From current US CAFE standards and the EPA and NHTSA-proposed 2025 fleet average fuel consumption target of 54.5 mpg, to Europe’s Euro standards for light and commercial vehicles, national and regional vehicle emission regulations governing CO2 and greenhouse gas (GHG) are becoming ever more stringent. OEMs and suppliers have been developing a host of alternative powertrains, with a significant focus on electrification. Most of the major vehicle manufacturers now offer a battery electric vehicle (BEV), and are keen to note the technology’s success. However, there is still a long uphill struggle ahead of these vehicles before they can be considered commercially viable.

Cosmin Laslau, Lead Energy Storage Analyst at Lux Research, told Megatrends, “In Europe, the US, and Japan, governments are saying that OEMs have to do more about the emissions and fuel efficiency of internal combustion engines. For some, EVs are the only way forward to meet those needs.” However, others argue that there are many improvements that can yet be made in ICEs, from downsizing to electric turbocharging and cylinder deactivation, as well as vehicle lightweighting and aerodynamic improvements. The leading contender for ICE improvement is micro-hybrid, or stop/start technology. Navigant Research has predicted that worldwide sales of vehicles equipped with stop/start technology will grow from 8.8 million in 2013, to 55.4 million in 2022. “There is a huge range of improvements left within the ICE,” said Laslau, creating “a bit of a moving target” for OEMs to meet just with EVs.

Consumer perception

Various studies have highlighted consumer opinion on EVs. The UK Department of Transport’s ‘Public attitudes towards electric vehicles: 2014’ survey found that only 5% of respondents were thinking of buying an EV. The most important factors putting them off buying an EV were recharging (40%), distance travelled on a battery (39%), cost (33%), and lack of knowledge (16%). The limited choice of EV models (11%), the vehicle’s performance and looks (11%) and the perception that the technology is not yet proven (9%) all also contributed to buyers being discouraged from purchasing an EV. As has been cited by many, the purchasing and maintenance cost, resale value, lack of charging infrastructure, range anxiety, and the time it takes to charge an EV were all significant factors deterring consumers.

In the US, a Navigant Research report concluded that while consumers hold a generally positive view of EVs, hybrids, and natural gas-powered vehicles, interest in BEVs and plug-in hybrid EVs (PHEVs) remains low, below 50%, due to features and cost. The Union of Concerned Scientists’ report assessed American consumers’ attitudes towards EVs and found that a quarter of households with vehicles could feasibly make the move to a BEV with a range as low as 60 miles (97km).

The European Commission published its survey on the ‘Attitude of European Car Drivers Towards Electric Vehicles’, which highlighted the need to improve some performance characteristics of EVs. Range and cost were the main factors deterring consumers from an EV purchase. Going forward, public incentives are needed to ensure a wider market deployment, and while European drivers can see the benefits and opportunities of EVs, before they can be considered a credible option, a number of pre-requisites need to be fulfilled.

In Asia, a GFK study concluded that the majority of consumers in Japan have a favourable opinion of EVs (82%), and 63% are considering an EV purchase. In the study, Japan was the only market where EVs were seen to meet the needs of consumers, although fewer than 50% considered ‘environmental friendliness’ as a factor. China, however, was at the other end of the scale, with only 20% of respondents considering an EV purchase, and just 16% holding a favourable opinion.

Compliance vehicles

In areas with high levels of pollution, the concept of zero emissions is taken a little more seriously. California, for example, has a zero emission vehicle mandate, requiring “large volume and intermediate volume vehicle manufacturers to bring to and operate in California a certain percent of ZEVs (such as battery electric and fuel cell vehicles), clean plug-in hybrids, clean hybrids and clean gasoline vehicles with near-zero tail pipe emissions”. In reality, this ranges between a few thousand and some tens of thousands of vehicles; in 2012, Toyota delivered the most, at 296,880 units. Laslau said, “What we are seeing is compliance vehicles that are being made to meet the regulation, rather than a genuine attempt to sell millions of EVs.”

Sales

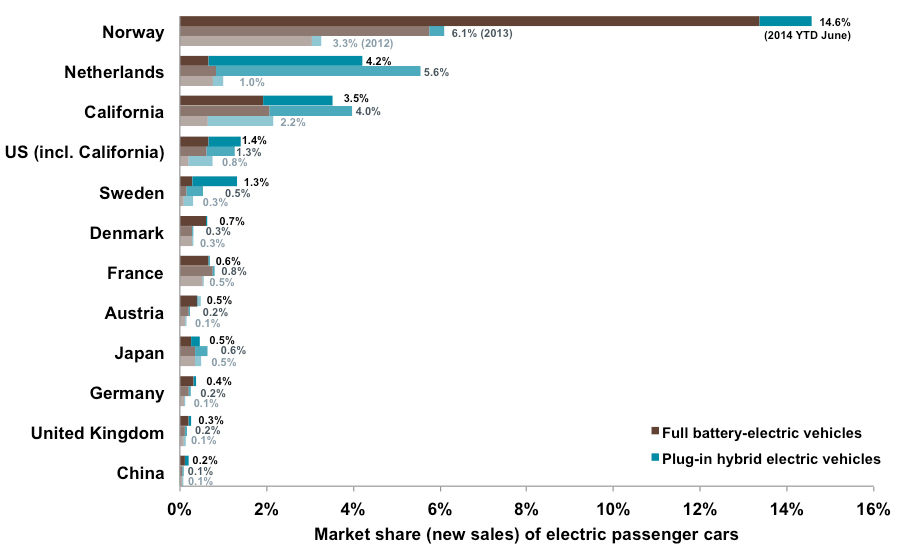

EV advocates often say that global EV sales are strong, having doubled in the past two years. True: around 45,000 vehicles were sold in 2011, according to the International Council on Clean Transportation (ICCT), and more than 200,000 were sold in 2013. However, consumer uptake of EVs has been limited to less than 1% in nearly every market. Laslau said, “You can skew the growth numbers by starting from a meaninglessly low base. If you’re adding 50,000 new vehicles in a year, that’s a drop in the bucket.”

Incentives

Taxation benefits have also helped EV sales so far. In Norway, the fiscal incentive of around €11,500 per all-electric vehicle equates to around 55% of the vehicle’s base price, and is associated with a 6% market share for EVs in 2013, and a 90% market share increase from 2012 to 2013, according to research by the ICCT. This figure highlights how national fiscal policy can significantly entice consumers into EV purchasing. Although this may be effective at the beginning, it is not sustainable over years. Dr Lars Peter Thiesen, Manager of Advanced Technology Strategy at GM Europe, told Megatrends, “In the future it will be important to receive funding in order to offset the higher price of these technologies and vehicles. However, one should be very clear that it won’t make sense from an economic point of view to have incentive systems running over decades.” It is expected that most incentives will run out at the end of the decade, but could be replaced by smaller incentives such as free parking, or access to bus lanes. However, these are less appealing to consumers as the cost will rise again.

Cost

Although various incentives currently help bring down the upfront cost of EVs, high battery costs are an ongoing issue. Laslau said, “The cost per unit of energy is around US$300-US$450 at the moment, but needs to be decreased by a factor of two or three to make an EV a credible competitor to the ICE, and make it go from 1% market penetration to 10%. In our opinion, the cost will not decrease that dramatically, at least for the next ten or 15 years.” There are efforts to combat this though, and Lux predicts costs will decrease by about 30%, which will lead to an increase in sales. Calvey Taylor-Haw, Chief Executive, Elektromotive told Megatrends, “I think there’s still a massive education process needed to explain to drivers that EVs are good. I’ve yet to meet anyone who hasn’t enjoyed driving an EV. The price also has to come down. The price of batteries is reducing by 25-30% per annum so it’s moving in the right direction.”

Infrastructure

There is also the concern over infrastructure. As sales of EVs do continue to rise, it is likely more charging infrastructure will be needed. According to research by Navigant, by 2020 the European car parc alone will include more than 2.9 million plug-in EVs, supported by over 4.1 million EV charging stations. Paul Muir, Sunderland City Council’s Transportation Strategy Officer, told Megatrends, “I believe that the infrastructure is sufficient to cope with the current demand; however, as the number of electric vehicles on the road increases, provision will also need to be increased in line.”

Lux Research sees three scenarios that could develop over the coming decades. The most likely is that consumers will own both an EV and an ICE vehicle. Secondly, there will be a rise in the popularity of plug-in hybrid vehicles, which offer emission savings, but still at an increased cost. The third scenario involves fuel cell vehicles, which Laslau says is unlikely due to cost, and huge infrastructure challenges.

Of all the zero emission technology available, BEVs are currently the most viable, and are here to stay. Market penetration is likely to reach around 1-2% in ten years’ time, according to Lux Research, but that isn’t necessarily bad news, as there will be growth opportunities for those working in the battery industry. Etienne Henry, Vice President Product Strategy and Planning, Nissan Europe told Megatrends, “Battery EV is probably the right technology today for zero emissions. There are other technologies like fuel cell that we are working on, but it’s not only about developing one car. It’s having the solution for the customer that they can use in a given environment. We have to think about the charging network. We thought that with electric vehicles we can quickly have the relevant solution for the customer, so that’s why we developed the car, but we have also developed the infrastructure with local authority support.”

As infrastructure develops, costs continue to come down, ranges are extended, and laws force more zero emission vehicles onto the road, sales of EVs are expected to rise. However, for the next ten to 15 years at least, EVs look set to remain a niche product.