both have been rescued thanks to foreign OEM interest; in the case of AvtoVAZ, the Renault–Nissan Alliance, and in the case of KamAZ, Daimler along with local investors. Interestingly, both still command strong sales positions.

In the last 12 months, there has been a significant number of manufacturing investment announcements, a key indicator of the confidence that the major OEMs and suppliers have in the Russian market.

AvtoVAZ remains the market’s best-selling passenger car OEM; in 2010, the top four of the five best-selling cars were Lada models, each selling over 100,000 units. The fifth best-selling car was the Ford Focus, of which just over 67,000 units were sold. In the first five months of 2011, the pattern was repeated, but with the Renault Logan claiming fifth place.

Sales by KamAZ grew by 25% in 2010 to 28,264 units. This put it far ahead of foreign competition in the >6t category, with the best-selling foreign >6t brand, Hyundai, reporting sales of 4,248 units.

According to the Automotive World report, the car market is expected to rise by nearly 24% in 2011; from 2012 onwards, the market will continue to rise, albeit at a much slower rate. In terms of LCV sales, the market is expected to rise by 20% in 2011, and regain its pre-crisis peak in 2012. The truck market (>3.5t) is forecast to reach its pre-crisis peak after 2013.

Click here for more information about the report: Forecast: The Russian new vehicle market: prospects to 2015. The webinars can be viewed online by clicking here for light vehicles and here for commercial vehicles.

The AutomotiveWorld.com Expert Opinion column is open to automotive industry decision makers and influencers. If you would like to contribute an Expert Opinion piece, please contact editorial@automotiveworld.com